The government is providing a very prestigious scheme to support the business-minded people of India and today in this article we will be sharing with all of our readers the important specifications regarding this prestigious scheme known as the Stand Up India Loan Scheme 2023. In this article, we will be sharing with all of you the important specifications regarding the scheme including the step-by-step procedure to fill up the application for this scheme and the details regarding the interest rate for this scheme. You have to make sure that you are following all of the important details of the scheme before filling out the application form.

Stand Up India Loan Scheme 2023

The Indian government will be providing various types of financial assistance to the candidates belonging to the economic backward category so that they can start their own business and get better business ideas. Loans will be provided from rupees 1,00,000 to Rupees 1 crore using this prestigious scheme known as the Stand Up India Loan Scheme, which is especially available for the candidates belonging to backward categories. 75% of the total project cost will be covered by the authorities and the entrepreneur will only have to commit to 10% of the total cost under this prestigious scheme.

Details Of Stand Up India Scheme

| Name | Stand Up India Loan Scheme 2023 |

| Launched by | Indian Government |

| Objective | Providing loans |

| Beneficiaries | Economically backward caste and category candidates and women entrepreneur |

| Official site | https://www.standupmitra.in/ |

PMEGP Loan Scheme

Objectives Of Stand Up India Loan Scheme

The objective through the development of this Stand Up India Loan Scheme is to facilitate bank loans between Rupees 10 lakh and Rupees 1 crore to at least one scheduled caste and Scheduled tribe borrower and at least one women borrower. The beneficiaries will be able to start their own business in various departments including manufacturing and other services in various sectors. The loan will be provided at a very minimal interest rate so that all of the beneficiaries can repay the loan within the speculated time period.

Benefits Of Stand Up India Loan Scheme

The Stand Up India Loan Scheme is a very prestigious loan scheme that is provided to the beneficiaries so that they can get a term loan as well as a working capital loan to start their own business. 70% of the total project cost will be covered in this scheme for all of the beneficiaries. The beneficiaries will be able to get loans at the lowest applicable interest rate from the banks and the repayment of the loan will be done over the next seven years with a moratorium period of up to Rupees 18 months. This scheme will encourage people to take up their own business.

Loan Details Under Stand Up India Loan Scheme

- Interest Rate: (Base Rate + (MCLR) + 3% + Tenor Premium)

- Loan Amount: Minimum Rs. 10 lakh & Maximum up to Rs. 1 crore

- Repayment Tenure: Up to 7 years, including moratorium period of 18 months

- Collateral: Required as primary security or guarantee of Credit Guarantee Scheme for Stand-up India Loans (CGFSIL)

National Pension Scheme

Eligibility Criteria

- The individual entrepreneur must be at least 18 years of age.

- The applicant must mandatorily be a woman or a member of the SC/CT community.

- Venture under this scheme must be a greenfield in nature, that too in the type of business specified.

- The applicant must not be a defaulter to any financial institution or a bank in the past.

- The further parameters that shall impact the availability of Stand Up India Loan are:

- The location of the business and the residence of the borrower.

- The category of the promoter, whether SC/ST or a woman.

- Assistance for the preparation of the project plan.

- The quantum of the self-investment in the business venture by the promoter borrower.

- If the borrower needs any assistance to raise the margin money.

- Prior experience of the borrower in handling such a business.

Documents Required

- Identity Proof: Any valid photo identity proof acceptable to the bank.

- Address Proof: Any valid address proof document of the individual and the business firm.

- Memorandum of Articles of the Association of the Company.

- Partnership deed in the case of a partnership firm.

- Copies of the lease deeds.

- Copy of the Rent Agreement.

- The last three balance sheets of the company.

- Assets and Liability statements of both the borrower and the guarantor.

Pradhanmantri Berojgari Bhatta

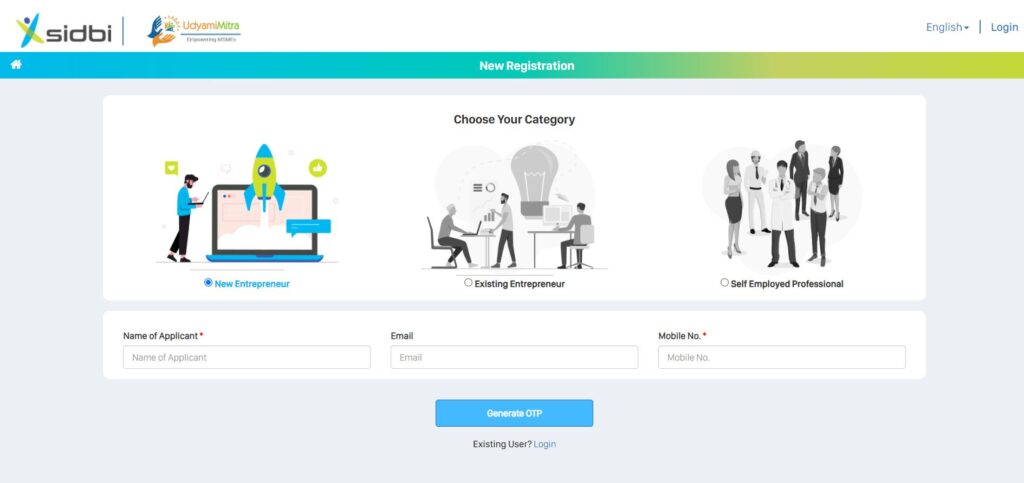

Stand Up India Loan Scheme Registration Process

- First, you need to visit the official website of the scheme

- The homepage will be displayed on your screen.

- You have to click on the option called click here for handholding support or apply for loan

- The registration form for the screen will be displayed on your screen

- You have to enter all of the important details in the application form including the details regarding your business and your area.

- Now, you need to select your category.

- Now you have to select the nature of your business and all of the other details related to your business.

- You need to enter all of your past business experience by entering the details of your business activity and years of experience.

- Fill up the application form with all of the details and finally register yourself for the scheme.

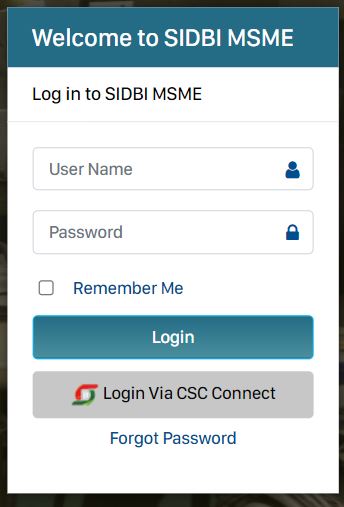

Login Procedure Under Stand Up India Loan Scheme

To login on to the official website you will have to follow the simple procedure given below:-

- First, you need to visit the official website of the scheme

- The homepage will be displayed on your screen.

- You have to click on the option called Login

- Two options will be displayed on your screen namely-

- Applicant

- Click on the option of your choice and enter the username and password to log in.

- The dashboard will be displayed on your screen according to your options.

Application Status Of Stand Up India Loan Scheme

If you want to check the application status then you will have to follow the simple procedure given below:-

- First, you need to visit the official website of the scheme

- The homepage will be displayed on your screen.

- You have to click on the option called Track Application Status

- A new page will open on your screen where you will have to log in using your credentials and finally click on the option called Application Status.

- You have to now enter the details asked on the web page and click on Track

- The application status will open on your screen.

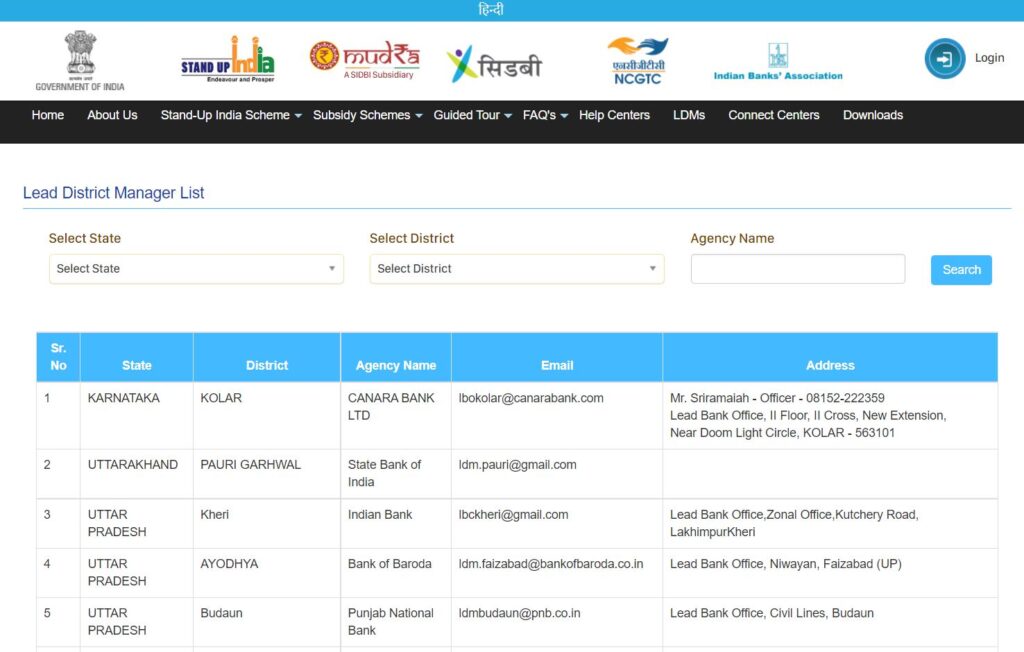

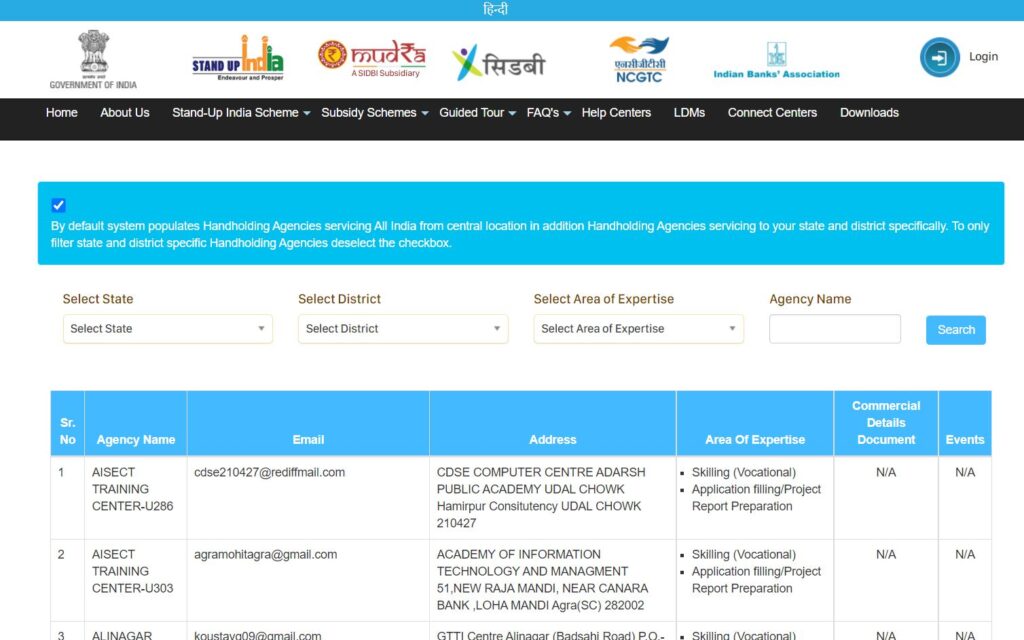

LDMS Details

If you want to check the LDMS details then you will have to follow the simple procedure given below:-

- First, you need to visit the official website of the scheme

- The home page will open on your screen.

- You have to click on the option called LDMs

- A new page will open on your screen and you will have to enter the details regarding your area.

- The list will open on your screen according to the details mentioned.

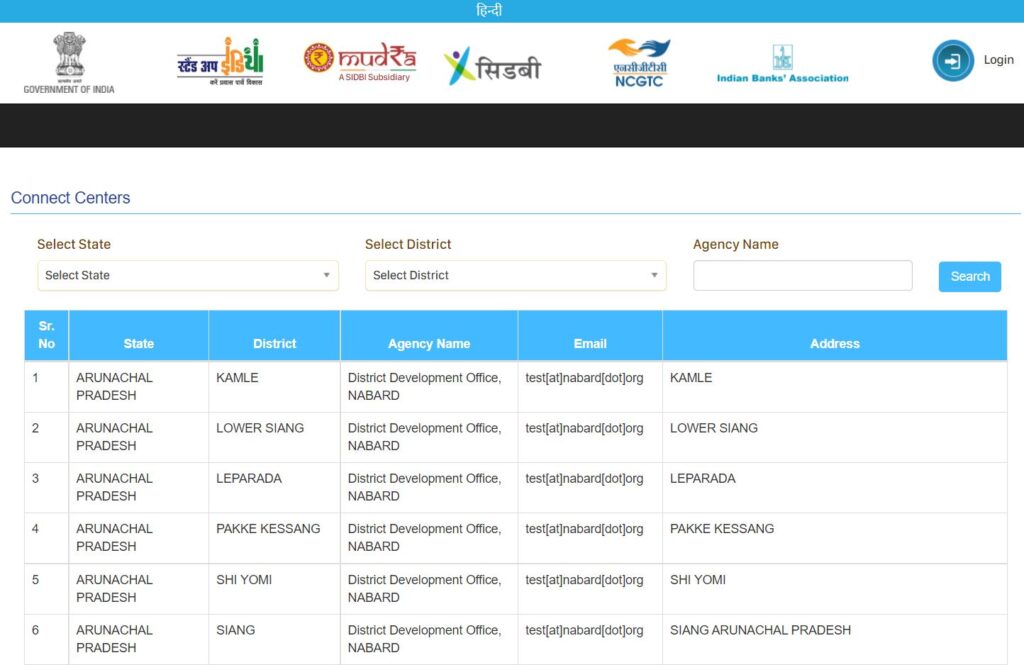

Connect Centers Of Stand Up India Scheme

- First, you need to visit the official website of the scheme

- The homepage will open on your screen.

- You have to click on the option called Connect Centers

- A new page will be displayed on your screen and you will have to enter the details regarding your area.

- The list will be displayed on your screen according to the details mentioned.

Scheme Statistics

The following are the statistics of the stand of India loan scheme for the year 2021:-

| Total application | 139408 |

| Total amount | 33098.87 crore |

| Sanctioned application | 121046 |

| Sanctioned amount | 27295.18 crore |

| Hand holding agencies | 24724 |

| HHA request | 10603 |

| Lenders onboarded | 367 |

| Branches connected | 152576 |

Help Center Details

If you want to check the Help centre details then you will have to follow the simple procedure given below:-

- First, you need to visit the official website of the scheme

- The home page will open on your screen.

- You have to click on the option called Help Center

- A new page will open on your screen

- You need to select the details regarding your area and the health centre present in that area will be displayed on your screen.

Contact Details

- Email:- support[at]standupmitra[dot]in help[at]standupmitra[dot]in

- National Helpline Toll free Number:-1800-180-1111