The property tax levied by the Greater Hyderabad Municipal Corporation (GHMC) is a tax levied on property owners in Hyderabad. This money is used by the municipal government in Hyderabad to improve public services. Residents can pay their GHMC property taxes online on the GHMC’s website. The tax rate is determined by the location and kind of occupancy. Hyderabad property taxes have the option of paying both online and offline. Individuals who have not paid their property tax on time are subject to a 2% penalty. By entering the required information about your property into a property tax calculator, you may estimate the approximate value of your property tax. Read below to check the detailed information related to GHMC Property Tax 2025 like Calculation of GHMC Property Tax 2025, Online Payment, and much more.

GHMC Property Tax 2025 Comprehensive Details

If you own property in Hyderabad, you are subject to the jurisdiction of the Greater Hyderabad Municipal Corporation, and you must pay GHMC Property Tax every year. Similarly, if you own property in Telangana, the GHMC collects Telangana property tax. This tax applies to residential, corporate, and apartment buildings, as well as any other tangible real estate you hold. It provides the state government with a significant source of revenue, which is utilized to build, maintain, and upgrade public infrastructure and services. A property owner must pay the tax once a year, and the amount is determined by several factors, including the property’s valuation and the state in which it is located. The GHMC property tax is calculated based on the property’s annual rental value.

Read More :- CCLA Webland Telangana

Calculation of GHMC Property Tax 2025

The Gross Annual Rental Value was used to compute the house tax for residential and commercial properties in Hyderabad Corporation. It is determined by the type of property, the constructed area of the building, the property’s intended use, and its location. User needs to follow the below-given steps to determine your Greater Hyderabad Municipal Corporation Property Tax:

- First of all, calculate the size of your plinth (PA). The overall built-up area, which includes all covered surfaces such as balconies and garages, is referred to as the plinth area.

- If the property is self-occupied, identify current rent-per-square-foot on the marketplace for equivalent properties in your area. If you’ve rented the property out, you’ll need to take into account the rent per square foot specified in the rental agreement. This is your MRV per square foot (Monthly Rental Value).

- Finally, Use the following calculation to calculate your residential property tax:

Annual Property Tax for Residential Property = PA x MRV (per sq.ft.) x 12 x (0.17 – 0.30) depending on the monthly rental value in the below table – 10% depreciation + 8% library cess.

Steps to Pay Property tax GHMC Online

User needs to follow the below-given steps to Pay Property tax Greater Hyderabad Municipal Corporation Online

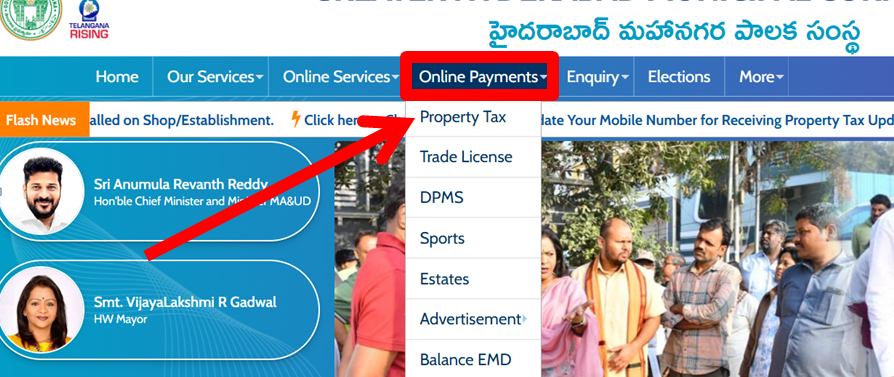

- First of all, go to the official website of the GHMC

- The homepage of the website will open on the screen.

- Under the Online Payments tab, click on the Property Tax option.

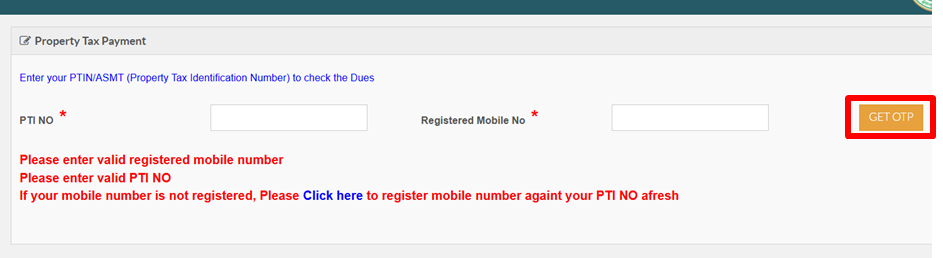

- Now, enter your PTI number

- After that click on the Get OTP

- Details about your arrears, taxable amount, interest on arrears, modifications, and so on are listed on the following page that loads. Examine these to confirm that everything is in order.

- In the drop-down box at the bottom of the page, select a payment option. To pay your property tax, you can use a credit card, a debit card, or net banking.

Read More :- Mabhoomi Telangana

Steps to Pay Property tax GHMC Offline

You can also pay your GHMC tax by writing a demand draught or a check payable to the ‘Commissioner, GHMC’ and depositing it at a State Bank of Hyderabad branch, a citizen service center, a MeeSeva counter, or a Bill Collector.

GHMC property tax rates

| Monthly Rental Value | General Tax | Conservancy Tax | Lighting Tax | Drainage Tax | Total |

| Up to Rs.50 | Exempt | Exempt | Exempt | Exempt | Exempt |

| Rs.51 – Rs.100 | 2.00% | 9.00% | 3.00% | 3.00% | 17.00% |

| Rs.101 – Rs.200 | 4.00% | 9.00% | 3.00% | 3.00% | 19.00% |

| Rs.201 – Rs.300 | 7.00% | 9.00% | 3.00% | 3.00% | 22.00% |

| Rs.300 and above | 15.00% | 9.00% | 3.00% | 3.00% | 30.00% |

Calculation of GHMC Commercial Property Taxes

User needs to follow the below-given steps to determine your GHMC Commercial Property Taxes

- Determine the size of your plinth (PA).

- For the fixed monthly rent per square foot in different circles in different taxation zones, the MRV for commercial property is indicated in the notifications sent by the GHMC. The MRV is available on the GHMC website (https://www.ghmc.gov.in/proposed div zones.aspx).

- Use the following formula to calculate the commercial property tax:

Annual Property Tax for Commercial Property = 3.5 x PA in sq.ft. x MRV in Rs./sq.ft.

Also, keep in mind:

- ATMs and cellular towers/hoardings are taxed at the highest level as commercial property, with monthly rents of Rs.70 and Rs.50 per square foot, respectively.

- The minimum monthly rent for educational institutions and hospitals is Rs.8 and Rs.9.50 per square foot, respectively.

Exemptions from property taxes in Hyderabad

- Non-agricultural lands, structures, and buildings are all subject to taxation. Although the tax rate varies depending on how the property is used, some properties are completely tax-free (or at least receive some concessions).

- Military servicemen and ex-servicemen hold completely tax-free properties.

- Religious places of worship are tax-exempt to the fullest extent possible.

- Residential buildings that are occupied by their owners and have an annual rental value of less than Rs.600 are tax-free.

- After a field report has been issued by the tax inspector, vacant premises will obtain 50% concessions called “vacancy remission.

- Taxation is completely excluded for recognized educational institutes (up to std. X).

Read More :- RTE Telangana

Rebates and penalties applicable to GHMC tax payments

- The GHMC property tax, like any other type of taxation, has due dates and penalties for late payments. The deadlines for paying half-yearly property taxes are July 31st and October 15th.

- If you miss this deadline, you will be assessed a penalty of 2% on your property tax for each month you are late.

- GHMC incentivizes property owners to pay property tax and collect arrears on time by offering cash awards to those who pay property tax before the due date through a fortunate draw.

Greater Hyderabad Municipal Corporation Zones and Circles

| S.NO | Name of Zone | Name Of circle |

| 1 | East Zone | Kapra, Uppal, Hayathnagar, LBNagar, SaroorNagar |

| 2 | West Zone | Gachibowli, Serilingampally, RC Puram, Patancheruvu, Moosapet, Kukatpally |

| 3 | Central Zone | Mehdipatnam, Karwan, Goshamahal, Musheerabad, Amberpet, Khairatabad, Jubilee Hills, Yousufguda |

| 4 | North Zone | Qutbullapur, Gajularamaram, Alwal, Malkajgiri, Secunderabad, Begumpet |

| 5 | South Zone | Malakpet, Santoshnagar, Chandrayangutta, Charminar, Falaknuma, Rajendra Nagar |

Contact Details

- Address :- CC Complex Tank Bund Road, Lower Tank Bund Hyderabad: 500063

- Website :- www.ghmc.gov.in

- Helpline :- 21111111

- Phone No. :- 040-23225397

Important Link

| Grievance Status | Click Here |

| Citizen Login | Click Here |

FAQ’s

The official website for GHMC property tax payment is https://www.ghmc.gov.in/

Property tax payments to the GHMC can be made in both the methods i.e., online and offline.

To find out about tax payment data on the GHMC website, go to the “search your property tax” option and enter the circle number as well as additional information such as the PTIN number, the name of the owner, and the door number.

If you do not pay your GHMC property tax, you will be charged a penalty of 2% per month on the outstanding balance.