Pradhan Mantri Mudra Yojana 2024 is a very prestigious loan scheme that is presented by the Central Government to help businesses that are not able to get adequate funds to successfully run and can’t collect a large number of funds in a very significant time. The main motive for the implementation of this scheme is to provide financial assistance through a loan with a low interest rate. Given below are some important details regarding the Pradhan Mantri Mudra Yojana 2024. We will also share with you all the step-by-step procedures to Online Apply for, PM Mudra Loan.

Pradhan Mantri Mudra Yojana 2024

The Pradhanmantri Mudra Yojana was a Central Government scheme through which loans are provided to the beneficiaries and around 75 lakh crore loans have already been given out to the beneficiaries through the implementation of this scheme. The repayment period for the loans provided under this Yojana is always extended by the Central Government to help the beneficiaries repay the loan amount without any burden and this scheme was started on 8 April 2015 to help the people who are facing financial problems in their business.

Read more:- Stand Up India Loan Scheme

PMMY Scheme Details

| Name | Pradhan Mantri Mudra Yojana |

| Launched by | Central Government |

| Objective | Providing interest-free loan |

| Beneficiaries | Small Business |

| Official site | www.mudra.org.in |

PM Mudra Loan Types

The following types of loans are provided under the Pradhan Mantri Mudra Yojana:-

| Name of Scheme | Loan Amount |

| Shishu | Up to Rs.50,000 |

| Kishor | Rs.50,000 to Rs.5 lakh |

| Tarun | Rs.5 lakh to Rs.10 lakh |

प्रधानमंत्री मुद्रा लोन योजना Benefits

There are a lot of benefits provided to the beneficiaries of the development of this Pradhan Mantri Mudra Loan Yojana and some of the benefits are mentioned below:-

- Under the Pradhan Mantri Mudra Loan Yojana, many people have got approval till now to get the loan.

- Rs 162195.99 crore will be provided to the citizens for implementing this scheme.

- Out of this amount, 148388.08 people have been provided loans till January 8, 2021.

- 97.6% and 97% of loans have been disbursed in the financial year 2020 and 2019 through banks, non-banking companies microfinance institutions, etc.

- An amount of Rs 329684.63 crores and Rs 311811.38 crores have been transferred to the accounts of the people.

- As of 1 November 2020, 1.54 loans were approved. Under this, an amount of Rs 98916.65 crore has been transferred to the accounts of the people.

- Under this scheme, loans from ₹ 50000 to 100000 will be provided.

- Shishu Cover will be given a loan of up to ₹ 50000.

- A loan of up to 100000 is provided for Tarun cover.

- About 22.53 crore people have taken advantage of this scheme till 31 January 2020, out of which the number of women taking loans is 15.75 crore.

- Due to the coronavirus, the Government will give a loan of up to 80 lakhs to help MSMEs fill this India, out of which 2.05 lakh crores is spent.

प्रधानमंत्री मुद्रा लोन योजना Additional Benefits

Under the Atmanirbhar Bharat Abhiyan the Pradhan Mantri Mudra Yojana Shishu category will receive the following additional benefits:-

- A relief of up to Rs.1,500 crore will be provided to borrowers under the MUDRA Shishu category.

- Interest subsidy worth Rs.1,500 crore will be provided to MUDRA Shishu borrowers.

- Fast recipients will get a discount of 2% on their interest rate for one year by the Government of India.

PMMY Scheme Objective

Many objectives of the Central Government will be fulfilled through the development of this Pradhan Mantri Mudra Yojana 2024 and some of them are listed below:-

- The main objective of the implementation of this scheme is to help the people of the country who want to start their own business but are not able to do so because of the lack of financial facilities

- This scheme will help the citizens of the country to increase their money supply and implement their own business

- A lot of beneficiaries of the Pradhan Mantri Mudra Loan Yojana are sole proprietors and various business firms present in the country

- The business firms can apply for the Pradhan Mantri Mudra Yojana and take the benefit of one of the three types of loans available in this scheme

Mudra Loan Activities Covered

A lot of different activities are covered under the Mudra loan Yojana and some of them are listed below:-

- Food products sector

- Transport vehicles used for transport of both goods and passengers

- Communities, social, and personal service activities

- Business loans for shopkeepers and traders

- Textile products sector and activities

- Agriculture-related activities

- Equipment finance scheme for Micro Units

Pradhan Mantri Mudra Loan Yojana Eligibility Criteria

You must follow the following eligibility criteria to apply for the Pradhan Mantri Mudra Loan Yojana:-

- Indian citizens who have their own business plans for service sector activities, or trading or manufacturing activities and require amounts of up to Rs.10 lakh can apply for MUDRA loans.

- MUDRA loans can be availed from public sector banks, private sector banks, regional rural banks (RRBs), small finance banks (SFBs), and microfinance institutions (MFIs).

- The applicant must be above the age of 18 years.

- The applicant can be

- An individual

- An MSME

- A trader

- A manufacturer

- A business owner

- A startup businessman

- A small-scale industrialist

- A shopkeeper

- An individual with agricultural engagements

Documents Required

The following documents must be submitted while applying for the scheme:-

| Particulars | Type of Document |

| Application Form | Duly filled up the application form on the basis of the loan category |

| Proof of Identity | Aadhaar card, Voter’s ID card, driving license, passport, etc. |

| Proof of Address | Utility bills (electricity bill, telephone bill, and so on), Aadhaar card, Voter’s ID card, passport, etc. |

| Photographs | 2 passport-sized photographs of the applicant |

| Caste Certificate | If applicable |

| Other documents | Quotation of the commodity or items which are to be bought and used for the business |

Banks Covered

The following banks are covered to give benefits to the beneficiaries of the Pradhan Mantri Mudra Yojana:-

- Allahabad Bank

- Bank of India

- Corporate Bank

- ICICI Bank

- j&k bank

- Punjab And Sind Bank

- Syndicate Bank

- Andhra Bank

- Bank Of Maharashtra

- Union Bank Of India

- Dena Bank

- Karnataka Bank

- IDBI Bank

- Punjab National Bank

- Indian Bank

- Kotak Mahindra Bank

- Canara Bank

- Axis Bank

- Saraswat Bank

- Bank Of Baroda

Mudra Card

A debit card is also issued when you successfully register yourself under the Pradhan Mantri Mudra Loan Yojana. The debit card is issued against the Mudra Loan account for the working capital portion of the loan. You can easily use the card to withdraw or to credit. The main purpose of the card is to manage the working capital limit in a cost-efficient manner and to keep the burden of the interest to a minimum. The main objective of implementing this card is to digitalize every transaction done by the beneficiaries under the Pradhan Mantri Mudra Loan Yojana. You can operate this card across the country for withdrawal of cash from any ATM or you can also make payments using this card.

PMMY Procedure to Online Apply

If you want to apply for the Pradhan Mantri Mudra Yojana then you will have to follow the simple procedure given below:-

- First, you will have to approach the financial institution which is listed under the Pradhan Mantri Mudra Yojana to provide loans to the beneficiaries.

- Make sure that you keep all of the necessary documents ready while visiting the financial institution.

- You have to ask for the Pradhan Mantri Mudra Loan scheme Application form from the concerned individual in the financial institution.

- You have to fill up the application form with all of the important details

- Make sure to submit the application form and keep the application ID safe and secure.

Read More: SBI e Mudra Loan

Pradhan Mantri Mudra Loan Yojana Offering Details

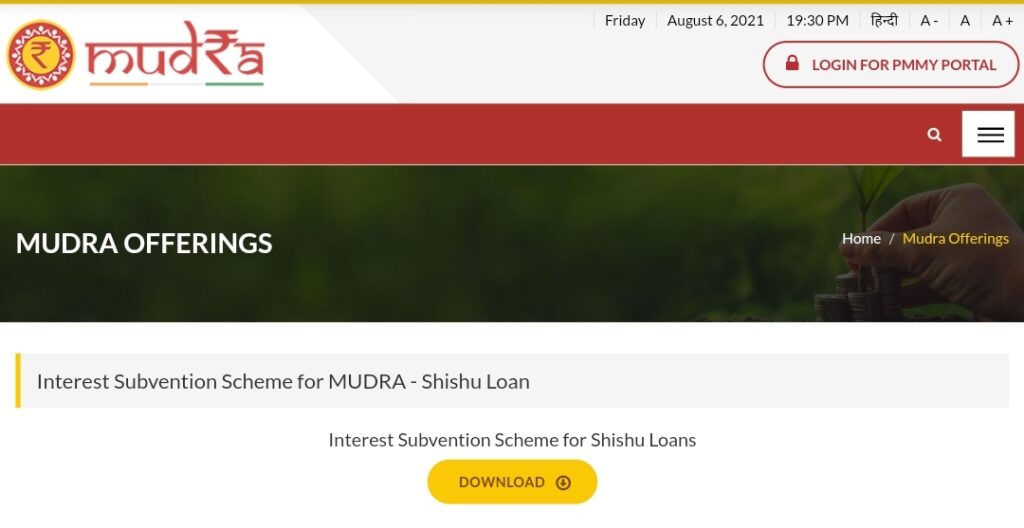

If you want to check the details of the Mudra Yojana then you will have to follow the simple procedure given below:-

- Visit the official web page for the scheme by clicking on the link given here

- The homepage of the screen will be displayed on your screen.

- You have to click on the option called Offerings

- A drop-down menu will be displayed on your screen.

- You have to click on the option called Offerings

- A new page will be displayed on your screen.

- The details regarding the Mudra Yojana will be displayed on your screen.

- You can download the important documents displayed on the screen to get detailed specifications.

Download Annual Reports

If you want to download the annual reports then you will have to follow the simple process given below:-

- Visit the official web page for the scheme by clicking on the link given here

- The homepage of the screen will be displayed on your screen.

- You have to click on the option called Financials

- A drop-down menu will be displayed on your screen.

- You have to click on the option called Annual Reports

- The list of annual reports over the year will be displayed on your screen

- You can click on your prescribed report and download it on your device in a PDF format.

Download Public Disclosure

If you want to download the public disclosures then you will have to follow the simple procedure given below:-

- Visit the official web page for the scheme by clicking on the link given here

- The homepage of the screen will be displayed on your screen.

- You have to click on the option called Financials

- A drop-down menu will be displayed on your screen.

- You have to click on the option called Public Disclosure

- The list of public disclosures over the year will be displayed on your screen.

- Click on your financial year.

- The disclosures related to the quarters in the financial year will be displayed on your screen.

- Click on your prescribed water and the report will be displayed on your screen.

Login Procedure

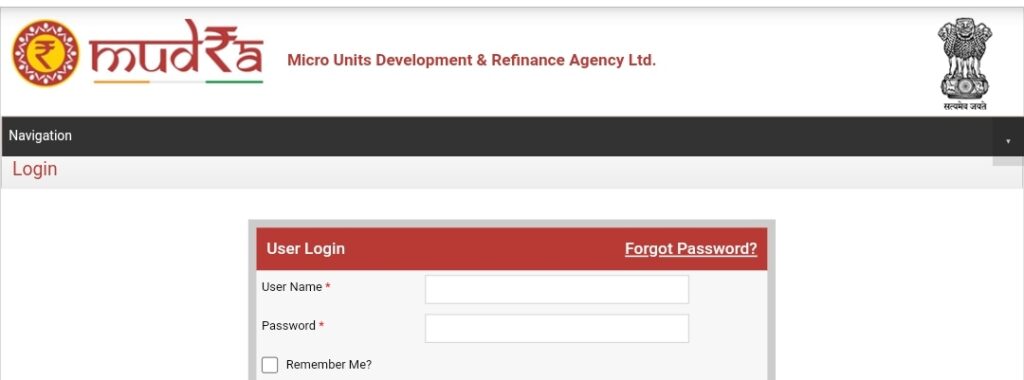

If you want to login through the official PMMY portal then you will have to follow the simple procedure given below:-

- Visit the official web page for the scheme by clicking on the link given here

- The homepage of the screen will be displayed on your screen.

- You have to click on the option called Login For PMMY Portal

- The login portal will be displayed on your screen.

- You have to enter your credentials.

- Enter your captcha code and click on login.

- You will successfully log in.

Contact Details

If you want to contact the helpline number for the Pradhan Mantri Mudra Yojana then you will have to follow the simple procedure given below:-

- Visit the official web page for the scheme by clicking on the link given here

- The homepage of the screen will be displayed on your screen.

- You have to click on the option called Contact Us

- The contact details for the various regional offices of the scheme will be displayed on your screen.

- You can contact the individuals.

प्रधानमंत्री मुद्रा लोन योजना हेल्पलाइन नंबर (राज्यवार)

| राज्य | फ़ोन नंबर |

| महाराष्ट्र | 18001022636 |

| चंडीगढ़ | 18001804383 |

| अंडमान और निकोबार | 18003454545 |

| अरुणाचल प्रदेश | 18003453988 |

| बिहार | 18003456195 |

| आंध्र प्रदेश | 18004251525 |

| असम | 18003453988 |

| दमन और दीव | 18002338944 |

| दादरा नगर हवेली | 18002338944 |

| गुजरात | 18002338944 |

| गोवा | 18002333202 |

| हिमाचल प्रदेश | 18001802222 |

| हरियाणा | 18001802222 |

| झारखंड | 18003456576 |

| जम्मू और कश्मीर | 18001807087 |

| केरल | 180042511222 |

| कर्नाटक | 180042597777 |

| लक्षद्वीप | 4842369090 |

| मेघालय | 18003453988 |

| मणिपुर | 18003453988 |

| मिजोरम | 18003453988 |

| छत्तीसगढ़ | 18002334358 |

| मध्य प्रदेश | 18002334035 |

| नगालैंड | 18003453988 |

| दिल्ली के एन.सी.टी. | 18001800124 |

| ओडिशा | 18003456551 |

| पंजाब | 18001802222 |

| पुडुचेरी | 18004250016 |

| राजस्थान | 18001806546 |

| सिक्किम | 18004251646 |

| त्रिपुरा | 18003453344 |

| तमिलनाडु | 18004251646 |

| तेलंगाना | 18004258933 |

| उत्तराखंड | 18001804167 |

| उत्तर प्रदेश | 18001027788 |

| पश्चिम बंगाल | 18003453344 |