Windlas Biotech IPO GMP| Windlas Biotech IPO Listing| Share Price of Windlas Biotech IPO| Check Allotment Status

Windlas Biotech IPO price band starts at Rupees 448 and goes up to 460 with the face value of the share at Rupees 1. A large number of applications were collected by the authorities which are more than the requirement of the company so the refund of the applicant will be also starting on 12th August 2021. The shares will be credited to the account of the beneficiaries on 13th August 2021 and the listings will be available from 16th August 2021. Given below are some important aspects regarding the Windlas Biotech IPO. We will also share with you all the details regarding the Allotment Status, Date & Time, GMP Today, Share Price.

Windlas Biotech IPO

Windlas Biotech Limited was established in the year 2001 and this company is one of the leading Pharmaceutical Formulation Contract Development And Manufacturing organizations present in India. The company is responsible for providing CDMO services including product discovery to product development, licensing, and commercial manufacturing of generic products including complex generics. The company is also responsible for selling its own branded products and the long-term focus of the company is to launch complex generic products in the category of chronic therapeutic which will be related to the lifestyle responsible disorders.

Read more:- CarTrade IPO

Windlas Biotech IPO Details

| Parameters | Details |

| Issue Type | Book Built Issue IPO |

| Face Value | ₹5 per equity share |

| IPO Price | ₹448 to ₹460 per equity share |

| Market Lot | 30 Shares |

| Min Order Quantity | 30 Shares |

| Listing At | BSE, NSE |

| Issue Size | [.] Eq Shares of ₹5(aggregating up to ₹401.54 Cr) |

| Fresh Issue | [.] Eq Shares of ₹5(aggregating up to ₹165.00 Cr) |

| Offer for Sale | 5,142,067 Eq Shares of ₹5(aggregating up to ₹236.54 Cr) |

Allotment Dates

| IPO Open Date | Aug 4, 2021 |

| IPO Close Date | Aug 6, 2021 |

| Basis of Allotment Date | Aug 11, 2021 |

| Initiation of Refunds | Aug 12, 2021 |

| Credit of Shares to Demat Account | Aug 13, 2021 |

| IPO Listing Date | Aug 17, 2021 |

Objectives Of The Issue

Windlas Biotech IPO was issued by the concerned authorities of the company to fulfill various objectives and some of them are mentioned below:-

- First of all, the IPO was issued to purchase equipment that is required for the expansion of the capacity of their existing facility which is present at Dehradun plant IV.

- Part of the subscription will also be used to finance the incremental working capital requirements of the company and make the company more productive.

- The authorities can also repay the company’s borrowing or prepay the company’s borrowing.

- Part of the subscriptions can also be used for general corporate purposes of the company.

Also Check: Chemplast Sanmar IPO

IPO Lot Size

Given below is the table indicating the Windlas Biotech IPO lot size:-

| Application | Lots | Shares | Amount (Cut-off) |

| Minimum | 1 | 30 | ₹13,800 |

| Maximum | 14 | 420 | ₹193,200 |

IPO Promoter Holding

Given below is the table indicating the detailed Windlas Biotech IPO promoter holding percentage:-

| Pre Issue Share Holding | 78% |

| Post Issue Share Holding | 65.16% |

Financial Statements

You can also check out the financial statements of the company for the past three years to make your decision regarding the subscription of the IPO:-

| Particulars | For the year/period ended (₹ in million) | ||

| 31-Mar-21 | 31-Mar-20 | 31-Mar-19 | |

| Total Assets | 2,961.23 | 3,384.88 | 2,981.80 |

| Total Revenue | 4,306.95 | 3,313.39 | 3,115.25 |

| Profit After Tax | 155.70 | 162.13 | 638.22 |

Strength Of The Company

If you are planning to invest your money in Windlas Biotech Limited then you will have to go through the competitive strength of the company mentioned in the list given below:-

- First of all, this company is one of the leading market players in the domestic pharmaceutical formulation CDMO segment.

- The company focuses on the chronic therapeutic category which is quite unique and one of its kind in the market currently.

- The manufacturing facilities of this company are present in Dehradun Uttarakhand.

- The company has a team of well-educated professionals and experienced promoters and the management team of the company is very senior and experienced.

- The product portfolio of the company is very innovative and is equipped with complex generic products.

- The financial performance of the company over the last few years has been very good which is a clear indication of the company doing very well in the future also.

Read More: Nuvoco Vistas IPO

GMP Details

The details of the Grey Market Premium of Windlas Biotech IPO is given in the list mentioned below:-

- The Grey market premium (GMP) of Windlas Biotech IPO was around Rs.130 on the day of the opening of the bid.

- The IPO has been subscribed 22 times on the date of closing of bid [6th August (12:40 60)] and till increase by the end of the day.

- The issue size of IPO is Rs.401.2 crores with the fresh issue of aggregating up to Rs.165 Cr.

- The company has kept the face value of Rs.5 per equity share.

- The shares will be listed on BSE and NSE and the scheduled listing date is 17th August 2021.

Check Allotment Status

If you want to check the Windlas Biotech IPO allotment status then he will have to follow the simple procedure given below:-

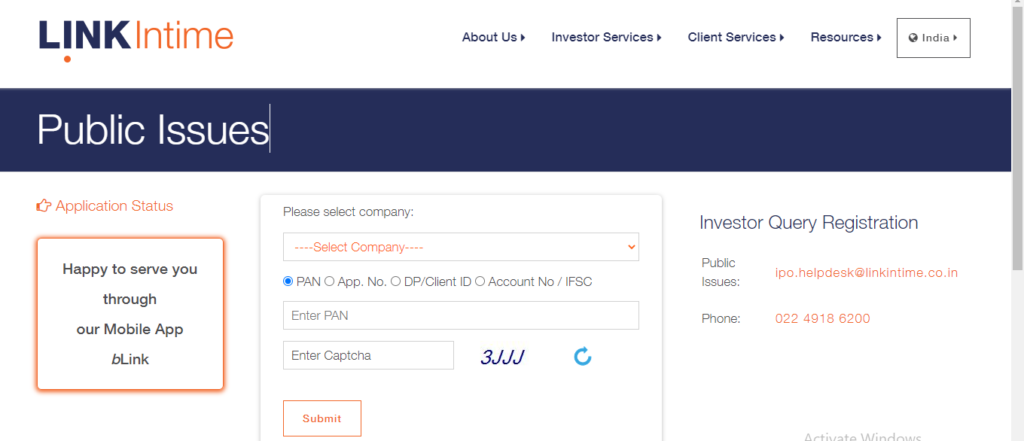

- Through Registrar Website (Link Intime)

- If you want to check it through the registrar website that is Link Intime then you will have to first visit the official website by clicking on the link given here

- The status page will open on your screen.

- You will have to enter important information including your PAN card number, application number and client ID.

- Click on search and the IPO allotment status will open on your screen

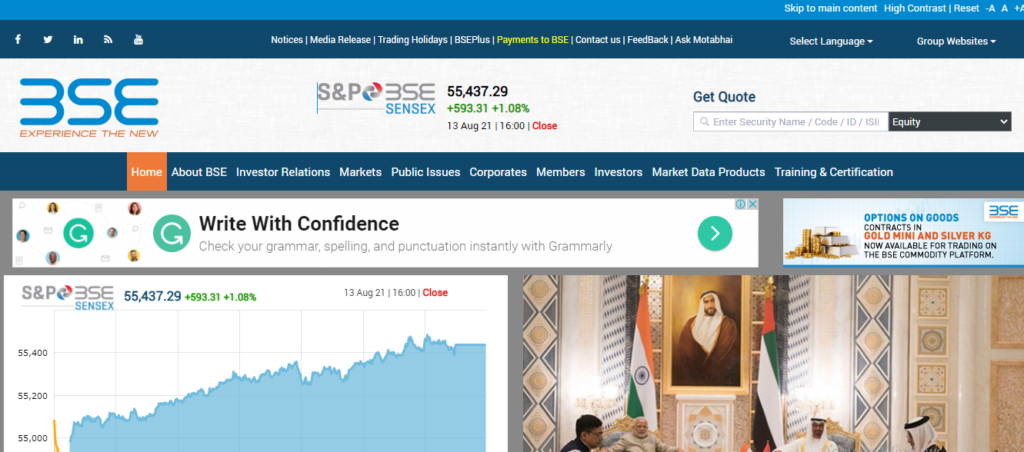

- Through BSE

- You will first have to visit the official webpage of BSE by clicking on the link given here

- The homepage will open on your screen.

- Select the issue type by clicking on the “Equity” option.

- Select the Issue name i.e. Windlas Biotech IPO from the dropdown list.

- Fill in the correct Application number.

- Enter your PAN number.

- Tick the “I am not Robot” option.

- Recheck the information entered and click on the Search Button.

- Finally, the Allotment status for the selected IPO will open.