As we know, India is a vast country, and there are thousands of insurance companies registered with the state as well as the central government. The main aim of these companies is to provide insurance or financial support during times of need for the citizens. The citizens register themselves for the insurance as per their need and requirement in future. One of the specific schemes is for the salaried employees of the country, which is the Employees Deposit Linked Insurance Scheme. In this article, we will learn about the benefits and importance of this scheme for employees who are dependent on their salary. We will also provide you with the procedure to apply for the scheme.

Employees Deposit Linked Insurance Scheme

The employee deposit linked Insurance also known as EDLI, is an insurance policy for salaried employees who are solely dependent on their salaries. The insurance is covered under the EPFO Employee Provident Fund organisation for private employees as well as the employees’ pension scheme.

Employees’ Deposit Linked Insurance Overview

| Name of Scheme | Employees Deposit Linked Insurance Scheme |

| Beneficiaries | Salary Employees |

| Benefits | Financial Support |

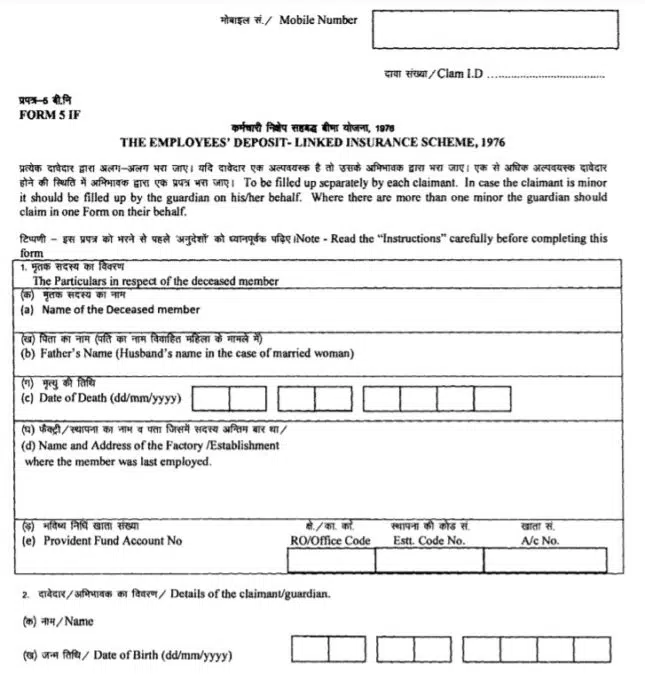

| Application form | https://www.epfindia.gov.in/site_docs/PDFs/Downloads_PDFs/Form5IF.pdf |

Benefits and the importance of Employees Deposit Linked Insurance Scheme

Maximum guaranteed insurance benefits: According to this, in the case of the death of the EPF member while in employment, the legal successor of a PF account holder will get up to Rs. 7 lakh. The ceiling was increased from Rs. 6 lakh to the current Rs. 7 lakh in April 2021. If the employee had a continuous 12-month period of employment, the minimum promised benefits would have been Rs. 2.5 lakh.Free advantages: Employees are not needed to pay a premium in order to get benefits under the EDLI plan, as was previously claimed.

Objectives and Features of the Employees Deposit Linked Insurance Scheme

If a member of the EPF passes away while still employed, the nominee or legal successor will get the maximum guaranteed benefit of up to Rs. 7 lakh. The minimum assurance benefit of Rs. 2.5 lakh, provided that the deceased member has been employed continuously for the 12 months before death. The employer’s minimum contribution is 0.5% of monthly employee salaries, up to a maximum of Rs. 15,000. No employee contributions were made. Automatic EDLI Scheme enrolment for PF members. Direct bank deposit of benefit into the bank account of the nominee or legal heir.

Application Procedure of Employees Deposit Linked Insurance Scheme

In the event of the EPF member’s passing within the service period, the registered nominee of the EDLI plan is given a lump sum payout. The nominee listed in both the Employees’ Provident Fund (EPF) Scheme and the EDLI is the same person.

- An application needs to be submitted through the application form in order for a nominee or beneficiary to receive insurance benefits in the event that a member passes away while in service. http://Form51F for the application form.

- For further help, download the guidelines through the link by clicking here.