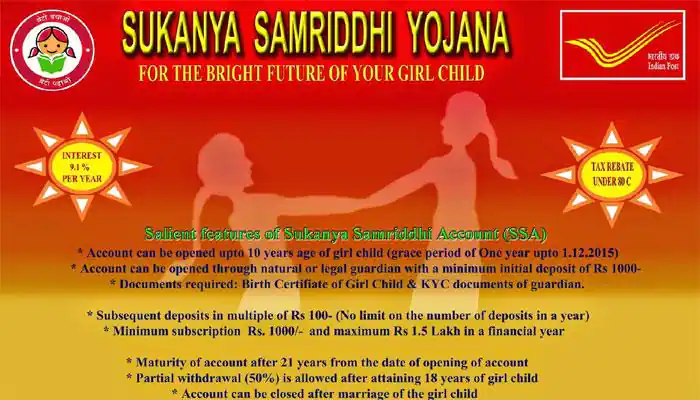

On January 22, 2015, the Ministry of Finance launched the Sukanya Samriddhi Yojana (SSY) and was introduced by the Hon’ble Prime Minister of India, Shri Narendra Modi, as part of the Beti Bachao Beti Padhao campaign, which translates to ‘Girl Child Prosperity Scheme’. Sukanya Samriddhi Account (SSA) is a savings system that is specifically established for the well-being of girl children. The Sukanya Samriddhi Yojana 2023 has been made available to consumers by allowing them to open an account at any post office. सुकन्या समृद्धि योजना accounts can be opened at any of the 22 recognized banks listed on the website. Read below to check the detailed information related to the SSY Scheme 2021 like Objectives, Key Features, Benefits, Interest Rates, Rules, Authorized Banks for Opening SSY Account, Eligibility Criteria, Required Documents, and much more.

Maharashtra Swadhar Yojana 2023

Sukanya Samriddhi Yojana 2023

The Government of India initiated a social effort to address the issue of our country’s dropping child sex ratio. ‘Save girls, educate the girl child,’ says the Beti Bachao Beti Padhao (BBBP) program. The Ministry of Women and Child Development, the Ministry of Health and Family Welfare, and the Ministry of Human Resource Development are all involved in this nationwide project. The initial deposit might be anywhere between Rs. 250 to Rs. 1,50,000 every year, depending on the account holder’s savings plan. Deposits can be made in multiples of Rs. 100 after that. While the account user is required to contribute to the Sukanya Samriddhi Yojana savings scheme for 14 years, the investment matures after 21 years from the day it was granted. The government has made it possible for the savings scheme account to be transferred from one bank or post office to another inside India.

Read More : मुख्यमंत्री कन्या उत्थान योजना

Highlights of सुकन्या समृद्धि योजना

| Scheme Name | Sukanya Samriddhi Yojana |

| Interest Rates | 7.6% per annum (for Financial Year 2023) |

| Minimum Deposit Amount | INR 250 |

| Maximum Deposit Amount | INR 1.5 Lakh in a financial year |

| Maturity Period | 21 years or until the girl child marries after the age of 18 |

| Maturity Amount | Depends on the invested amount |

| Eligibility | Parents or legal guardians of a girl child below the age of 10 are eligible to open the SSY in the name of the girl child |

| Income Tax Rebate | Eligible for rebate under section 80C of the Income Tax Act, 1961 (Maximum cap of Rs. 1.5 Lakh in a year) |

Mukhyamantri Kanya Vivah Yojana 2023

Objectives of Sukanya Samriddhi Yojana

Sukanya Samriddhi Yojana’s mission is to help women achieve a sustainable income by motivating them to enroll in a savings plan that will allow them to achieve long-term life goals and expectations such as higher education, marriage, and income security. The rate of return for FY 2018-19 AY 2019-20 is 8.5 percent, making it one of the greatest savings schemes of its kind. This underlines the value of contributing to the Sukanya Samriddhi Yojana savings plan. It also provides tax advantages under Section 80C of the Income Tax Act of 1961.

Read More: Saral Jeevan Bima Yojana

Key Features of Sukanya Samriddhi Yojana

Some of the main features of the SSY Scheme are as follows:

- In the absence of parents, the Sukanya Samriddhi Yojana saving system allows legal guardians to open an account on behalf of the girl child.

- The minimum yearly contribution to the Sukanya Samriddhi Yojana is Rs. 250, with a maximum annual contribution of Rs. 1,50,000. The previous minimum limit was Rs. 1,000, however, it has been reduced to make the scheme more accessible to the general public.

- Parents with two girl children can have two accounts running at the same time under the Sukanya Samriddhi Yojana saving program, while parents with three girl children can have up to three accounts open.

- In the event of the account holder’s untimely death, the account can be canceled prematurely.

- As of Financial years 2018-19, the current interest rate is 8.5 percent. It changes every three months. This is one of the highest rates for such savings plans.

- Deposits made to the Sukanya Samriddhi Yojana are eligible for tax benefits under Section 80C of the Income Tax Act, 1961.

- As a confirmation for reviving the account, a contribution of Rs. 50 must be made beyond the minimum yearly deposit to the Sukanya Samriddhi Yojana savings scheme at the end of the year.

- After reaching the age of 18, the account holder of the Sukanya Samriddhi Yojana plan can withdraw up to 50% of the accrued cash.

- Sukanya Samriddhi Sukanya Samriddhi Sukanya Samridd Yojana accounts expire 21 years after they were issued, or on the day of her marriage, whichever comes first.

- To keep the account from being canceled, a minimum of Rs. 250 must be paid every year.

- Checks, demand draughts, and cash can all be used to contribute to the Sukanya Samriddhi Yojana savings scheme.

- The higher interest will be paid to the account holder after the scheme has matured.

Benefits of Sukanya Samriddhi Yojana

SSY Scheme is a savings scheme that allows parents or legal guardians to plan financially for their female child’s future to ensure her future and assist her in achieving her goals. Sukanya Samriddhi Yojana has several advantages that make it an effective saving strategy for the girl child’s financial future. Some of the key benefits of Sukanya Samriddhi Yojana are as follows:

- Interest rate is high: For Financial Year 2018-19, the current return rate of 8.5 percent is one of the highest among similar savings schemes. Every three months, the interest rate is adjusted. However, when compared to other savings plans, the rate remains the highest.

- Tax advantages: Sukanya Samriddhi Yojana provides tax benefits under Section 80C of the Income Tax Act, 1961, in addition to ensuring the account holder’s economic security. The highest amount of tax exemption available is Rs. 1,50,000, which is also the maximum for all other investments exempted from taxes under this section of the Income Tax Act, 1961.

- Withdrawal (partial or premature): The Sukanya Samriddhi Account matures when the account holder achieves the age of 21, however, deposits can be placed into it for 14 years from the date of commencement. The account is closed when the girl child reaches the age of 21 or marries, whichever comes first. To withdraw the balance sum from her Sukanya Samriddhi Account, you must ensure that she was at least 18 years old on the date of her marriage.

- Maturity has many Advantages: The account balance that the girl child would be eligible for at the maturity of a Sukanya Samriddhi Yojana savings program is the sum total of the principal amounts continuously deposited in the account and the rising interest on this principal amount. This sum is payable to the account holder, i.e., the girl child for whom the account was established.

Read More: Pradhan Mantri Suraksha Bima Yojana

Sukanya Samriddhi Yojana Interest Rates

The SSY scheme’s interest rate has been decreased from 8.4 percent to 7.6 percent, and it is compounded annually. The government sets the interest rate, which is established on a quarterly basis. The following table shows the interest rate offered by the scheme:

| Duration | Rate of interest (%) |

| April 2020 onwards | 7.6 |

| 1 January 2019 – 31 March 2019 | 8.5 |

| 1 October 2018 – 31 December 2018 | 8.5 |

| 1 July 2018 – 30 September 2018 | 8.1 |

| 1 April 2018 – 30 June 2018 | 8.1 |

| 1 January 2018 – 31 March 2018 | 8.1 |

| 1 July 2017 – 31 December 2017 | 8.3 |

| 1 October 2016 – 31 December 2016 | 8.5 |

| 1 July 2016 – 30 September 2016 | 8.6 |

| 1 April 2016 – 30 June 2016 | 8.6 |

| From 1 April 2015 | 9.2 |

| From 1 April 2014 | 9.1 |

Eligibility Criteria

Applicants who want to apply for the Sukanya Samriddhi Yojana 2021 must fulfill the eligibility criteria put forward by the Government of India. The eligibility criteria for Sukanya Samriddhi Yojana 2021 are given below:

- A girl child’s parent or legal guardian can open a Sukanya Samriddhi Yojana i.e., SSY account on her behalf until she reaches the age of ten.

- A girl kid must be a citizen of India.

- A household is only allowed two Sukanya Samriddhi Yojana i.e., SSY accounts, one for each girl kid.

- In the name of a girl child, only one account can be opened.

- Sukanya Samriddhi Accounts can be formed for more than two girls under the following circumstances:

- A third account can be formed if a girl child is born before twin or triplet girls, or if triplets are born first.

- A third SSY account cannot be formed if a girl kid is delivered after twin or triplet girls.

- At the time of application for the savings scheme, the account holder must provide proof of age.

Also Read: Kalyana Lakshmi Scheme

Eligibility Criteria of Parents for Sukanya Samriddhi Yojana

The following are the requirements for parents or legal guardians to open an account for their girl child:

- A Sukanya Samriddhi Account can only be opened on behalf of a girl child by her biological parents or legal guardians.

- A parent or legal guardian can only open two accounts for their girl children.

- As previously stated, a parent or legal guardian can open one Sukanya Samriddhi Account for each girl child, with a maximum of two accounts allowed. When it comes to twins or triplets, one parent or legal guardian can open up to three accounts.

Rules for Sukanya Samriddhi Yojana

As per the provisions of SSY Rules 2016, the rules for Sukanya Samriddhi Yojana 2021 are given in the table below:

| Particulars | Provisions as per the SSY Rules 2016 |

| Who would be the SSY account’s beneficiary? | From the time the account is opened until it is matured or closed, any girl child who is a resident Indian. |

| Who has the authority to open the account? | The account can be opened by the parents or legal guardians of a girl child under the age of ten. |

| Who has access to the account and can make deposits and withdrawals? | The money may be deposited and operated by either the guardian or the girl child (if she has reached the age of ten). The account must be controlled by the girl kid after she reaches the age of eighteen. |

| Number of accounts | Each girl child has only one account.A family’s account can be formed for a maximum of two girl children (including adopted children)If more than two females are born in the first order of birth, or if one girl kid is born in the first order of birth and twins or more than twins are born in the second-order of birth, accounts for more than two girl children are authorized. |

| Where can an SSA account be opened? | Any post office or permitted commercial bank branch |

| Documents Required to open an account | To open an account, you’ll need the following documents. The girl child’s birth certificate, guardian’s identity, and address must be verified. A medical certificate proving the birth of several girl children in the same order of birth is required. Any other documentation that the post office or banks may request |

| When is it possible to open an SSA account? | Between the time a girl kid is born and the time she reaches the age of ten years |

| Deposit amount and time limit | A minimum of Rs 250 (formerly Rs 1,000) and a maximum of Rs 1,50,000 every financial year, for a maximum of 15 years subject to the above cap, multiples of Rs 100 |

| Mode of Deposit | Through cheque, cash, demand draft, or online transfer |

| Interest on deposits | The interest rate for the second quarter of FY 2021-2022, which runs from July 1 to September 30, is 7.6% p.a.Except if the default is due to the death of the guardian who started the Account, the full deposit in an “Account under the default” (where a minimum of Rs 250 has not been placed) that is not regularised within the prescribed time will accrue interest on the post savings bank account. After the SSY’s term, i.e. after 21 years from the date of account opening, no interest is payable. After the girl kid becomes a non-citizen or non-resident of India, no interest is paid. |

| Consequences of excess or short deposit | Excess – Any deposit that exceeds the maximum cap will not earn interest and can be withdrawn by the depositor at any time.Shortage – If no minimum deposit is made in a financial year, the account is regarded to be in default, and it can be regularised within 15 years of account opening by paying a penalty of Rs 50 each defaulted year. |

| Tenure of SSA | 21 years from the account opening date |

| Rules pertaining to the closure of SSA | Maturity-based closure: After 21 years, the account matures, and the remaining balance in the SSA, including interest, is paid to the kid upon submission of an application and evidence of identity, domicile, and citizenship documentation. Closure Too Soon Only in the following circumstances is it permissible: The reasons for the planned marriage After a girl kid reach the age of 18, she can file an application with her age verification documents one month before or three months after her wedding. The amount in the SSA will be paid to the guardian of the girl child who dies and the death certificate is produced. If a girl child’s status changes, such as if she becomes a non-resident or a non-citizen of India, the case is deemed closed. The female kid or her guardian must notify the girl child or her guardian within one month of the status change.After 5 years, if the post office or bank determines that the operation or continuance of the SSA is causing excessive hardship to the female child (for example, the guardian’s death, the girl child’s medical reasons), the girl child or guardian may request that the SSA be closed prematurely.If the SSA is to be closed for any reason after the account is opened, it will be allowed, but the full deposit will only receive an interest rate applicable to post office savings banks.If the SSA is to be closed for any reason after the account is opened, it will be allowed, but the full deposit will only receive an interest rate applicable to post office savings banks. |

| Withdrawal | This is permissible for higher education reasons if the girl child has reached the age of 18 or has finished the 10th grade, and for meeting the actual fee or other costs required at the time of entrance.The application for withdrawal must be accompanied by documentary verification in the form of a confirmed offer of admission in an educational institution or a fee slip. The maximum withdrawal is 50% of the balance in the SSA at the conclusion of the previous financial year. This can be paid in a single payment or in five payments. |

| Transfer of balance of the SSA | The balance in the SSA can be transferred for free everywhere in India, including from and to post offices, banks, and post offices and banks. This can be done with proof of either the guardian’s or the girl child’s change of address. In all other cases, a charge of Rs 100 must be paid to make such a transfer. |

Read More: UP Mukhyamantri Abhyudaya Yojana

Required Documents

While filling up the application form for Sukanya Samriddhi Yojana 2023, some important documents will be needed by the applicants, make sure to keep them handy. The documents required for various processes are as follows:

- Form for starting an SSY account.

- At the time of account opening, the girl child’s birth certificate must be supplied.

- At the time of account opening, the depositor must provide proof of identity and residence.

- If more than one kid is born in the same order, a medical certificate must be filed.

- Any other documentation that the bank or post office may require.

Authorized Banks for Opening Sukanya Samriddhi Yojana Account

The below-mentioned banks are Authorized Banks to open Sukanya Samriddhi Yojana Account:

| State Bank of India | Canara Bank | Oriental Bank of Commerce |

| United Bank of India | Bank of India | Indian Bank |

| UCO Bank | Axis Bank | ICICI Bank |

| Punjab National Bank | Allahabad Bank | Corporation Bank |

| Punjab & Sind Bank | Vijaya Bank | Dena Bank |

| Indian Overseas Bank | Union Bank of India | Central Bank of India |

| IDBI Bank | Syndicate Bank | Bank of Maharashtra |

| Bank of Baroda | Andhra Bank | – |

Procedure to invest in Sukanya Samriddhi Yojana

You can invest in this plan at your local post office or at partner public and private banks’ designated locations. You must submit KYC papers such as a passport or an Aadhaar card, as well as the required paperwork and an initial deposit by cheque or draught. Investors must complete the Sukanya Samriddhi Yojana (SSY) Application Form, which can be acquired from a local post office or a participating public or private sector bank. You may also get the SSY New Account Application Form from one of the following websites:

- The India Post Website

- The Reserve Bank of India Website

- Individual websites of public sector banks like PNB, SBI, BoB, etc.

- The websites of participating private sector banks like Axis Bank, ICICI Bank, and HDFC Bank.

- While the SSY application form can be downloaded from a variety of places, the fields in the form are the same regardless of where you get it.

Know More: जननी सुरक्षा योजना

Steps to fill Sukanya Samriddhi Yojana 2023 Application Form

The SSY Application Form needs applicants to submit some vital information about the girl child whose name the Sukanya Samriddhi Yojana 2021 investment will be made. It’s also necessary to provide information on the parent or guardian who will be opening the account and making deposits on her behalf. The following are the most important fields on the SSY Application Form:

- Girl Child’s Name who will be the Primary Account Holder

- Date of the girl child’s birth

- Details of the primary account holder’s birth certificate like Certificate number, date of issue, etc.

- Account holder’s parent or guardian’s name

- Amount of the initial deposit

- Date and Check / DD Number that has been used for an initial deposit.

- Parent/Guardian Identification Numbers like Aadhaar Number, Driving License, etc.

- Present and Permanent Address as per parent or guardian’s ID document.

- Information about any other KYC documents like Voter ID card, PAN card, etc.

- After filling out the given information, sign the form and submit it to the account opening authority (Post office / Bank Branch) together with copies of all relevant papers.

SSY Account Transfer

The concept that the Sukanya Samriddhi Yojana Account can be readily transferred from one region of India to another is one of its main advantages. You can easily move this tax-saving deposit account for the benefit of girls from one India Post Office to another or from one approved bank branch to another under existing guidelines. Fill out and submit the transfer request form with the Post Master of the India Post Office where your account is now situated to start the transfer of your SSY account from a post office. If you want to transfer your deposit from one specified bank branch to another, similar transfer forms are accessible both online and offline. For

Sukanya Samriddhi Yojana’s SSY Tax Implications

SSY investments are classified as EEE (Exempt, Exempt, Exempt) investments for tax purposes. This means that the investment principal, the interest generated, and the maturity amount are all tax-free. The tax deduction benefit on the primary amount invested under Section 80C of the Income Tax Act, 1961 is up to Rs 1.5 lakh per year under the existing taxation conditions of the Sukanya Samriddhi Yojana.

Sukanya Samriddhi Yojana Calculator

Any investment’s benefit can only be calculated by looking at how much it grows over time. The maturity advantage you can actually earn when the Sukanya Samriddhi matures can be seen on the savings scheme’s official website. To determine the maturity benefit, follow these steps:

- First of all, visit the official website of the Sukanya Samriddhi Account Yojana.

- On the home page of the website, click on the Calculator’ option.

- Now enter all the required details like the Girl child’s Age, Deposit Amount, and Date of Deposit.

- After entering all the details, click on the Calculate button.

- According to the current rate of interest for Sukanya, the calculator will automatically create and represent the results for the principal amount, maturity amount, and interest amount that you are projected to get after maturity.