PF Balance Check Online | PF Balance Check With/Without UAN Number | EPF Balance Enquiry Number | PF Balance Check Number | PF Balance Check by SMS/Miss Call/Aadhar Number

PF Balance is also known as Employee’s Provident Fund i.e., EPF Balance. The PF Balance or EPF Balance was established by the Employees’ Provident Funds Act of 1952, and it is administered by the Employees’ Provident Fund Organization. Because the EPF is managed by the Government of India and ensures a guaranteed rate of return, it is considered a low-risk investment. you should know how much money you have in your EPF account because it is a large amount that can be set aside for crucial financial goals. With so many withdrawal choices, you may want to consider re-investing your EPF money in the future to help you reach your financial goals. There are different ways to check the balance of your EPF account like Umang App, EPFO Member e-Sewa online, SMS, a missed call, or various other options.

PF Balance Check 2025: Comprehensive Details

PF Balance is a retirement savings plan for employees. Both the employee and the employer invest an equal amount to a savings account that can be used when the employee retires or changes jobs. For the financial year 2020-21, the interest rate on EPF contributions is 8.5 percent. The company contributes 12% of the employee’s salary to the employee’s EPF account i.e., basic plus salary dearness allowance retaining allowance. Make sure your employer has activated your Universal Account Number (UAN) before PF Balance Check. All employees registered in the EPF plan are given a UAN, throughout their working career, all employees should have only one UAN, regardless of how many companies they work for. With UAN, you may easily access your PF account services, such as withdrawals, checking your EPF balance, and applying for an EPF loan.

Read more :- e RUPI Explained

Objectives of PF Balance Check

Your income ends when you retire, but your expenditures do not. A good retirement fund is required to ensure that your everyday requirements are satisfied and that your lifestyle remains the same as before. The PF Balance comes to the rescue in this situation. It also offers a variety of advantages like It aids paid employees in achieving financial stability and security, Employee contributions to their PF account are regarded as eligible for tax exemption under Section 80C of the Indian Income Tax Act Employees can get a loan based on their EPF balance, and so many other benefits. Also, to check your PF Balance, you don’t have to wait for your employer to share your Employees’ Provident Fund (EPF) statement at the end of the year to know your balance if you’re an employee and a member of the EPFO.

Various Methods for PF Balance Check

Employees can check their PF Balance / EPF Balance online with or Without UAN through various methods. Some of the methods to check the PF Balance / EPF Balance are given below:

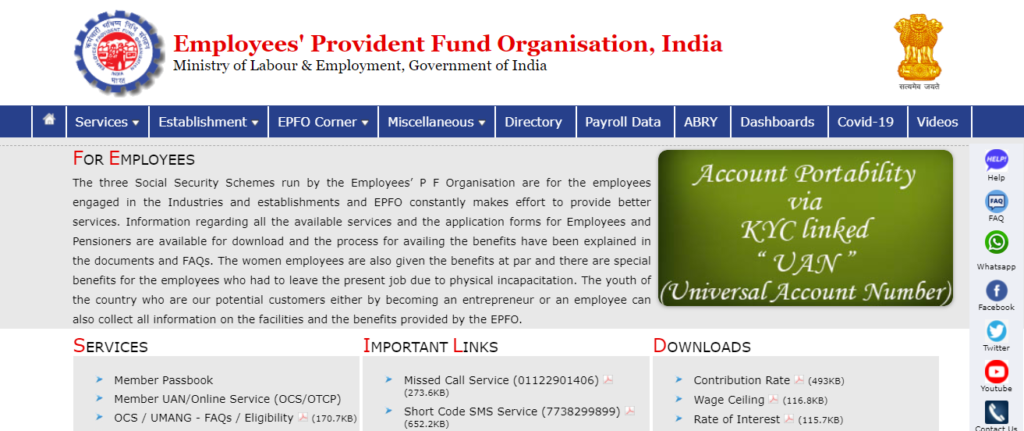

PF Balance Check By EPFO Portal

To check the PF Balance / EPF Balance through EPFO Portal, the user must have a Universal Account Number i.e., UAN. Follow the below-given step by step procedure to check the PF Balance

- First of all, go to the official website of EPFO Portal.

- On the homepage of the website, click on the ‘Services’ option followed by the ‘For Employees‘ option.

- For Employees, the page will open on your screen. Click on the ‘Member passbook’ under the ‘Services’ tab.

- Once you click on the ‘Member passbook’ option, a login page will open on your screen.

- Now, you need to enter your ‘Universal Account Number i.e., UAN’, ‘Password’, and the ‘Captcha Code’.

- Click on the ‘Login’ button.

- Once you are successfully logged in, you will be able to check your EPF balance under your respective Member ID.

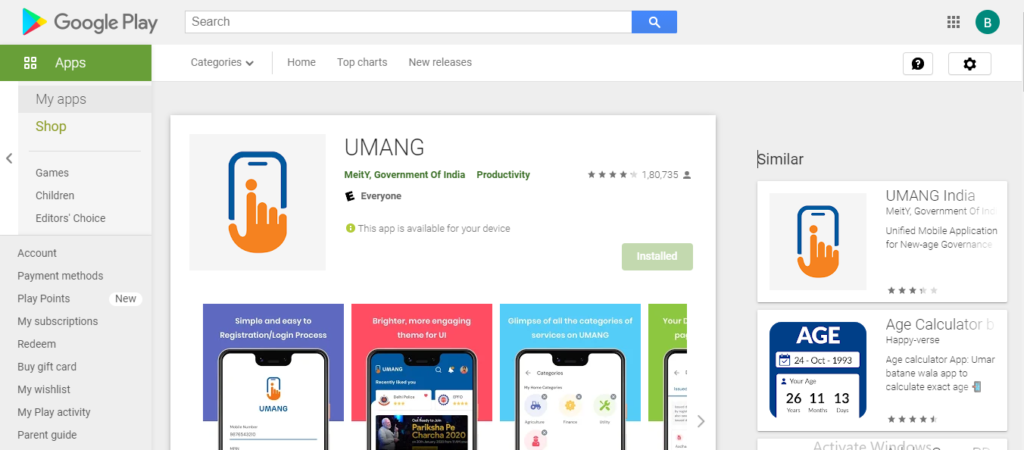

PF Balance Check By Umang App

The government has introduced the Umang app for citizens to check their PF Balance more conveniently and also provide access to a variety of government services in one spot. Employees can check their EPF balance on their phones by downloading the Unified Mobile Application for New-age Governance (UMANG) app. This software allows users to see their EPF Passbook, submit claims, and track their claims. To get started, you just need to enter your phone number and complete a one-time registration using their UAN-registered cell phone number.

The steps to use the UMANG app to check your historical EPF transactions are given below:

- Install and open the app on your smartphone.

- Select the EPFO option.

- The employees’ Provident Fund Organization (EPFO) page will open on your screen.

- Click on the “Employee Centric Services” option.

- On the Employee Centric Services page, click on the ‘View Passbook’ option.

- Now, enter your ‘UAN Number’ and the ‘One-Time Password (OTP)’ that you will receive on your registered mobile number.

- Click on the ‘Login’ button.

- Once you are successfully logged in, you will be able to check your EPF balance, EPF transactions, withdrawals, and deposits from your current and previous employment.

PF Balance Check By Missed Call

Members of the EPF can check their balance by placing a missed call. If you have registered and verified your mobile phone on the UAN portal and have completed KYC for your UAN. Make sure your UAN has your bank account number, Aadhaar number, and PAN. If the following information isn’t linked to the UAN, the employee might ask the employer to do so. All you have to do is make a missed call from the cell number associated with your UAN to 011-22901406. After two rings, the phone automatically disconnects, so you won’t be charged. You will then receive a text message with information on your balance and the most recent contribution made to your PF account.

Also Check: |PMMY| Pradhan Mantri Mudra Yojana

EPF Balance Check By SMS

Another method of checking your EPF balance is by using SMS. You can quickly check your PF balance by sending an SMS if you have registered your UAN with EPFO (Employee Provident Fund Organization) i.e., your UAN must be linked to your bank account, Aadhaar, and PAN. If the following information isn’t linked to the UAN, the employee might ask the employer to do so. The SMS will provide you with information on your most recent contribution and PF balance. You can also receive the SMS in your preferred language. The languages that are supported for the SMS are English, Hindi, Gujarati, Punjabi, Marathi, Telugu, Tamil, Kannada, Bengali, and Malayalam.

The steps to send an SMS are given below:

- Send a text message to 7738299899 through the UAN’s registered mobile number

- The message must be written in the following format: EPFOHO UAN ENG.

- UAN will be your own registered UAN i.e., Universal Account Number.

- In the SMS, you’ll have to select your favorite language. To do so, simply type the first three characters of your desired language.

- For example: Use the first three characters of the word English, i.e., EPFOHO UAN ENG, to receive updates in English, or if you wish to get the message in Punjabi, put EPFOHO UAN PUN.

How to Check an Exempted Establishment’s /Private Trust’s EPF Balance

Large firms with in-house EPF trusts, such as Godrej, HDFC, Nestle, Wipro, TCS, Infosys, and others, are prohibited from submitting their EPF fund to the EPFO. The EPF fund can be managed by certain exempted enterprises through their trusts. These trusts, on the other hand, are likely to perform better than the EPFO-managed fund. Because the EPF contribution goes to the company-managed trusts rather than the Employees’ Provident Fund Organization in the situation of an exempted establishment or private trust, only the company-managed trust can disclose an employee’s PF account balance. When it comes to EPF accounts managed with exempted establishments, there is no popular way for checking PF balance. Members of exempted establishments do not have access to the EPFO’s passbook system. Many employers can run their own PF systems for their employees under the Employee Provident Fund and Miscellaneous Provisions Act, 1952.

Employees of these exempted businesses can check their EPF balance in one of four ways:

- Inspect the company’s employee portal:

Most large firms have a website where employees may log in and check the balance of their EPF account under the EPF area. Wipro and TCS are two examples of firms that offer the ability to monitor one’s EPF account balance and obtain a PF statement via the internet.

- View your PF slip or payslip:

The majority of large corporations send salary slips to their employees via internal emails. Employees can check their EPF account balance on their payslips. In addition to the salary slip, some employers provide an EPF slip also.

- Contact the company’s HR department:

Employees should contact the company’s HR department because it handles the employees’ PF and can offer the necessary information.

- Keep track of your contributions:

Employees can compute their annual EPF balance by examining their wage slips and keeping track of their monthly contributions. For EPF interest calculations, use the EPFO’s interest rate.

How to Check EPF Balance for Inoperative Accounts

Inactive EPF accounts are those in which no contributions have been made for the past 36 months. From 2011 onwards, the EPFO had stopped paying interest on inactive accounts. But then as per the government notification released in November 2016, it stated that even inactive accounts will continue to earn interest and will no longer be categorized as dead. However, after the new amendment takes effect, all inactive accounts received an annual interest rate of 8.5 percent. Previously, accounts became inactive due to various factors like the time-consuming formalities required in EPF transfer and employees preferring to register new accounts when changing jobs.

Follow the steps outlined below to see the EPF balance of inactive accounts.

- First of all, go to the official website of EPFO Portal i.e., https://www.epfindia.gov.in/site_en/index.php.

- On the homepage of the website, click on the ‘’For Employees’ tab’ option followed by the ‘Inoperative Account Help Desk’ option.

- Click on the ‘First Time User’

- Click on Proceed button.

- Now describe your problem in the given space and click Next.

- Now you need to enter the details of your previous company like Company Address, Date of Joining, PF number, etc., and then click on the Next button.

- After clicking on the ‘Next button’, now you need to enter your personal information like Name, Contact Number, Email ID, Date of Birth, PAN, Aadhar Number, etc.

- Now click on ‘Generate PIN’.

- After clicking on ‘Generate PIN’, you will receive a Reference Number.

- Save this number for future reference.

- Finally, your complaint will now get registered and it will be forwarded to the EPFO’s Field Officer.