The Prime Minister Employment Generation Program Scheme (PMEGP) was launched by the Indian government in 2008. It is a credit-linked subsidy program. The Prime Minister’s Employment Generation Programme (PMEGP) is a program that offers financial help to people who want to start new businesses. Read below to check the detailed information related to the PMEGP Loan Scheme 2023like Objectives, Features, Eligibility Criteria for PMEGP Scheme 2021, Required Documents, Subsidy Offered by Prime Minister’s Employment Generation Program (PMEGP), Interest Rate on PMEGP Loans, Application Procedure, List and much more.

Prime Minister Employment Generation Programme (PMEGP)

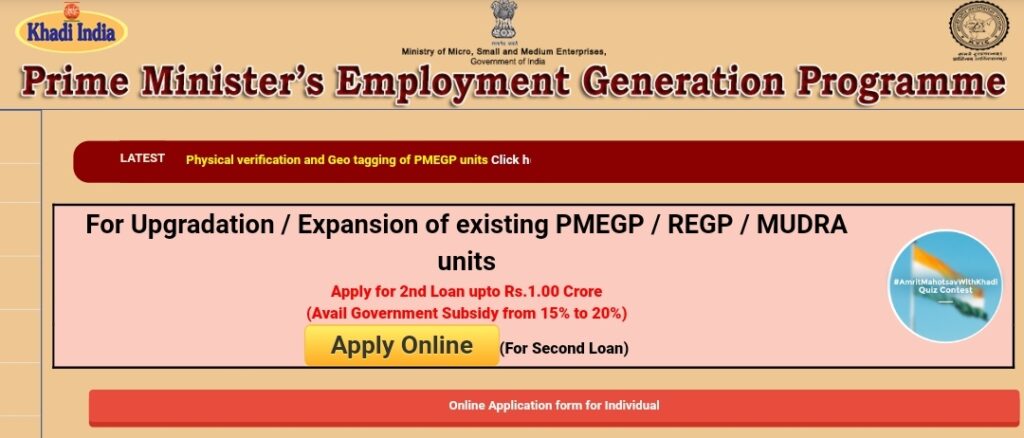

At the national level, the PMEGP Scheme is being implemented by the Khadi and Village Industries Commission (KVIC). State Khadi and Village Industries Commission Directorates, State Khadi and Village Industries Boards, District Industries Centers, and banks are implementing the Scheme at the state level. The Prime Minister’s Rojgar Yojna and the Rural Employment Generation Program have been combined to become the PMEGP. By assisting unemployed youngsters and traditional craftspeople, this initiative aims to provide self-employment prospects in the non-farm sector through micro-enterprise firms. The beneficiary is only required to contribute 5-10% of the project cost, while the government gives a subsidy of 15-35 percent of the project cost based on several conditions. The remaining monies are provided to the entrepreneur as term loans by the collaborating banks.

Read More :- Saral Jeevan Bima Yojana 2021

Highlights of PMEGP Loan Scheme 2023

| Interest Rate | vary from lender to lender |

| Maximum project cost | Rs. 25 lakhs for Manufacturing Unit |

| Rs. 10 lakhs for Service Unit | |

| Subsidy on Project | From 15% to 35% |

| Eligible Entities | Business owners, Institutions, Co-operative Societies, Charitable Trusts & Self-Help Groups |

| Applicant’s Education | At least 8th class pass |

| Age Criteria | Minimum 18 years |

Objectives of PMEGP Loan Scheme 2023

The main objectives of the PMEGP Scheme are as follows:

- To generate new self-employment initiatives, micro firms, and projects in India’s urban and rural areas to create job opportunities.

- To provide long-term work to a significant number of potential and traditional craftsmen, as well as unemployed people from both urban and rural India.

- Facilitating the engagement of financial institutions to increase credit flow to the micro sector

- To provide a common ground for traditional artisans and unemployed adolescents in rural and urban areas to come together and generate self-employment opportunities.

- Increase craftspeople’s wage-earning potential while also contributing to an increase in both urban and rural employment growth rates.

- To take steps to dissuade rural people from migrating to cities in search of work by providing them with stable and long-term employment. This is especially true for traditional and future craftspeople, as well as unemployed adolescents in rural and urban areas who work traditionally or seasonally but are unemployed the remainder of the year.

Read More: Mahaswayam Employment Registration

Key Features of PMEGP Loan Scheme 2023

Some of the main features of the Prime Minister Employment Generation Programme are as follows:

- In both urban and rural areas, the Scheme is implemented through the Khadi and Village Industries Commission, State Khadi and Village Industries Commission Directorates, State Khadi and Village Industries Boards, and District Industries Centers and banks in a 30:30:40 ratio between Khadi and Village Industries Commission / Khadi and Village Industries Boards / DIC. respectively

- There is no limit to the amount of money you can earn when you start a project.

- Existing units or those receiving any type of government assistance (state or federal) are disqualified.

- Only new units that are about to be founded are eligible for assistance under the PMEGP.

- In plain areas, the per capita investment under the scheme should not exceed Rs 1 lakh, and in hilly areas, it should not exceed Rs 1.5 lakh.

- This plan is open to any industry, including coir-based initiatives (except for those on the negative list).

- This is the maximum project cost in the service sector of Rs 10 lakh and the manufacturing sector of Rs 25 lakh.

Eligibility Criteria

- You must be at least 18 years old to participate.

- For those requesting funding above Rs.5 lakh in the service / commercial sector and more than Rs.10 lakh in the industrial sector, they must have finished at least VII standard.

- Societies that have been registered under the Societies Registration Act of 1860

- Self-Help Organizations (SHGs inclusive of those that fall Below the Poverty Line provided they have not received any benefits from any other scheme

- Cooperative Production Societies

- Trusts for charitable purposes

- Existing units (under the REGP, PMRY, or any other State or Central Government scheme), as well as units that have received subsidies under any other State or Central Government scheme, are not eligible for this program.

- For projects worth more than Rs 5 lakh in the service sector and more than Rs 10 lakh in the manufacturing sector, standard VIII must be passed.

Also Check: Pradhanmantri Ujjwala Yojana

Required Documents

- Passport-sized photographs

- Duly filled application form

- Applicant’s Identity Proof

- Address Proof

- Project report

- Applicant’s PAN card, Aadhaar card

- 8th class Certificate

- Certificate of Entrepreneur Development Program (EDP) training

- Certificate for SC / ST / OBC / Minority / Ex-Servicemen / PHC

- Special category certificate, if required

- Certificate of academic and technical courses, if any

- Any other document required by the bank or NBFC

PMEGP Loan Scheme 2023 (PMEGP) Offered Subsidy

The maximum unit/project size allowed in the manufacturing sector is Rs.25 lakh, while the maximum size allowed in the service/business sector is Rs.10 lakh. The following are the subsidy rate categories for the beneficiary under the program:

| Beneficiary Categories | Beneficiary’s Share of total project | Subsidy rate (From Govt.) – Urban | Subsidy rate (From Govt.) – Rural |

| General | 10% | 15% | 25% |

| Special* | 5% | 25% | 35% |

Interest Rate on PMEGP Loans

Following an initial moratorium, the interest rate applicable to PMEGP shall be the usual interest rate, which ranges from 11 percent to 12 percent, and the repayment duration might range from three to seven years.

Read More: Sukanya Samriddhi Yojana

Steps to Apply for PMEGP Loan Online

In consultation with the Director of Industries of respective states and the Khadi and Village Industries Board, the Divisional / State Directors of the Khadi and Village Industries Commission will issue local advertising messages through electronic and print media applications inviting potential beneficiaries to submit project proposals and start a service unit. To Apply for PMEGP Loans online, applicants need to follow the below-given steps

- First of all, go to the official website of the PMEGP i.e., kviconline.gov.in or my.msme.gov.in

- On the homepage of the website, click on the PMEGP option.

- A new page will open on the screen with two options i.e.,

- PMEGP Portal

- Backward and Forward Linkages

- Click on the PMEGP Portal option.

- A new page will open on the screen.

- Click on the Online Application Form for Individual option

- PMEGP online application for the individual applicant will open on the screen.

- Now, fill in the form with all the required details.

- After filling in all the details correctly, accept the declaration and click on the Save Applicant Data button.

- After that upload all the required documents.

- Finally, click on the Submit button.

- Once the form is successfully submitted, the applicant will receive an application ID and a password on their registered mobile number.

- Save the user id and password for future reference.

List of PMEGP Loan Banks for 2021

The following is a list of major banks that provide funding under the PMEGP scheme:

| State Bank of India | Central Bank of India |

| HDFC Bank Ltd. | ICICI Bank Ltd. |

| Bank of Baroda | Indian Bank |

| Punjab National Bank | Union Bank of India |

| Canara Bank | Bank of India |

| Axis Bank | IDFC First Bank |

| Kotak Mahindra Bank | UCO Bank |

List of Ineligible Business for Prime Minister Employment Generation Programme Loan

The list of Ineligible businesses for PMEGP loans are as follows:

- Manufacturing of recycled plastic containers and polythene carry bags with a thickness of less than 20 microns

- Businesses and industries involved in the processing, manufacture, and selling of meat

- Businesses and industries are involved in the processing, manufacture, and selling of intoxicant commodities like pan, beedi, and cigarettes.

- Sericulture, cultivation, floriculture, and horticulture-related businesses and industries.

- The Khadi Certification Rule applies to the processing of pashmina wool and other items that include hand spinning and weaving.

- Transport in the countryside (except houseboat, shikara, tourist boat in Andaman & Nicobar Islands and Jammu & Kashmir, auto-rickshaw and cycle rickshaw.)

- CNG auto-rickshaws will be allowed only in the Andaman and Nicobar Islands, as well as the country’s North-Eastern region, with prior consent from the Chief Secretary of State.

PMEGP Loan Security

There is no requirement for collateral security or a third-party guarantee in this case. Any assets acquired as a result of the bank loan must be held in the trust of the bank.

Information on MSME Loans under the PMEGP Program (2020-2021)

| Application Received | Sanctioned by Bank | Margin Money Released |

| No. of applications: 482944 | No of Projects: 95460 | No of Projects: 73968 |

| Margin Money: Rs. 14804.22 crore | Margin Money: Rs. 3054.21 crore | Margin Money: Rs. 2170.24 crore |

Payment of PMEGP Loans and Job Creation 2021

| Micro Units availed loans under PMEGP | 84,793 (Target: 78,625) |

| Employment generated | 6,78,344 (Target: 6,29,000) |