You can get a very prestigious amount of pension in your old age if you apply for the Atal Pension Yojana 2023 created by the prime minister in the year 2015. If you want to have a prestigious time in your old age and you want to focus on your inner peace then you can apply for the Atal Pension Yojana and then you will not have to worry about your non-employment in your old age. Given below are the procedure details regarding the अटल पेंशन योजना 2023 which will be helpful for the people attaining the age of 60 years in the upcoming time. We have shared with you all the procedures to apply online for this scheme and also the payment benefits and the maturity benefits of the scheme.

Atal Pension Yojana 2023

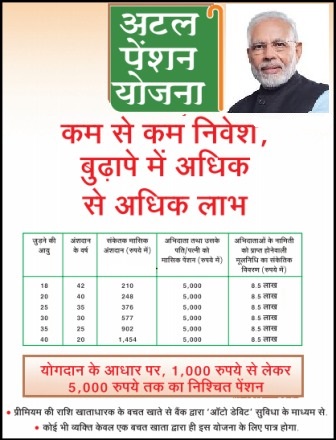

The Atal Pension Yojana was started by the prime minister on 1st June 2015 under which the people above the age of 60 years will be able to get Rupees 1000 to Rupees 5000 per month as a pension. The pension will be given every month to the beneficiaries directly to their bank accounts and the family members can also get the benefit of the pension in the case of an ultimate death of the beneficiary.

The beneficiary will have to deposit a premium every month then after completing the age of 60 years financial assistance will be provided to support the old days of the beneficiary. You can join the scheme as soon as you turn 18 years of age and you will have to pay a premium of rupees 210 every month until you are 40 years of age. If you join this scheme at 40 years old, you will have to pay a premium of Rupees 297 to Rupees 1454.

Read more :- Ayushman Bharat Golden Card

अटल पेंशन योजना 2023 Details

| Name | Atal Pension Yojana 2022 |

| Launched by | Prime Minister of India |

| Objective | Providing pension benefits |

| Beneficiaries | People attaining the age of 60 years |

| Official Site | Click Here |

Features Of Atal Pension Yojana

- Tax benefits are also provided to the taxpayers who will enrol themselves under this scheme.

- The customer must have a savings bank account or a post office savings account in order to get the benefit of this scheme.

- The customer must have an Aadhaar number to get the successful payment of their pension under this scheme.

- More than 3 crore subscribers are enrolled under this scheme during the financial year of 2020

- In the year 2021 more than 79 lakh new subscribers have been added under the scheme.

- Of the 3.2 crore account holders connected under Atal Pension Yojana, 70% of accounts have been opened by banks in public areas and the remaining 19% accounts have been opened by banks in rural areas. In these 6 months, there has been an increase in the number of account holders joining this scheme.

- Mobile application is also available for the beneficiaries to check the details of their pension under this scheme.

- The account holder can take advantage of this scheme after the age of 60 years. For this, the account holder has to provide the contribution amount till the age of 60 years.

- Under Atal Pension Yojana, the account holder before 60 years cannot exit from the scheme. But in certain circumstances such as in case of illness or death, exit from Atal Pension Yojana can be done.

Atal Pension Yojana Benefits

- Through the development of the scheme, many candidates will be able to get free support in their old age regardless of whether they are alone or with their family.

- The candidates will be able to get the benefit of the scheme by just opening a savings account or a post office account and there is no need to fill up a separate application form or go through a detailed application procedure.

- You can easily get your customized Pension Payment and premium payment chart as per the contribution that you are willing to make.

- The candidates are eligible to get 1000 Rupees to 5000 Rupees pension according to the contribution that they will make.

- This will be a highly beneficial scheme for your old age.

APY Withdrawal Details

There are certain circumstances where the candidates will need to withdraw from the scheme and to withdraw you will have to follow the following rules:-

- You can easily withdraw yourself from the atal pension Yojana after you have attained the age of 60 years. In this method, you will be provided with the amount directly by the authorities to your bank account.

- If there is a death of the beneficiary then the amount will be provided to the spouse of the subscriber and if the spouse is not present then the amount will be provided to the nominee.

- If you withdraw before attaining the age of 60 years then you will have to gain special permission from the department otherwise it is not possible to withdraw.

Application Fees

The candidates will have to pay a nominal amount of fees in order to be eligible for the scheme:-

| For contribution up to ₹100 per month | ₹1 |

| For Contribution of ₹ 101 to ₹ 500 per month | ₹2 |

| For Contribution of ₹ 501 to ₹ 1000 per month | ₹5 |

| For Contribution above ₹1001 | ₹10 |

APY Pension Amount Details

You can pay various premiums in order to get various amounts of pension in your old age. Some of the premium plans are given below:-

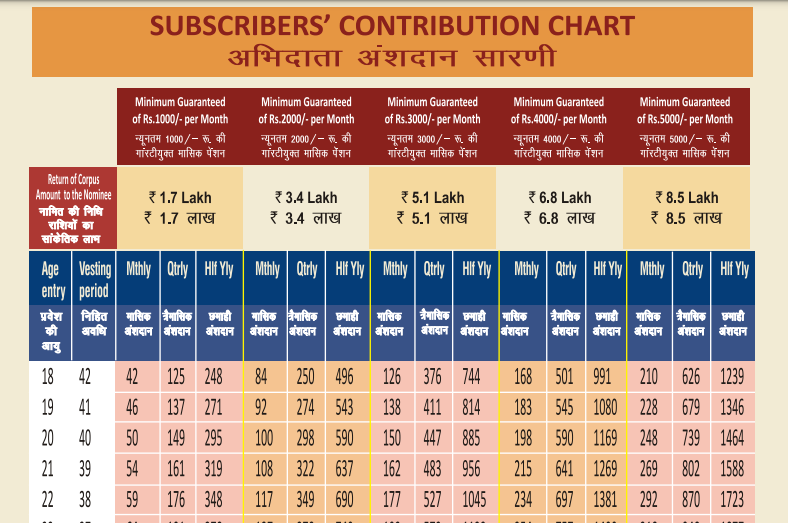

- If you are 20 years old and you want to get a pension of ₹ 2000 then you have to pay a premium of ₹ 100 per month and if you want to get a pension of ₹ 5000 then you have to pay a premium of ₹ 248 per month.

- If you are 35 years old and you want to get a pension of ₹2000 then you have to pay a premium of ₹362 and to get the pension of ₹5000 you have to pay a premium of ₹902.

- Along with your investment, 50% of the amount under this scheme will also be paid by the government.

- If the account holder dies before the age of 60 years, then the benefit of this scheme will be provided to the family of the account holder.

Also Read: UP Pension Scheme

Non Payment Clause

If you are not able to do your payment under the scheme then you will have to go through the following non-payment rules and regulations:-

- If the applicant does not make the contribution under Atal Pension Yojana, then his account will be frozen after 6 months and after 12 months his account will be deactivated and after 24 months his account will be closed.

- If the applicant fails to make the payment on time, he will have to pay a penalty. This penalty ranges from ₹1 to ₹10 per month.

Non Eligibility Criteria

The following people or not eligible to get the benefits of the Atal Pension Yojana 2021:-

- The Employees’ Provident Funds and Miscellaneous Provisions Act, 1952.

- The Coal Mines Provident Fund and Miscellaneous Provisions Act, 1948.

- Simmons Provident Fund Act, 1966

- Assam Tea Garden Provident Fund and Miscellaneous Provisions, 1955.

- Jammu and Kashmir Employees Provident Fund and Miscellaneous Provisions Act, 1961.

- Any other statutory social security scheme.

Eligibility Criteria Atal Pension Yojana

The applicant must follow the following eligibility criteria to apply for the scheme:-

- Applicants must be Indian citizens.

- The candidate age should be 18 to 40 years.

- Applicants should have a bank account and a bank account should be linked with an Aadhar card.

- The following documents must be submitted by the candidates-

- Applicant’s Aadhar Card

- Mobile Number

- Identity Card

- Proof Of Permanent Address

- Passport Size Photo

APY Scheme Contribution Chart

The applicant must follow the following contribution chart to get their desired amount of pension at their old age:-

| Age of entry | Years of contribution | First Monthly pension of Rs.1000/- | Second Monthly pension of Rs.2000/- | Third Monthly pension of Rs.3000/- | Fourth Monthly pension of Rs.4000/- | Fifth Monthly pension of Rs.5000/- |

| 18 | 42 | 42 | 84 | 126 | 168 | 210 |

| 19 | 41 | 46 | 92 | 138 | 183 | 224 |

| 20 | 40 | 50 | 100 | 150 | 198 | 248 |

| 21 | 39 | 54 | 108 | 162 | 215 | 269 |

| 22 | 38 | 59 | 117 | 177 | 234 | 292 |

| 23 | 37 | 64 | 127 | 192 | 254 | 318 |

| 24 | 36 | 70 | 139 | 208 | 277 | 346 |

| 25 | 35 | 76 | 151 | 226 | 301 | 376 |

| 26 | 34 | 82 | 164 | 246 | 327 | 409 |

| 27 | 33 | 90 | 178 | 268 | 356 | 446 |

| 28 | 32 | 97 | 194 | 292 | 388 | 485 |

| 29 | 31 | 106 | 212 | 318 | 423 | 529 |

| 30 | 30 | 116 | 231 | 347 | 462 | 577 |

| 31 | 29 | 126 | 252 | 379 | 504 | 630 |

| 32 | 28 | 138 | 276 | 414 | 551 | 689 |

| 33 | 27 | 151 | 302 | 453 | 602 | 752 |

| 34 | 26 | 165 | 330 | 495 | 659 | 824 |

| 35 | 25 | 181 | 362 | 543 | 722 | 902 |

| 36 | 24 | 198 | 396 | 594 | 792 | 990 |

| 37 | 23 | 218 | 436 | 654 | 870 | 1087 |

| 38 | 22 | 240 | 480 | 720 | 957 | 1196 |

| 39 | 21 | 264 | 528 | 792 | 1054 | 1318 |

| 40 | 20 | 291 | 582 | 873 | 1164 | 1454 |

Application Procedure Atal Pension Yojana

If you want to apply for the Atal Pension Yojana then you will have to follow the simple procedure given below:-

- The applicant should first open his savings account in any national bank.

- Now you will have to fill up the application form for the scheme.

- Enter all the information asked in the application form for Prime Minister Atal Pension Yojana like Aadhar card, mobile number etc.

- You will have to submit the application form to the bank manager.

- The bank manager will verify all of the details that you have submitted in the application form and you will be eligible for the scheme as per the verification done by the professionals.

Registration Procedure Atal Pension Yojana

If you want to register yourself under the Atal Pension Yojana by opening your account and you will have to follow the simple procedure given below:-

- Earlier, the account under Atal Pension Yojana could be opened only through mobile app and net banking. But now due to this new step account holders can open their accounts without the mobile app and net banking.

- If you want to open an account under Atal Pension Yojana then you have to approach the bank where you have your savings account.

- From there you have to get the registration form.

- Now, you have to submit this registration form to the same bank by filling in all the information asked in the registration form

- Also, attach all the important documents to the registration form.

- You will also have to provide a valid phone number along with the form on which you will receive all the SMS.

- Now you are eligible for the benefits of the scheme.

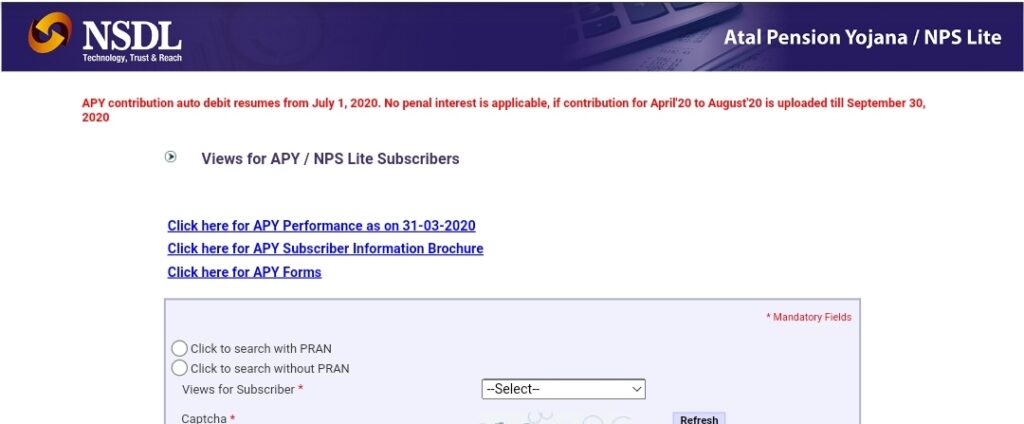

Download Atal Pension Yojana Contribution Chart

If you want to download the contribution chart as a pdf on your mobile then you will have to follow the simple procedure given below:-

- First of all, you have to go to the official website of NSDL

- The home page of the website will be displayed on your screen.

- Click on the link called APY-Contribution Chart

- The chart will open on your screen.

- The details will be displayed on your screen and you can download the chart by clicking on the download button.

APY Scheme Important Forms

If you want to download the forms related to the Atal Pension Yojana then you will have to click on the direct link provided below:-

| APY Subscriber Registration Form | Click Here |

| APY Subscriber Registration Form – Swavalamban Yojana Subscribers | Click Here |

| Subscriber details Modification and Change of APY-SP Form | Click Here |

| Form to upgrade/downgrade pension amount under APY | Click Here |

| APY Death & Spouse Continuation Form | Click Here |

| Voluntary Exit APY Withdrawal Form | Click Here |

| APY Application for Banks to be registered under Atal Pension Yojana | Click Here |

| APY – Service Provider Registration Form | Click Here |

| Subscriber Grievance Registration(G1) Form for APY Subscriber | Click Here |

| APY Common Grievance | Click Here |

Transaction Statement

If you want to check the transaction statement then you will have to follow the simple procedure given below:-

- First of all, you have to go to the official website of NSDL

- The home page of the website will be displayed on your screen.

- Click on the link called APY e-PRAN/Transaction Statement

- Anew page will be displayed on your screen.

- You can search with PRAN or without PRAN

- Now you have to select your option

- Enter the captcha code.

- Click on Submit and the details will be displayed on your screen.

Brochure Downloads

If you want to download the brochure for the scheme then you will have to follow the simple procedure given below:-

- APY Subscriber Brochure in English

- APY Subscriber Information Brochure in Hindi/English

- APY Subscriber Information Brochure in Telugu

- APY Subscriber Information Brochure in Assamese

- APY Subscriber Information Brochure in Bengali

- APY Subscriber Information Brochure in Gujarati

- APY Subscriber Information Brochure in Kannada

- APY Subscriber Information Brochure in Marathi

- APY Subscriber Information Brochure in Malayalam

- APY Subscriber Information Brochure in Odiya

- APY Subscriber Information Brochure in Punjabi

- APY Subscriber Information Brochure in Tamil

- APY Subscriber Information Brochure in Urdu