GST Login Portal Online | GST Portal Online Registration | GST Track Status | gst.gov.in Portal Login Guide

Goods and service tax(GST) is a value-added tax that is levied on the goods and services that are sold for domestic consumption. The consumers pay GST and it is remitted to the government by the business selling goods and services. Today we have come up with this article in order to give you complete information regarding the GST Login portal. By reading this article you will get complete details regarding this portal. Other than that you’ll also get to know the details of objectives, benefits, and features, eligibility criteria, required documents, application status, helpline number, etc. So if you are interested in getting all the details regarding the GST Login Portal 2023 then you have to go through this article thoroughly.

About GST Login Portal 2023

The goods and service tax(GST) came into existence in India in the year 2017. It was the biggest reform in the country’s tax structure. It is basically an indirect sales tax that is applied to the cost of goods and services. There is a particular percentage of GST that is charged over different products and services. The consumer has to pay GST according to the product he or she purchases. This GST adds to the price of the product and the consumer who buys a certain product pays the sales price including the GST.

GST is collected by businesses or sellers and is forwarded to the government. In some countries, GST is also referred to as a value-added tax. The Government of India has launched a GST Login Portal. Through this portal, citizens can file the GST returns sitting at their homes which will bring transparency to the system. This portal will also save a lot of time and money. Many other services which are required for filing GST are also available on this portal.

Objective Of GST Login Portal

The main objectives of the GST Login Portal are as follows:-

- To file GST from the comfort of the home

- To eliminate double taxation

- Make filing of GST easier for general user

- To bring transparency to the system

- Save time and money

- To register on the portal

Key Details Of GST Login Portal

- Name Of The Article- Gst Login Portal

- Launched By- Government Of India

- Beneficiary- Citizens Of India

- Objective- To File Gst

- Official Website- Click Here

- Year- 2021

- Application Procedure- Online/Offline

- Scheme Type- Government Scheme

Benefits And Features Of GST Login Portal

- GST came into existence in India in the year 2017

- Goods and service tax is the biggest reform in country’s tax structure

- GST is an indirect tax which is applied on cost of goods and services

- Every good and service have different percentage of GST which is charged over them

- The consumer has to pay GST according to the product he or she purchases

- The sales price of a product includes GST

- Businesses and sellers are responsible for collecting GST and forwarding it to the government

- In some countries GST is also referred to as value added tax

- For filing GST the Government of India launched the GST login portal

- Through this portal citizens can file GST sitting at their home

- This portal will save a lot of time and money and will also be in transparency to the system

Also Read: Cowin Slot Booking

Document Required To Apply On GST Login Portal

- Aadhar card

- PAN card

- Bank account details

- Cancelled cheque

- Mobile number

- Email Id

- Passport size photograph

Services Available On GST Login Portal

- Registration

- Application for filing clarification

- Track application status

- Create challan

- Grievance against payment

- Track payment status

- Search HSN code

- Generate user ID for unregistered applicant

- Cause list

- Holiday list

- Locate GST practitioner

- Track application status of refund

- E way bill system

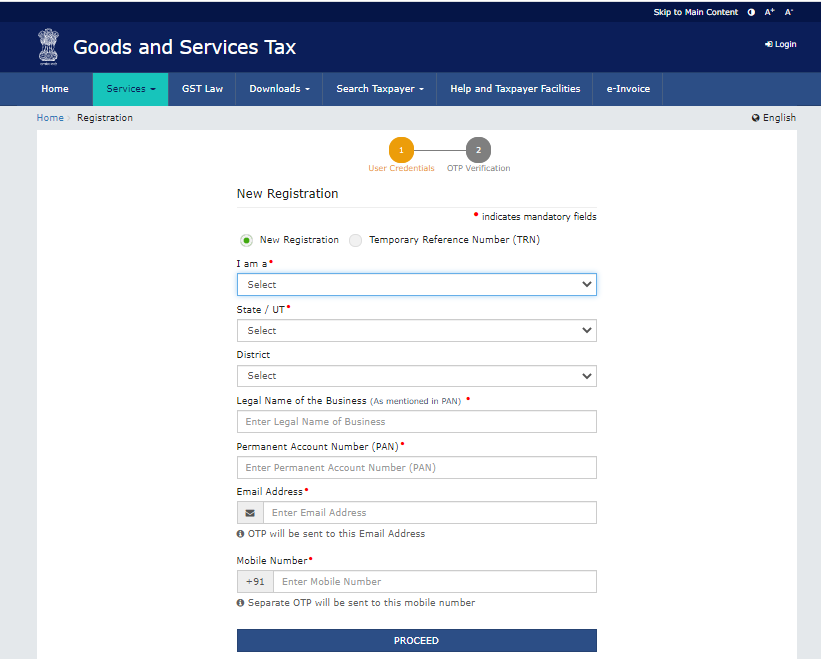

Procedure To Register On The Portal

- First of all go to the official website of goods and service tax

- The home page will open before you

- On the homepage you are required to click on services

- Now you have to click on registration

- After that you have to click on new registration

- Registration form will appear before you

- Now you have to enter the following details in this registration form:-

- Name

- State/UT

- District

- Legal name of the business

- Permanent account number

- Email address

- Mobile number

- After that you have to click on proceed

- Now you have to enter the OTP in to the OTP box

- After that you have to click on register

- By following this procedure you can register on the portal

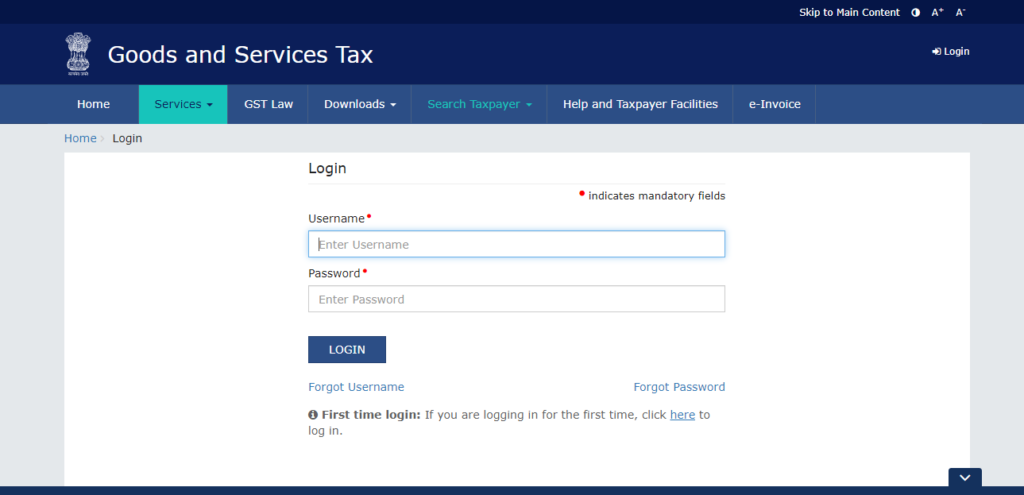

Procedure To Login On The Portal

- Go to the official website of goods and service tax

- The home page will open before you

- Now you are required to click on login

- A new page will appear before you

- On this new page you have to enter your username and password

- Now you have to click on login

- By following this procedure you can login on the portal

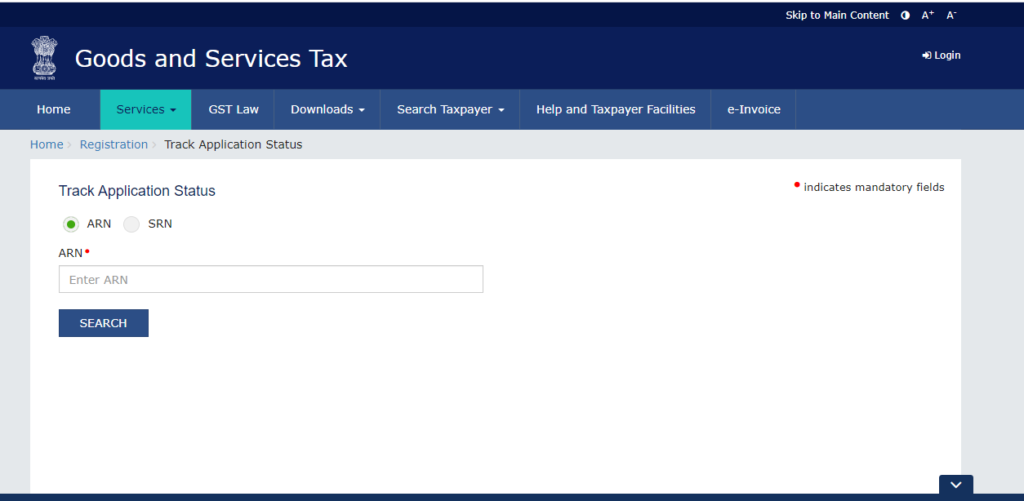

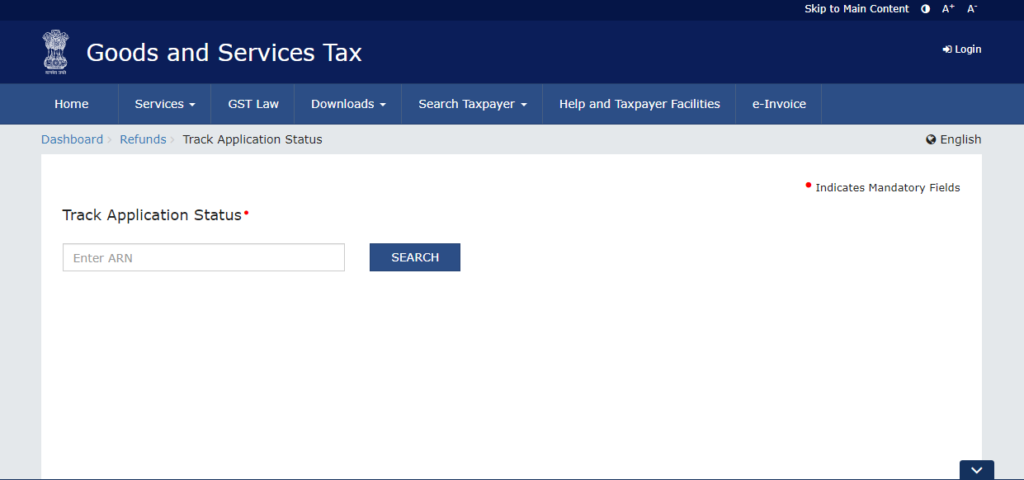

Procedure To Track Application Status

- Visit the official website of goods and service tax

- The home page will open before you

- On the homepage you are required to click on services

- Now you have to click on registration

- After that you have to click on track application status

- Now you have to either enter your ARN number or SRN number

- After that you have to click on search

- By following this procedure you can track application status

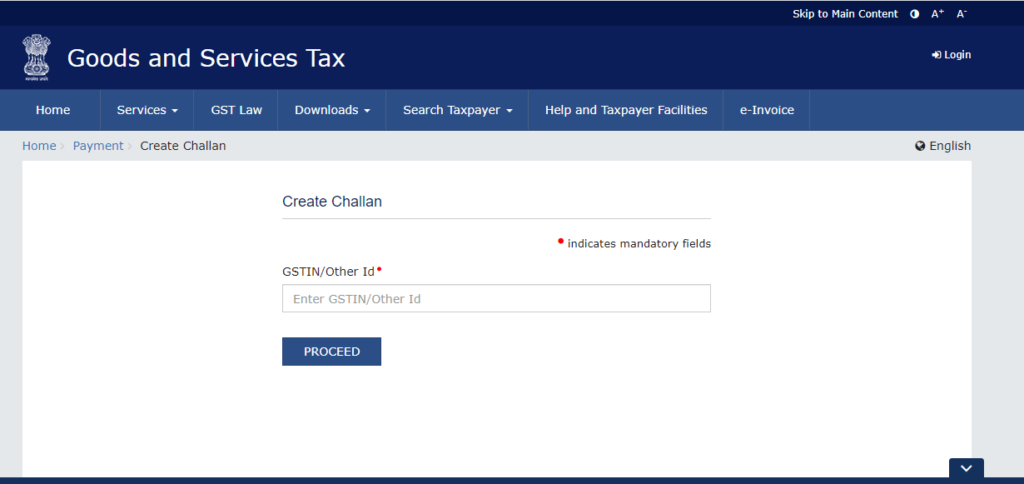

Procedure To Create Challan

- First of all go to the official website of goods and service tax

- The home page will open before you

- Now you are required to click on services

- After that you have to click on payments

- Now you have to click on create challan

- After that you have to enter your GSTIN/Other ID

- Now you have to click on proceed

- A new page will appear before you

- You have to enter all the required details on this new page

- After that you have to click on submit

- By following this procedure you can create challan

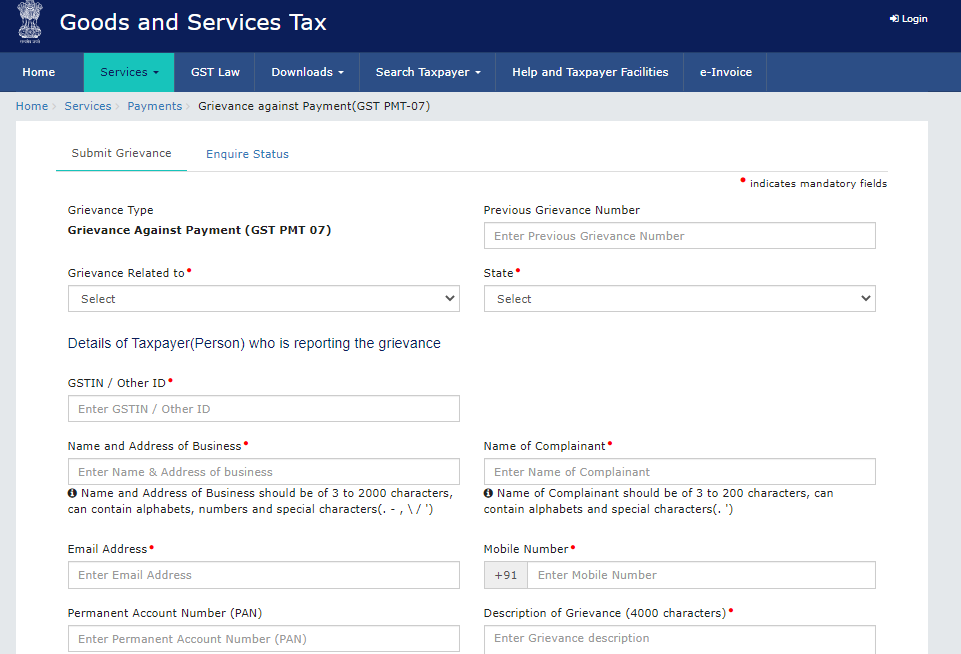

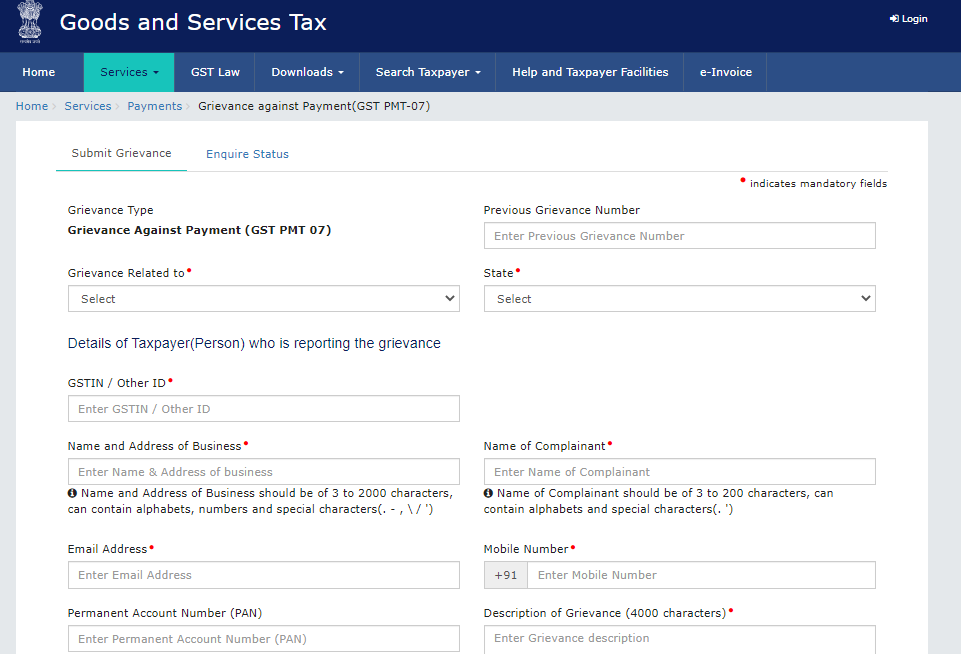

Procedure To Lodge Grievance Against Payment

- Go to the official website of goods and service tax

- The home page will open before you

- On the home page you are required to click on services

- Now you have to click on payments

- After that you have to click on grievance against payment

- Grievance form will appear before you

- You have to enter the following details on the Grievance form:-

- Grievance related to

- Previous grievance number

- State

- GSTIN/other ID

- Name and address of business

- Email address

- Permanent account number

- Description of grievance

- Mobile number

- Name of complainant

- Now you have to upload supporting document

- After that you have to enter CPIN

- Now you have to click on submit

- By following this procedure you can lodge grievance

Procedure To View Grievance Status

- First of all go to the official website of goods and service tax

- The home page will open before you

- Now you are required to click on services

- After that you have to click on payments

- Now you have to click on grievance against payment

- After that you have to click on enquire status

- Now you are required to enter your grievance number

- After that you have to click on search

- Your grievance status will be on your computer screen

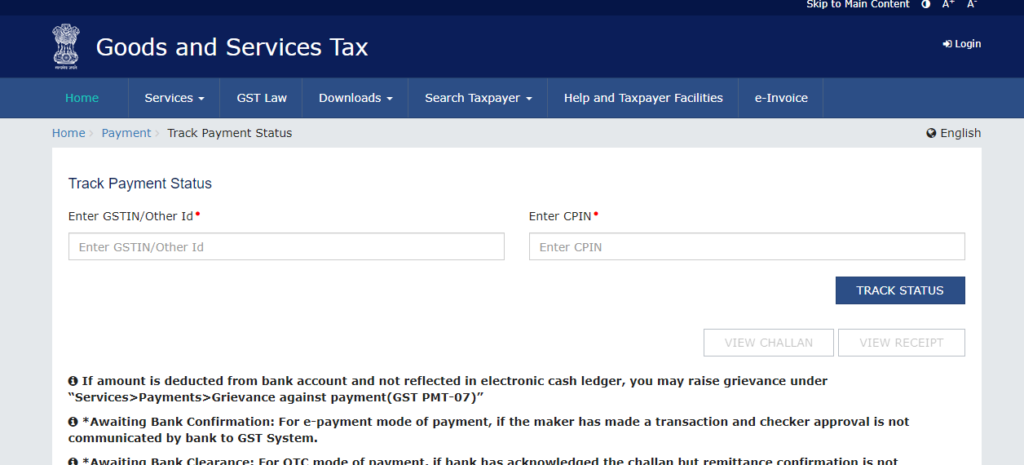

Procedure To Track Payment Status

- Visit the official website of goods and service tax

- The home page will open before you

- On the homepage you are required to click on services

- After that you have to click on payments

- Now you have to click on track payment status

- A new page will appear before you

- On this new page you have to enter GSTIN/other ID and CPIN

- After that you have to click on track status

- Your payment status will be on your computer screen

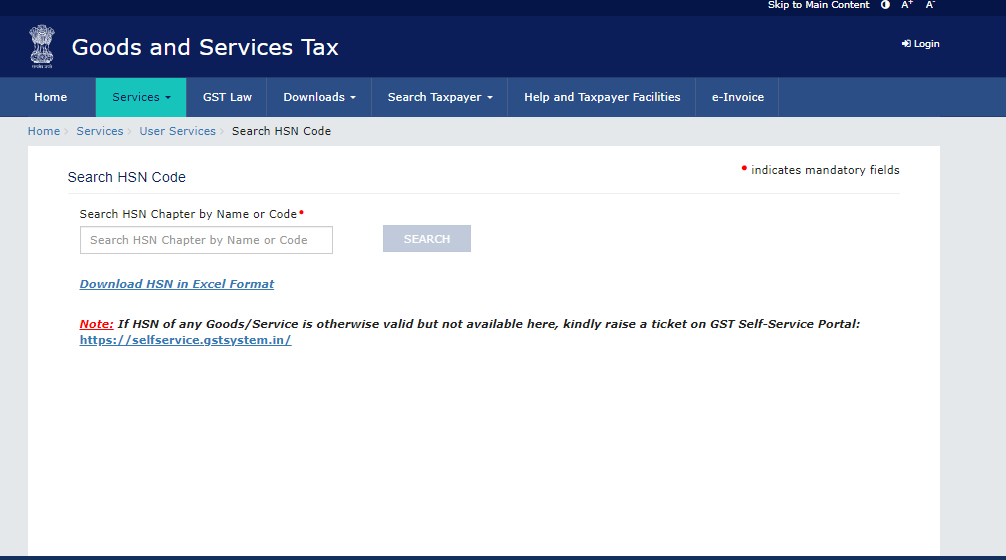

Procedure To Search HSN Code

- First of all go to the official website of goods and service tax

- The home page will open before you

- Now you are required to click on services

- After that you have to click on user services

- Now you have to click on search HSN code

- After that you have to enter name or code

- Now you have to click on search

- Required information will be on your computer screen

Procedure To Generate User Id For Unregistered Applicant

- Go to the official website of goods and service tax

- The home page will open before you

- On the homepage you are required to click on services

- Now you have to click on user services

- After that you have to click on generate user ID for unregistered applicant

- Now you have to enter the following details on the registration form:-

- Basic details

- Details of authorised signatory

- Address of applicant

- Captcha code

- After that you have to click on proceed

- Now you have to enter the OTP in to the OTP box

- After that you have to click on submit

- By following this procedure you can generate user ID for unregistered applicant

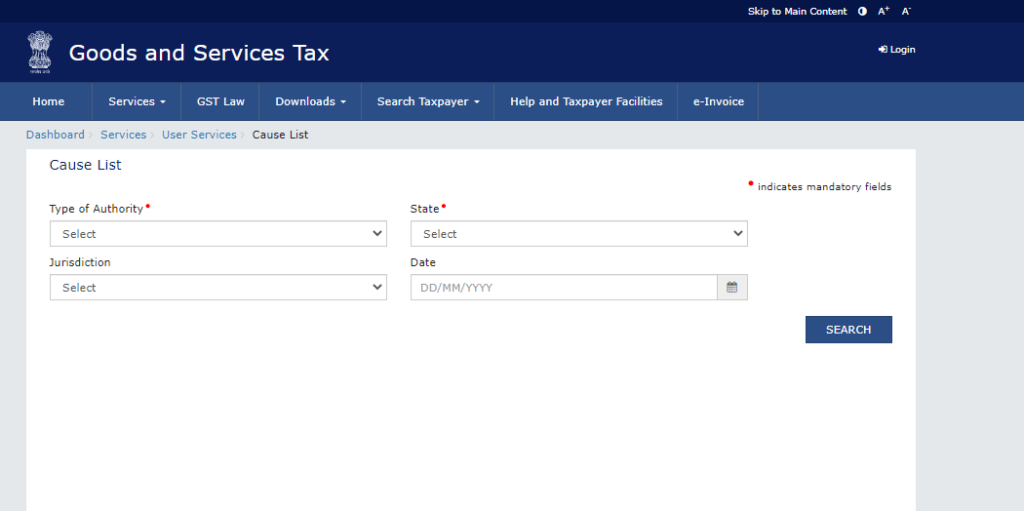

Procedure To View Cause List

- Visit the official website of goods and service tax

- The home page will open before you

- Now you are required to click on services

- After that you have to click on user services

- Now you have to click on cause list

- A new page will appear before you

- You have to enter the following details on this new page;-

- Type of authority

- State

- Jurisdiction

- Date

- Now you have to click on search

- By following this procedure you can view cause list

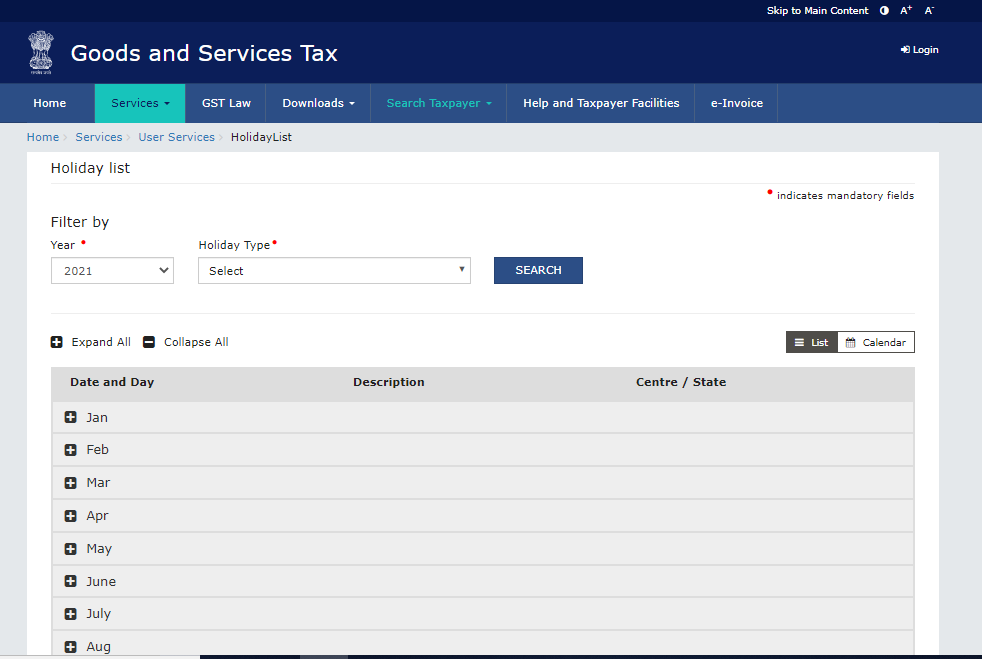

Procedure To View Holiday List

- First of all go to the official website of goods and service tax

- The home page will open before you

- On the homepage you are required to click on services

- Now you have to click on user services

- After that you have to click on holiday list

- After that you have to select year and holiday type

- Now you have to click on search

- Holiday list will be on your computer screen

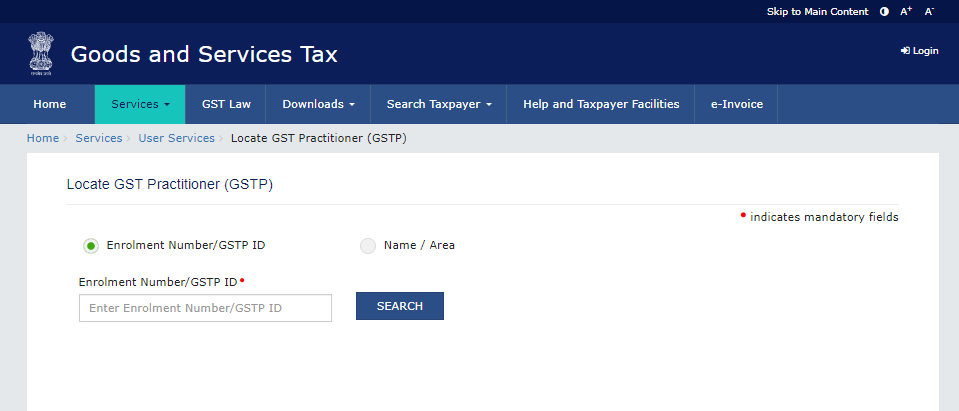

Procedure To Locate Gst Practitioner

- Go to the official website of goods and service tax

- The home page will open before you

- Now you are required to click on services

- After that you have to click on user services

- Now you have to click on locate GST practitioner

- After that you have to either enter enrollment number/GSTP ID or Name/Area

- Now you have to click on search

- Required information will be on your computer screen

Procedure To Search Taxpayer

- Visit the official website of goods and service tax

- The home page will open before you

- On the home page you are required to click on search taxpayer

- Now following options will appear before you:-

- You have to click on the option of your choice

- After that you have to enter the required information

- Now you have to click on search

- Required information will be on your computer screen

Read More: T20 World Cup Schedule 2021

Procedure To Track Refunds Application Status

- First of all go to the official website of goods and service tax

- The home page will open before you

- Now you are required to click on services

- After that you have to click on refunds

- Now you have to click on track application status

- Now you have to enter your ARN number

- After that you have to click on search

- Refund application status will be on your computer screen

Some Important Downloads

- Returns offline tool- Click Here

- Tran-1 offline tool- Click Here

- GSTR3B offline utility- Click Here

- ITC03 offline tool- Click Here

- GST ARA 01- application for advance ruling- Click Here

- GSTR 6 offline tool with amendments- Click Here

- GSTR 7 offline utility- Click Here

- GSTR 10 offline tool- Click Here

- GSTR 9A offline tool– Click Here

- GSTR 4 offline tool (Annual)- Click Here

- Matching offline tool- Click Here

- Tran-2 offline tool- Click Here

- ITC01 offline tool- Click Here

- GSTR 4 offline tool (quarterly filing)- Click Here

- GSTR 11 offline tool- Click Here

- GSTR 8 offline tool- Click Here

- GSTR 9 offline tool- Click Here

- GSTR 9C offline tool- Click Here

- GST statistics- Click Here

Contact Details

- Helpline Number- 1800-103-4786