SBI e Mudra Loan 2023 Apply Online | e Mudra Loan SBI Interest Rates | SBI e Mudra Loan Eligibility | SBI e Mudra Loan Benefits

State Bank of India Mudra Yojana was created by the Government of India to provide proper loan facilities to the people who are kick-starting their business and developing a new and innovative business idea in the country. Given below we have shared some of the most important specifications regarding the SBI e Mudra Loan. We will share with all of you the details regarding the step-by-step procedure to apply online for the schemes and also the EMI Calculator of the scheme. Make sure that you read about the eligibility criteria and the interest rate under this scheme.

SBI e Mudra Loan 2023

The people who want to kick start their business in India can easily apply for the Pradhan Mantri Mudra Yojana loan scheme which provides up to Rupees 10 lakh loans to the beneficiaries and helps them to engage in productive activities without having to worry about financial expenses that they will have to go through. You can easily get any type of business that you want to start or the goal you want to achieve. There are three different types of loans available by the State Bank of India in this e Mudra Loan Yojana presented by the Indian government in the year 2015.

Details Of SBI e Mudra Loan

| Name | SBI e Mudra Loan |

| Launched by | SBI |

| Objective | Providing loans on low interest |

| Beneficiaries | Low-income group people |

| Official site | https://emudra.sbi.co.in:8044/emudra/basic-details |

Benefits Of SBI e Mudra Loan

Through the development of this Pradhan Mantri Mudra Yojana, the micro-enterprises in the country will have better access to financial assistance and they will be able to complete their business requirements through the loans. The loans provided in this prestigious Pradhan Mantri Mudra Yojana are available at a very low-interest rate and it will also help in the Employment generation and the generation of GDP in our country. The processing fees of this scheme are also very low and it will help the businesses to flourish in the country.

Unemployment Allowance Scheme

Additional Benefits Under SBI e Mudra Loan

The following additional benefits will be provided to the beneficiaries under the system:-

| Limit | Shishu | Kishor | Tarun |

| Daily Cash Withdrawal Limits | 10,000 | 15,000 | 20,000 |

| Daily POS Limit | 15,000 | 25,000 | 30,000 |

Types Of Loans

The following types of loans are provided under the State Bank of India Mudra Yojana 2021:-

- Shishu – Loans up to Rs.50000, with the rate of interest being a minimum of 1% per month or 12% per annum. Repayment period of 1-5 years.

- Kishore – Loans from Rs.50001 up to Rs.5 lakhs. The interest rate would depend on the lender, keeping the applicant’s credit history in mind in compliance with the scheme guidelines. Repayment duration depends on the bank’s discretion but not to exceed 5 years.

- Tarun – Loans from Rs.5 lakhs to Rs.10 lakhs. The interest rate would depend on the lender, keeping the applicant’s credit history in mind in compliance with the scheme guidelines. Repayment duration depends on the bank’s discretion but not to exceed 5 years.

Loan Details

The candidates must go through the following details of the loans available in the SBI Mudra scheme:-

| Loan Amount | Loan Tenure | Interest Rate | Processing Fee |

| Shishu: Up to Rs.50,000Kishore: Between Rs.50,001 and Rs.5 lakhTarun: Between Rs.5,00,001 and Rs.10 lakh | 3 years to 5 years (moratorium period of up to 6 months may be offered) | Linked to the MCLR | Nil for Kishore and Shishu loans; 0.50% plus tax for Tarun |

Pradhan Mantri Suraksha Bima Yojana

Funding Details Of Loan

The funding in this scheme is provided through the following avenues:-

- Through a Micro Credit Scheme (MCS) for loans up to Rs. 1 lakh, where the financing comes through microfinance institutions

- Using a refinance scheme for Commercial Banks, Regional Rural Banks (RRBs), and Scheduled Co-operative Banks (SCBs)

- Through women enterprise program

- By securitization of the loan portfolio

Eligibility Criteria Under SBI e Mudra Loan

The applicant must follow the following eligibility criteria to apply for the SBI Mudra Yojana:-

- The applicant must be above the age of 18 years.

- An applicant must be below the age of 60 years.

- The deposit account should have been active for a minimum of 6 months.

- MUDRA Loans can be availed by entrepreneurs looking to set up a new business or by established, profit-making entities, to expand their business.

- The loan can be applied by the following people engaged in Non–Corporate Small Business Segment (NCSB) from both rural and urban areas. This segment comprises millions of proprietorship or partnership firms running as Small Manufacturing Units, Service Sector Units, Shopkeepers, Fruits & Vegetable Vendors, Truck Operators, Food-service Units, Repair Shops, Machine Operators, Small Industries, Artisans, Food Processors and others.

- Start-up applicants should present a viable business model, depicting the profit-making ability of the business model to avail of this loan. Start-ups are usually categorized under the Shishu scheme and get up to Rs.50000 loan amount.

- Established business units, already into profit-making, can apply under the Kishor and Tarun categories for credit towards the expansion of business or upgradation of machinery and equipment. These applicants have to submit proof of profits and also substantiate the need for machinery and equipment upgradation. They have to explain how this expansion or upgradation can help in bettering their profits and also create more employment opportunities.

Udyog Aadhar Registration

Documents Required

You will have to submit the following documents for applying for the SBI Mudra Yojana 2021:-

- ID Proof: Voter’s ID card, Driving License, PAN Card, Aadhaar Card, Passport or Photo IDs issued by a Government authority.

- Residence Proof: Recent telephone or electricity bill, property tax receipt, Voter’s ID card, Aadhaar Card, Passport, and Certificate issued by a government authority, local Panchayat or municipality, among others.

- Bank Statement: Last 6 months’ bank statements from their existing bank, if any.

- Quotations for the proposed purchase of equipment or machinery: The application should be accompanied by the quotation for the machinery and other items that have to be bought for the business.

- Photograph: 2 recent passport size photographs of the applicant.

- Caste certificate in case of SC, ST, OBC, or minority group, if applicable.

- Business Proof: These may include copies of relevant licenses, registration certificates, and lease or rent agreements, or other documents that are establish the ownership, identity and address of the business unit. Businesses with Udyog Aadhaar Memorandum can submit the same also.

- Income Tax Documents: IT returns of the past 2 years for individuals and business entities should be submitted.

Guidelines Of SBI e Mudra Loan

You have to follow the following guidelines to apply for this prestigious SBI Mudra Yojana:-

- Loans that are issued under the Pradhan Mantri Mudra Yojana scheme are guaranteed under the CGFMU or the Credit Guarantee for Micro Units. The same guarantee is also provided by the NCGTC or the National Credit Guarantee Trustee Company.

- The guarantee that is offered by the CGFMU and the NCGTC is available for a maximum period of five years. Thus, the maximum repayment scheme for the Pradhan Mantri Mudra Yojana scheme is fixed at 60 months.

- MUDRA RuPay cards will be offered to all eligible accounts.

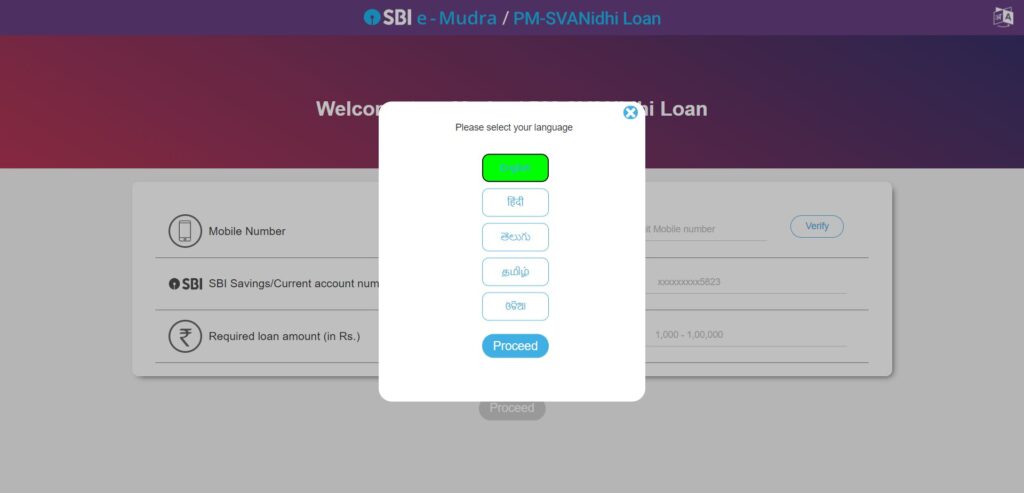

SBI e Mudra Loan 2023 Application Procedure

You must follow the following details in order to apply for the scheme:-

- The candidates can apply for the scheme by going to the official website of SBI e Mudra Yojana and checking the detailed eligibility criteria and the information regarding the scheme.

- Go to the Official Website of e Mudra Yojana presented by the State Bank of India

- You have to now enter your 10 digits mobile number and your current account number or the SBI saving account number.

- Enter your required loan amount in Rupees and click on Proceed

- The details regarding the amount will be displayed on your screen.

- You can now follow the procedure given on the screen to apply for the loan.