Krsnaa Diagnostics IPO GMP Today | Krsnaa Diagnostics IPO Subscription Status | Share Price of Krsnaa Diagnostics | Krsnaa Diagnostics IPO Listing Date & Time

Krsnaa Diagnostics offers diagnostic services and clinical laboratory services including radiology services. The company is more focused on underdeveloped areas present in our country and it is serving around 5.27 million patients as per the reports presented in the month of December for the year 2020. The company started IPO subscriptions recently and given below are some important specifications regarding the Krsnaa Diagnostics IPO. We will also share with you all the step-by-step procedures through which you can easily check the allotment status. We have also shared the specifications regarding the Allotment Date/ Status, GMP Today, Listing Price.

Krsnaa Diagnostics IPO

The subscriptions period for the company started from 4th August 2021 and went till 6th August 2021. The price band for the share was fixed between Rupees 933 to Rupees 954 per share. The total issue price of the company was 71.12 lakh Rupees and the bid was received for over 45 crore shares. Ineligible candidates will be getting their refund starting from 12th August 2021 and the equity shares will be transferred to the eligible investors’ account starting from 13th August 2021. The information regarding the allotment of the shares will be available at the official links presented by the company and the candidates can check the allotment status easily online.

Krsnaa Diagnostics IPO Details

| Parameters | Details |

| Issue Type | Book Built Issue IPO |

| Face Value | ₹5 per equity share |

| IPO Price | ₹933 to ₹954 per equity share |

| Market Lot | 15 Shares |

| Min Order Quantity | 15 Shares |

| Listing At | BSE, NSE |

| Issue Size | [.] Eq Shares of ₹5(aggregating up to ₹1,213.33 Cr) |

| Fresh Issue | [.] Eq Shares of ₹5(aggregating up to ₹400.00 Cr) |

| Offer for Sale | 8,525,520 Eq Shares of ₹5(aggregating up to ₹813.33 Cr) |

| Employee Discount | 93 |

Krsnaa Diagnostics IPO Allotment Dates

| Events | Dates |

| IPO Open Date | 04 August 2021 |

| IPO Close Date | 06 August 2021 |

| IPO Allotment Date & Time | 12 August 2021Released |

| Initiation of Refunds | 12 August 2021 |

| Shares Credit to Demat Account | 13 August 2021 |

| IPO Listing Date | 16 August 2021 |

Objectives Of The Issue

The company will be issuing the IPO for utilizing it in various objectives mentioned below:-

- The main objective of the company is to finance the cost of establishing diagnostics centres in Punjab, Karnataka, Himachal Pradesh, and Maharashtra.

- The company will also be repaying and prepaying the borrowings of the firm fully or partially as per their financial decisions.

- The company will also use the funds for general corporate purposes.

Strengths Of Krsnaa Diagnostics

If you are planning to invest in this company then you must look through the strengths of the company mentioned below in the following list:-

- The company is one of the most successful diagnostic service provider companies present in India as of today with a very low number of competitors as compared to other markets.

- The company also provides a wide range of diagnostic services including imaging, pathology and some other different kinds of diagnostic services.

- You can expect quality healthcare services at affordable prices through the company which is one of its main attractions.

- The company is present in around 13 states present across India.

- The financial performance of the company has been consistent for a long period of time.

Check Other IPOs

Here are some of the other IPOs. You can click on any to check the details.

Financial Information

Given below is the table indicating the financial position of the company for the last 3 years:-

| Particulars | For the year/period ended (₹ in million) | ||

| 31-Mar-21 | 31-Mar-20 | 31-Mar-19 | |

| Total Assets | 6,045.30 | 6,299.82 | 5,289.85 |

| Total Revenue | 6,614.76 | 2,713.79 | 2,143.15 |

| Profit After Tax | 1,849.29 | (1,119.51) | (580.57) |

Krsnaa Diagnostics IPO Lot Size

Given below is the table indicating the IPO lot size of the company:-

| Application | Lots | Shares | Amount (Cut-off) |

| Minimum | 1 | 15 | ₹14,310 |

| Maximum | 13 | 195 | ₹186,030 |

IPO Promoter Holding

Given below is the promoter holding percentage of the company:-

| Pre Issue Share Holding | 31.62% |

| Post Issue Share Holding | 27.38% |

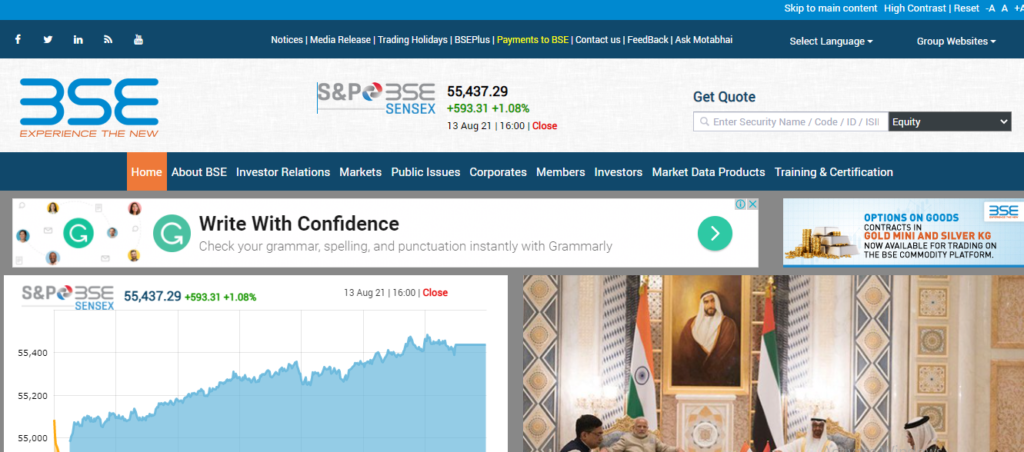

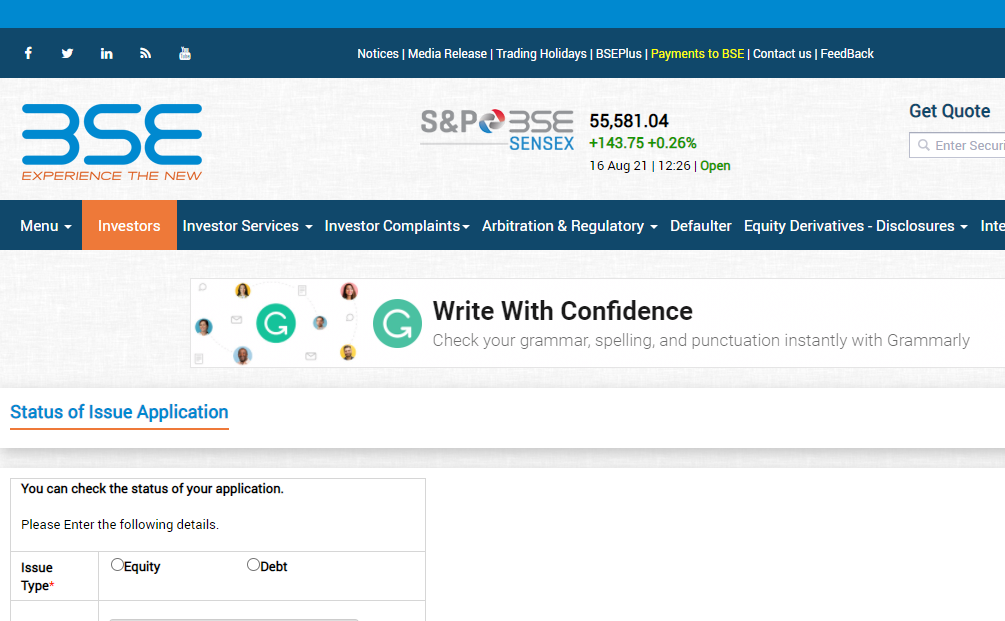

Krsnaa Diagnostics IPO Allotment Status at BSE

If you want to check the allotment status of the company through BSE then you will have to follow the simple procedure given below:-

- You will first have to visit the official website of BSE by clicking on the link given here

- The web page will open on your screen.

- You will have to click on the Check Application Status option.

- Enter Krsnaa Diagnostics IPO name.

- You will have to enter your application number and your PAN card details.

- Enter the captcha code and click on submit.

- The Krsnaa Diagnostics IPO share allotment status will open on your screen.

Check Allotment Status At KFintech

If you want to check the allotment status of the company through KFintech then you will have to follow the simple procedure given below:-

- You will first have to visit the official website of KFintech by clicking on the link given here https://kcas.kfintech.com/ipostatus/

- The web page will open on your screen.

- You will have to log in using your details.

- Enter Krsnaa Diagnostics IPO name.

- You will have to enter your application number and your PAN card details.

- Enter the captcha code and click on submit.

- The Krsnaa Diagnostics IPO share allotment status will open on your screen.

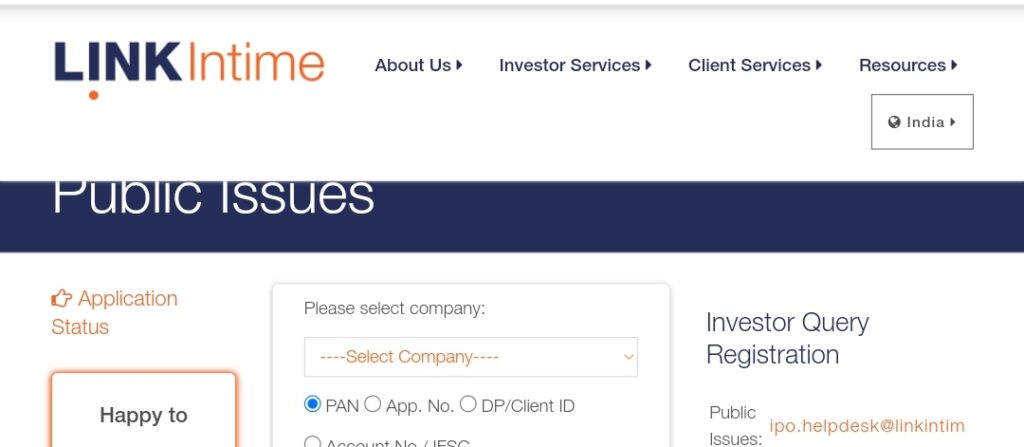

Check Allotment Status Through Link InTime

If you want to check the allotment status of the company through Link InTime then you will have to follow the simple procedure given below:-

- You will first have to visit the official website by clicking on the link given here https://web.linkintime.co.in/IPO/public-issues.html

- You need to select your IPO.

- Eenter the application number/depository number or DP Client ID/Pan number.

- Enter the captcha code and click on submit.

- The Krsnaa Diagnostics IPO share allotment status will open on your screen.