PAN Card Apply Online | PAN Card Application Form | Download PAN Card Online | PAN Card Status Check | Permanent Account Number Correction Form

The Permanent Account Number (PAN) Card is a photo ID card with a 10-digit alphanumeric Unique Number for each user. It is appointed by the Minister of Finance, Government of India. The applicant must submit the form, together with supporting documents such as evidence of identity, proof of residency, and proof of date of birth, as well as two current passport-size color photographs and specified fees of Rs 94/-, processing fees of Rs 85/- and service tax of Rs 9/-. Read below to check the detailed information related to the New PAN Card Online, Objectives, PAN Card Structure, Applications of PAN Card, Types, Eligibility Criteria, Required Documents, Fee, Steps to Apply on NSDL Portal, Apply for Correction, Reprint Permanent Account Number Card, and much more.

New PAN Card Online

Only Indian citizens, Indian corporations, Entities Incorporated in India, and Unincorporated Entities of India are required to fill out Form 49A while applying for a PAN. An applicant who is not a resident of India, organizations established outside of India, and unincorporated organizations outside of India must fill out Form 49AA to receive a PAN card. Both the PAN application form can be downloaded from the official website. Applicants can also fill the application form via the offline mode which can be obtained from IT PAN Service Centers and TIN facilitation centers such as UTI and NSDL. The candidate must include the designation and code of the concerned Income Tax Department Assessing Office in the PAN application form.

Read More :- E Aadhaar Download Online

Highlights of Permanent Account Number Card

| Name | New PAN Card |

| Appointed By | Minister of Finance, Government of India |

| Forms | Form 49A (Indian Citizens)Form 49AA (Foreign Citizens) |

| Objective | To issue the Pan card |

| Official Website | https://www.tin-nsdl.com/, https://www.pan.utiitsl.com/PAN/#one. |

Objectives of PAN Card

PAN stands for Permanent Account Number, and it is a one-of-a-kind identifying number provided by India’s Income Tax Department to identify each taxpayer in the country. It can be used to open a bank account, travel by train with an e-ticket, and for a variety of other purposes.

PAN Card Structure

The following are the important points related to the structure of the PAN Card:

- The PAN Card includes the details like

- Name

- Father’s Name

- Date of birth

- Address

- Signature

- Photograph

- PAN Number

- When a PAN number is assigned to the user, a Specific format is followed.

- PAN Numbers are ten-digit alphanumeric numbers that include both numbers and alphabets.

- The first three letters of the ten-digit code are alphabets

- The fourth letter indicates the taxpayer’s category. Individual taxpayers, for example, are assigned the letter P, while firms are assigned the letter F, companies are assigned the letter C, and municipal governments are assigned the letter L.

- The fifth letter is also the first letter of the cardholder’s surname.

- The sixth, Seventh, Eighth, and Ninth letters of a PAN Number are Numeric Numbers.

- The Tenth letter of a PAN Number is an Alphabet.

Applications of PAN Card

The PAN Card is used for the following purposes:

- Income Tax (IT) Return Filing

- For income tax refunds

- To open a Demat account for purchasing and selling shares

- Withdrawing, depositing, or transferring funds worth Rs 50,000 or more from one bank account to another

- It can also be used as Identity proof.

PAN Card Types

PAN cards differ depending on the taxpayer for whom they are issued. The following are the various types of PAN cards for:

- Individual taxpayers

- Trusts and cooperative societies

- Company or organization

- Partnership firms or business units

New PAN Card Eligibility Criteria

Applicants who want to apply for the New PAN Card must fulfill the eligibility criteria put forward by the Minister of Finance, Government of India. The eligibility criteria New PAN Card are as follows:

- According to the Income Tax Act, Indian residents who fall into the following categories are eligible to apply for a PAN Card:

- Anyone, including individuals, businesses, and joint ventures are eligible to apply

- Businessmen or self-employed professionals with annual revenue of at least 5 lakh rupees.

- Ones who pay or are liable to pay tax to the IT Department are eligible to apply

- Trusts, organizations, and groups that are registered.

- One who deals with imports and exports.

- There is no minimum or maximum age requirement to apply for PAN Card

Required Documents for New PAN Card

While filling up the application form for the New PAN Card, some important documents will be needed by the applicants, make sure to keep them handy. The documents required for New PAN Card are as follows:

- Applicants Passport Size Color Photograph

- Aadhaar card

- Demand draft / Check of amount Rs. 107 (inclusive of service tax) as a fee. The charge for applying for PAN is Rs. 994 (including service tax) for foreign communication addresses.

- Along with these documents, the below-given documents are also required to apply for a New PAN Card.

Proof of Identity

| Copy of any one of the following documents | Aadhaar card Photo identity Card Passport Driving license Voter Id Arm’s license Ration card Pensioner card Ex-Servicemen Contributory Health Scheme Card Central Government Health Scheme Card |

| Originals Documents Required | Bank Certificate of identity (signed by a Member of Legislative Assembly or Member of Parliament or Municipal Councilor) |

Proof of Address

| Copy of any one of the following documents | Applicant’s photo identity Card Domicile Certificate Aadhaar Card Passport Driving license Post office Passbook Property tax assessment order Letter of allotment issued by the State Government or Central Government |

Copy of any one of the following documents(Not older than three months) | Water Bill Bank account Statement Landline bill Electricity bill Depository account Statement Gas connection card Credit card statement |

| Original documents Required | Employer certificate Certificate of address signed by a Member of Legislative Assembly or Member of Parliament or Municipal Councilor or a Gazette officer |

Proof of Date of Birth

| Copy of any one of the following documents | The birth certificate is issued by a municipal authority. Domicile certificate issued by the Government.Any photo identity card issued by the State Government or Central Government of India.10th class mark certificate issued by a recognized board. Passport. Driving License. Aadhaar Card, Any photo identity card issued by a Central Public Sector Undertaking or State Public Sector Undertaking Pension payment order.Contributory Health Scheme photo card for Ex-servicemen |

PAN Card Fee

- The PAN application processing fee is Rs 107/-. (Inclusive of Service Tax).

- For international communication addresses, the fee for obtaining a PAN is Rs. 994 (including service tax).

- Payments can be made by Check, Demand Draft, Credit Card, or Net Banking.

- The check or demand draft must be made payable to NSDL-PAN.

- The demand draught must be payable in Mumbai, and the name and acknowledgment number must be written on the back.

Steps to Apply for a New PAN Card on NSDL Portal

Depending on whether you are an Indian citizen or a foreign citizen, you must complete Form 49A or 49AA when applying for a new PAN card. On the NSDL website, Applicants need to follow the below-given steps to apply for a PAN card.

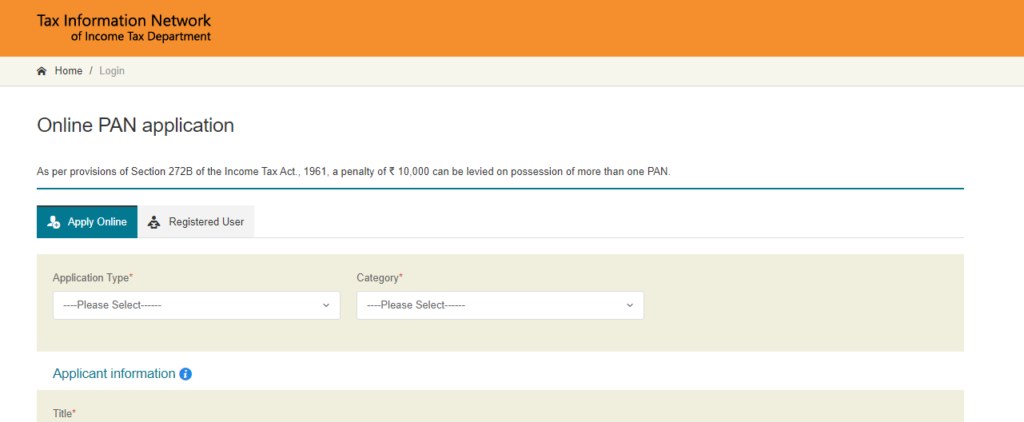

- First of all, go to the Online PAN Application section of the official website of NSDL.

- An application form will open on the screen.

- Chooses your application form type from the given options i.e.,

- Form 49A (Indian Citizens)

- Form 49AA (Foreign Citizens)

- Changes or Correction in PAN /Reprint of PAN Card.

- Now, choose your category from the given drop-down list i.e.,

- Individual,

- Association of Persons,

- Body of Individuals,

- Trust,

- Limited Liability Partnerships,

- Firm,

- Government,

- Hindu Undivided Family,

- Artificial Judicial Person,

- Local Authority.

- After that, select the Title and enter the following details:

- Last name / surname

- First name

- Middle Name

- Date of Birth / Incorporation / Formation in DD / MM / YYYY format,

- Email ID,

- Mobile Number

- Now enter the Captcha code, accept the declaration and click on the Submit button.

- Once you will click on the Submit button, a dialogue box will appear on the screen with the Token Number.

- Click on the Continue with PAN Application Form link.

- Once you will click on the link, the Application Form as per your selected option i.e., Form 49A or Form 49AA will open on the screen.

- Now fill in the form with all the required details.

- After filling in all the details, you will be provided with different options to submit the form i.e.,

- Forward application documents physically

- Submit digitally through digital signature

- Submit digitally through e-sign.

- Click on one of the given options.

- Now a new page will open on the screen, Upload all the required documents your documents like:

- Identity proofs

- Address proofs

- Date of birth proofs

- Now Confirm the declaration, place, and date of application.

- Review and recheck the form to avoid any mistakes.

- Click on the Proceed button.

- Once you will click on the Proceed button, you will be directed to the payment gateway.

- Now, two options will be provided to pay the application fee i.e.,

- Demand Draft

- Online Payment through Bill Desk.

- As per your choice, select one of the options.

- Now, if you select the Demand Draft option, you will need to make a DD before you begin the application process as you need to enter the DD number, amount, date of issue, and the name of the bank from where DD is created.

- However, if you select Online Payment through the Bill Desk option, then you can pay through Net Banking, and Credit or Debit Cards.

- After that, click on the ‘I agree to terms of service’ option and proceed to pay.

- Depending on whether you provide documents separately to NSDL or upload them online, the PAN application fees will vary.

- After successful payment through the online mode, the applicant will receive an acknowledgment receipt and payment receipt.

- Print the acknowledgment receipt and payment receipt for future reference.

- Now attach two recent photographs along with the acknowledgment receipt.

- After the payment is successful, send the supporting documents via post or courier to NSDL.

- Finally, when your documents will reach the NSDL, NSDL will process your application.

PAN Card Correction on NSDL Website

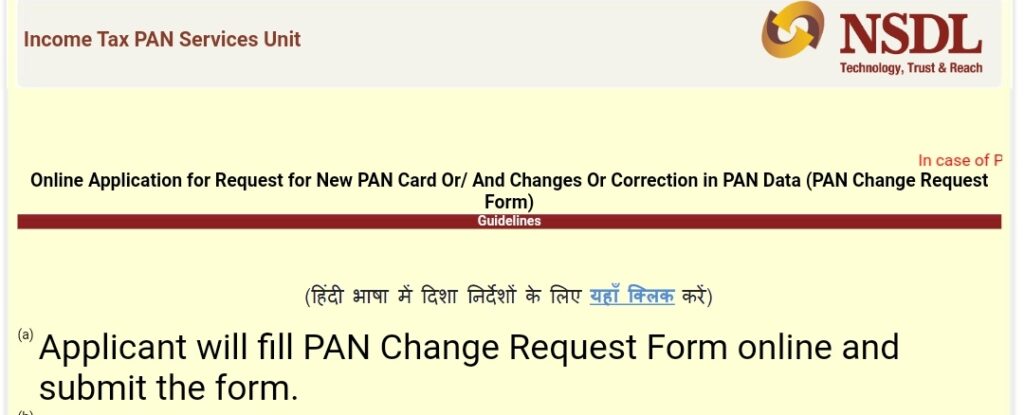

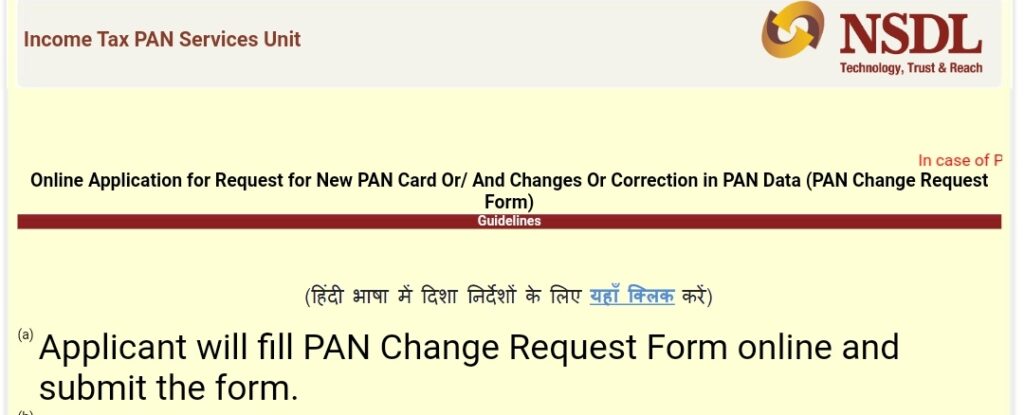

To Apply for Correction of New PAN Card Details on NSDL Website, applicants need to follow the below-given steps:

- Visit the NSDL website.

- A new page will open on the screen.

- Under DSC Based PAN Application New, click on the Change / Correction in PAN Data

- A new page will open on the screen.

- Now, select the category and click on the Select button.

- The change/ correction form will open on the screen.

- Fill in the form with all the required details.

- Pay the application fee.

- Finally, click on the Submit button.

- After successful payment through the online mode, the applicant will receive an acknowledgment receipt and payment receipt.

- Print the acknowledgment receipt and payment receipt for future reference.

- After that, you mail the required documents like address proof, identity proof, and date of birth proof.

- Also, submit the proof of an existing PAN card.

Steps to Reprint PAN Card

To Reprint New PAN Card on NSDL Website, applicants need to follow the below-given steps:

- Visit the NSDL website:

- A new page will open on the screen.

- Under DSC Based PAN Application New, click on the Reprint of PAN Card.

- A new page will open on the screen.

- Now, select the category and click on the Select button.

- The reprint form will open on the screen.

- Fill in the form with all the required details.

- Pay the application fee.

- Finally, click on the Submit button.

- After successful payment through the online mode, the applicant will receive an acknowledgment receipt and payment receipt.

- Print the acknowledgment receipt and payment receipt for future reference.

- After that, you mail the required documents like address proof, identity proof, and date of birth proof.

- Also, submit the proof of an existing PAN card.

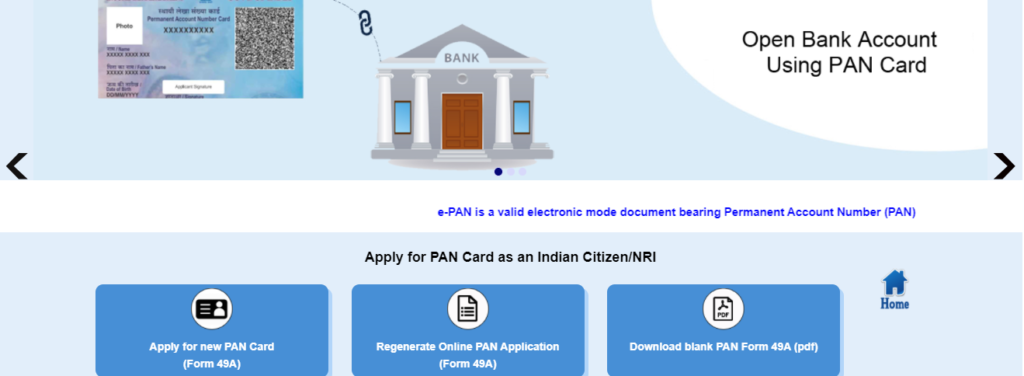

Steps to Apply for a New PAN Card on UTIITSL Portal

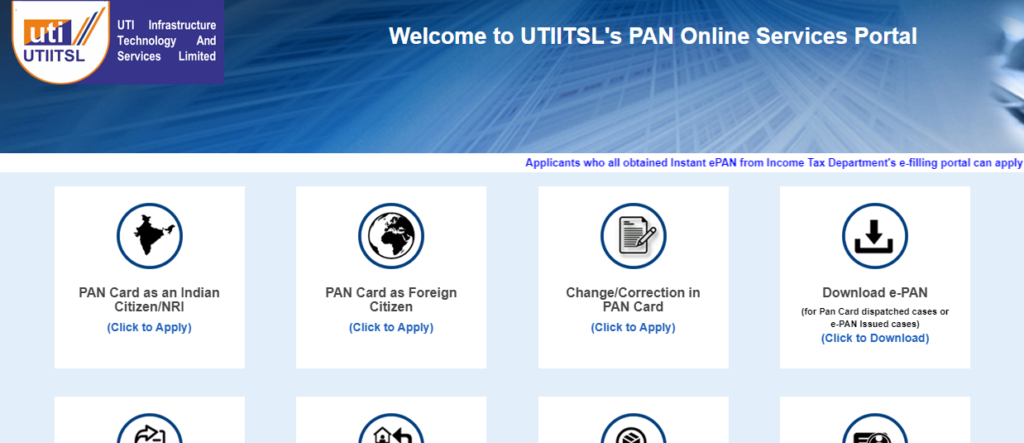

To apply for a New PAN Card on UTIITSL Portal, applicants need to follow the below-given steps:

- First of all, go to the official website of UTIITSL i.e., https://www.pan.utiitsl.com/PAN/#one.

- The home page of the website will open on the screen.

- Click on the PAN Card as an Indian Citizen / NRI (Cick to Apply) option.

- A new page will open on the screen, with different options i.e.,

- Apply for a new Pan Card (Form 49A)

- Regenerate Online Pan Application (Form 49A)

- Download Blank Pan Form 49A (Pdf)

- Click on the Apply for new Pan Card (Form 49A)

- Form 49A will open on the screen.

- Now, select one of the desired options from the given options i.e.,

- Physical Mode: In physical mode, you need to submit the printed signed application forms at your nearest UTIITSL offices.

- Digital Mode: In digital mode, you don’t need to submit a physical copy at the UTIITSL offices and Application forms will be signed using Aadhaar based eSignature or Dsc mode.

- After that, select the Status of the Applicant from the given drop-down list.

- Then select the Pan card mode from the two options i.e.,

- Both physical PAN Card

- e-PAN e-PAN only, no physical PAN Card will be dispatched

- Now, click on Submit button.

- Once you will click on the Submit button, the reference number will be allocated to you. Save that for future use.

- Now click on the OK button, and an application form will open on the screen

- Fill in the form with all the required details like:

- Personal Details

- Document Details

- Contact and Parent Details

- Address Details

- Other Details

- After that upload all the required documents

- Now, click on Proceed button.

- The payment gateway will open on the screen.

- Pay the application fee through the desired mode.

- After successful payment through the online mode, the applicant will receive an acknowledgment receipt and payment receipt.

- Print the acknowledgment receipt and payment receipt for future reference.

- Now mail the acknowledgment receipt and payment receipt to your nearest UTIITSL office along with copies of the required documents.

Steps to Apply for a New PAN Card Offline

To apply for a New PAN Card in an Offline mode, applicants need to follow the below-given steps:

- First of all, go to the official website of NSDL i.e., https://www.tin-nsdl.com/

- Select ‘Application Type‘ and click on ‘Form 49A‘if you are a resident of India.

- Click on Form 49AA, if you are a non-resident individual (NRI) or a foreign national

- Now click on the Download option to download the desired application form.

- After that, Fill in the application form with all the required details

- Attach all the required documents.

- Pay the application fee of Rs. 110 through cash or demand draft.

- Now put the form in an envelope

- Write ‘APPLICATION FOR PAN -N-15 DIGIT ACKNOWLEDGEMENT NUMBER’ on the envelope cover.

- Example, ‘APPLICATION FOR PAN – N-881010200000063’).

- Finally, Send the envelope to the following address:

- Income Tax PAN Services Unit,

- NSDL e-Governance Infrastructure Limited,

- 5th Floor, Mantri Sterling, Plot No. 341,

- Survey No. 997/8, Model Colony,

- Near Deep Bungalow Chowk,

- Pune – 411016

Important Points to Consider While Applying for a New PAN Card

Some of the important points that the individual must consider while applying for a New Pan Card are as follows:

- Personal information entered in the form must be related to the documents presented.

- The candidate must complete Form 49A entirely in block letters.

- The provided resident address, phone number, and email address must all be valid.

- If the individual’s existing PAN card is lost or stolen, the application for a new PAN card will be rejected.

- When applying online, your signature must be scanned at 600 dpi in black and white and saved in JPEG format. (Size must be under 60kb)

- When applying online, your photo must be scanned at 300 dpi, color, and 213 * 213 pixels in JPEG format. (It must be less than 30kb in size.)

- A signature or left thumb impression must be placed over the attached photo in such a way that the signature or thumb impression appears on both the photo and the Form.

- The signature should not be on the right-hand side of the Form, where the photograph is placed.

- Within the box on the left side of the Form, provide your signature or left thumb impression.

- A thumb impression must be confirmed under an official seal and stamp by a Gazetted Officer or Magistrate. Range code, AO code, and AO type.

- The applicant must fill out the form with the Jurisdictional Assessing Officer’s Area Code. The PAN centers or the Income Tax Office can provide you with this code.