Exxaro Tiles IPO Listing Date & Time | Exxaro Tiles IPO Allotment Date & Status| Share Price of Exxaro Tiles IPO| Exxaro Tiles IPO GMP Today| Exxaro Tiles IPO Subscription Status

Exxaro Tiles is a company that manufactures and markets vitrified tiles. This company was introduced in the year 2008. The company began as a partnership enterprise in 2007-08 as a frit manufacturing. Frit is one of the raw materials used in the production of tiles and has since diversified, developed, and transformed into a producer of vitrified tiles. The company produces glazed vitrified tiles produced from ceramic elements such as Quartz, Clay, and Feldspar, as well as double-charged vitrified tiles (double layer pigment). They have over 1000 tile designs to choose from. The products are divided into two categories. It is made up of vitrified tiles and glazed vitrified surfaces. Exxaro Tiles IPO (initial public offering)share allotment will take place on August 11th.

Exxaro Tiles IPO – Comprehensive Details

This company is among the most well-known manufacturers and distributors of Vitrified Tiles which are mostly used for flooring. Its product collection includes over 1000 different tile designs in six sizes. The company’s well-known products include the Topaz Series, Galaxy Series, and High Gloss Series. Its items are used in huge infrastructure projects such as residential, educational, commercial, hotels, hospitals, government, builders or developers, and religious organizations, and several others. It also sells tiles to many countries around the world, including Poland, Bosnia and Herzegovina, the United States, and others. Exxaro Tiles currently operates two state-of-the-art manufacturing plants in Padra and Talod, with an annual installed capacity of 1,32,00,000 sq mt. It also has six exhibition locations across six cities, as well as two marketing offices in Delhi and Morbi.

Highlights of Exxaro Tiles IPO

| IPO Opening Date | Aug 4, 2021 |

| IPO Closing Date | Aug 6, 2021 |

| Issue Type | Book Built Issue IPO |

| Face Value | ₹10 per equity share |

| IPO Price | ₹118 to ₹120 per equity share |

| Market Lot | 125 Shares |

| Min Order Quantity | 125 Shares |

| Listing At | BSE, NSE |

| Issue Size | 13,424,000 Eq Shares of ₹10(aggregating up to ₹161.09 Cr) |

| Fresh Issue | 11,186,000 Eq Shares of ₹10(aggregating up to ₹134.23 Cr) |

| Offer for Sale | 2,238,000 Eq Shares of ₹10(aggregating up to ₹26.86 Cr) |

| Employee Discount | 12 |

Objectives of Exxaro Tiles IPO

There are over 1,000 different patterns and sizes to choose from. It also supplies wall tiles to several merchants, whose production is outsourced. Exxaro tiles are available in over 24 states. More than 2,000 merchants have signed up with the company. They also export tiles to more than 12 nations. Exports, which accounted for 13.88 percent of the company’s total revenue, grew at a CAGR of 47.92 percent between FY19 and FY21. The company’s two plants have a combined annual production capacity of 13 million square meters.

Competitive Features of Exxaro Tiles IPO

Some of the Competitive Features of IPO are as follows:

- One of India’s largest glazed vitrified tile production factories.

- Different sizes and designs of vitrified tiles are available.

- With over 2,000 registered dealers, they have a large dealer network.

- It has a portfolio of almost 1,000 designs.

- In India, there is a strong PAN India presence in 27 states.

- With exports to more than 13 countries throughout the world, they have a global presence.

- Plants with a focus on quality and design.

- Management with ceramic industry experience and a dedicated crew.

- Two channels are used for domestic marketing. The distribution of equipment and products through a network of dealers and distributors linked to the infrastructure.

Objects of the Issue:

- To repay or prepay secured borrowings that the company has taken out.

- To meet the needs for working capital.

- Meet the needs of the company in general.

Exxaro Tiles Product Categories

The company’s commercial operations are primarily separated into two product categories.

- Double Charge Vitrified Tiles: Double Charge Vitrified Tiles are 3 to 4 mm thicker than other types of tiles because they are passed through a press that prints the design with a double coating of pigment. This method does not allow for elaborate patterns, but it does produce a long-lasting tile surface that is suited for high-traffic commercial projects.

- Glazed Vitrified Tiles: Glazed vitrified tiles are flat slabs made of ceramic ingredients like clay, feldspar, and quartz, as well as other ingredients, that are burned at high temperatures to assure great resistance and low water absorption.

Key Dates

The tentative dates for Exxaro Tiles IPO are given in the table below:

| IPO Opening Date | Aug 4, 2021 |

| IPO Closing Date | Aug 6, 2021 |

| Basis of Allotment Date | Aug 11, 2021 |

| Initiation of Refunds | Aug 12, 2021 |

| The credit of Shares to Demat Account | Aug 13, 2021 |

| IPO Listing Date | Aug 16, 2021 |

Financial Status of Exxaro Tiles Company

The financial status of the Company is given in the table below:

| Particulars | For the year/period ended (₹ in million) | ||

| 31-Mar-21 | 31-Mar-20 | 31-Mar-19 | |

| Total Assets | 3,693.14 | 3,870.55 | 3,582.55 |

| Total Revenue | 2,598.53 | 2,439.64 | 2,440.06 |

| Profit After Tax | 152.23 | 112.59 | 89.17 |

Synopsis for Exxaro Tiles IPO

Exxaro Tiles’ IPO will begin on August 4th and will end on August 6th. Exxaro Tiles’ initial public offering i.e., IPO raised 161.09 crores, with a fresh issue of 134.23 crores i.e., 11,186,000 equity shares with a face value of ten rupees each and an offer for sale of 2,238,000 equity shares i.e., an aggregating up to 26.86 crores. The price range for Exxaro Tiles’ first public offering is 118 to 120 dollars per share, with a lot size of 125 shares. From August 4th, investors can subscribe to Exxaro Tiles IPO for a minimum investment of Rs. 14,750.

Check Other IPOs

Shareholding Pattern for Exxaro Tiles IPO

The Shareholding Pattern for the IPO is given in the table below:

| Shareholding % | Pre- IPO (%) | Post-IPO (%) |

| Public | 43.91 | 57.93 |

| Promoter & Promoter Group | 56.09 | 42.07 |

Lot Size of Exxaro Tiles IPO

The lot size for the Exxaro Tiles IPO market is 125 shares. A retail individual investor can apply for up to 13 lots i.e., 1625 shares or $195,000. The lot share for minimum and maximum application along with the shares and amount is given in the table below:

| Application | Lots | Shares | Amount (Cut-off) |

| Minimum | 1 | 125 | ₹15,000 |

| Maximum | 13 | 1625 | ₹195,000 |

Promoter Holding of Exxaro Tiles IPO

The promotor Holding of the IPO is given in the table below:

| Pre-Issue Share Holding | 56.09% |

| Post Issue Share Holding | 42.5% |

Exxaro Tiles IPO GMP

Investors who did not receive an allotment of shares will have their funds returned to their accounts on August 5th. Meanwhile, equity share trading will begin on August 9. A fresh issue of Rs 56 crore is included in the offering, as well as an offer for sale by Rivendell PE LLC for Rs 675 crore. Exxaro Tiles equity shares are currently selling at a premium of Rs 530-550 in the grey market, according to data from IPO Watch and IPO Central. Likewise, Exxaro Tiles’ premium in the grey market was roughly Rs 470, with the stock trading at Rs 525-550 per share, up from the issue price of Rs 900.

Exxaro Tiles IPO Subscription Status

The IPO share allotment for Exxaro Tiles will be revealed on August 11th. The public offering of Exxaro Tiles, a manufacturer of vitrified tiles, experienced a tremendous reaction from investors, raising Rs 161.09 crore. From the 4th to the 6th of August, it is available for purchase. It was subscribed 22.65 times, according to media reports. The Subscription Status of Exxaro Tiles IPO is given in the table below:

| Category | Subscription Status |

| Qualified Institutional (QIB) | 17.67 Times |

| Non-Institutional (NII) | 5.36 Times |

| Retail Individual | 40.05 Times |

| Employee | 2.53 Times |

| Total | 22.65 Times |

Listing Date for Exxaro Tiles IPO

The Listing Date for IPO is given in the table below:

| Listing Date | Monday, August 16, 2021 |

| BSE Script Code | 543327 |

| NSE Symbol | EXXARO |

| Listing In | T Group of Securities |

| ISIN | INE0GFE01018 |

| IPO Price | ₹120 per equity share |

| Face Value | ₹10 per equity share |

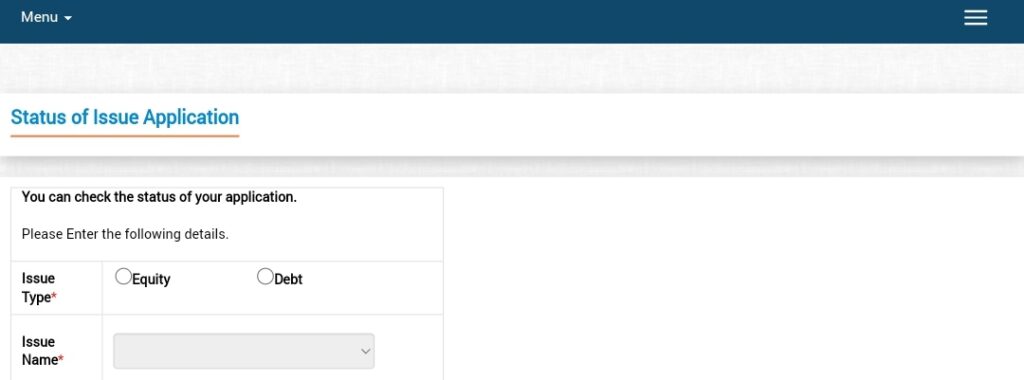

Allotment Status of Exxaro Tiles IPO from BSE Site

To check the Allotment Status from BSE Site, users need to follow the below-given steps:

- First of all, go to the official website of BSE i.e., bseindia.com/investors/appli_check.aspx

- Under the ‘Status of Issue Application’, mark the ‘Equity’ option.

- Now, select the ‘Issue Name’, enter the ‘Application Number’, and ‘PAN Number’.

- Verify ‘I am not a robot by clicking on that.

- Finally, click on the ‘Search’ Button and your IPO Allotment Status will open on the screen.

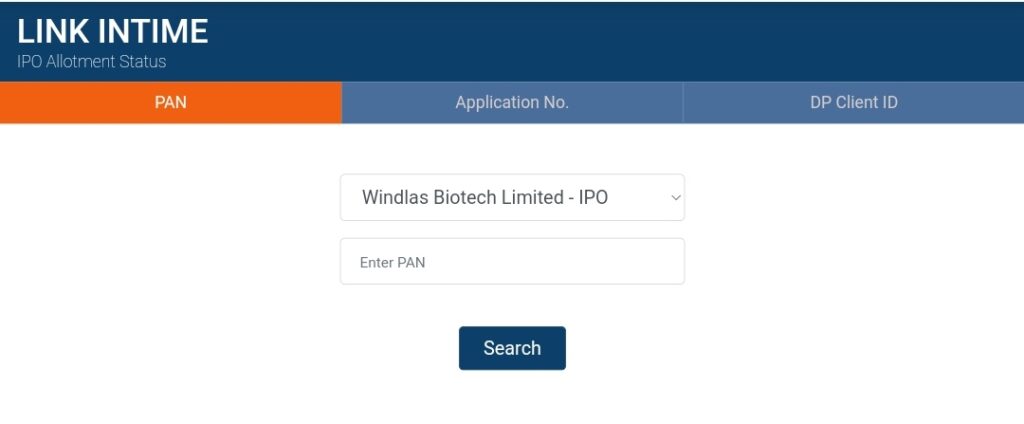

Allotment Status through LINK INTIME

To check the Allotment Status through Link Intime, users need to follow the below-given steps:

- First of all, go to the Link time IPO allocation page i.e., https://linkintime.co.in/MIPO/Ipoallotment.html

- Select the IPO name

- Enter the PAN number

- Finally, click on the ‘Search’ button.

- Once you click the Search button, the Exxaro Tiles IPO allocation will open on the screen.