E Way Bill Registration | E Way Bill Generation | ewaybill.nic.in Login | E Way Bill Rules | GST E Way Bill Status

The Central Government has launched GST E Way Bill Registration, transporter enrolment, and citizen e-way bills. The GST Council has authorized the implementation of the EWB for Interstate logistics of products in all states from April 1, 2018. However. due to some unspecified reasons, the intrastate EWB has been rescheduled to begin implementation on June 3rd, 2018 across the country, rather than June 1st, 2018. However, the GST council with the central government has notified that the said date, June 3rd, is the deadline for all states to implement the Intrastate GST E Way Bill. The central government has made interstate and intrastate e-way bills mandatory. Thus, the transporters must register every time they transport products worth more than Rs. 50,000.

E Way Bill – Comprehensive Details

The GST E Way Bill is an electronic bill that will be compulsory for the movement of products whose value exceeds 50,000 rupees. Every enrolled taxpayer is supposed to have this e-way bill on hand when transferring goods, and it can be generated through the GSTN portal. Once an e-way bill has been generated, the provider, receiver, and transporter will each receive a unique EWB Number, allowing products to be transported from one location to another. Log in to the e-way bill interface to make an e-way bill payment. Several states have already begun to use e-way bills as part of the GST Network (GSTN). This portal was created by the National Informatics Center (NIC). The website ewaybill.nic.in, as well as SMS and the Android app, can be used to generate an e-way bill.

Read more :- GST Login Portal

Highlights of E Way Bill

| Name | E Way Bill |

| Full Name | Electronic Way Bill |

| Mandatory for | Transporters who transport products worth more than Rs. 50,000 |

| Official Website | ewaybill.nic.in |

Objectives of E Way Bill

The motto of the E-Way Bill is “One Nation, One Tax, One Market.” All firms and dealers that pay taxes regularly have already received a printed brochure from the VAT authorities. The interstate and intrastate e-way bills have also been made mandatory by the central government. An electronic-way bill, often known as an EWB, is a document used for the transportation or shipping of products that was introduced on April 1, 2018, under the Goods and Service Tax (GST) framework. EWBs are required for carrying items valued more than Rs. 50,000, whether it be an interstate or intra-state exchange.

EWB Portal Benefits

Some of the benefits of the EWB Portal are as follows:

- Users can create master data for their customers, suppliers, and items to make the E Way Bill production process easier.

- There are several methods for quickly generating an EWB.

- Users will receive notifications to their registered email and/or cell phone number.

- Users can keep an eye on the E Way Bill that has been produced in their accounts.

- Either the transport company or the supplier of the goods who is generating the E Way Bill will record the vehicle number.

- On the portal, users can create sub-users and roles for easy EWB generating.

- Every E Way Bill will have a QR code on it so that the summary can be easily viewed.

- For individuals transporting many consignments, a detailed E Way Bill can be generated.

Also Check: Link Aadhaar Card to Bank Account

List of all States where Intrastate E Way Bill has been Approved

The following is a list of all states that have approved the Intrastate E Way Bill:

| Punjab | Arunachal Pradesh | Telangana |

| Bihar | Chhattisgarh | Gujarat |

| Goa | Haryana | Himachal Pradesh |

| Odisha | Andhra Pradesh | Kerala |

| Jharkhand | Jammu & Kashmir | Karnataka |

| Assam | West Bengal | Tamil Nadu |

| Madhya Pradesh | Maharashtra | Meghalaya |

| Mizoram | Tripura | Manipur |

| Puducherry | Rajasthan | Sikkim |

| Uttar Pradesh | Uttarakhand | Nagaland |

List of all Union Territories where Intrastate E Way Bill has been Approved

The following is a list of all Union Territories that have approved the Intrastate E Way Bill:

| Chandigarh | Dadar & Nagar Haveli |

| Lakshadweep | Andaman & Nicobar |

| Daman & Diu | – |

Documents Required for E Way Bill Registration

The applicants applying for EWB Registration need to submit the documents as proof along with their application form. The applicants are also advised to keep the scanned copy of their documents ready while filling up the application form. The documents required to apply for E Way Bill Registration are given below:

- Tax invoice or Bill of Supply or Challan related to the shipment of goods

- Registered mobile number

- Registration on the EWB portal

- Product details

- Recipient details

- Details of the Road Transporter like Transporter ID or Vehicle number

- Details of the rail, air, or ship Transporters like Transporter ID, Transport document number, and date on the document

Who is Eligible to Generate an E Way Bill?

The persons that are eligible to generate an EWB are as follows:

- Registered Person: When there is a movement of items valued at more than Rs 50,000 to or from a registered individual, an E Way Bill must be generated. Even if the value of the items is less than Rs 50,000, a registered individual or the carrier may choose to generate and carry an EWB

- Unregistered Persons: Unregistered individuals must also generate an E Way Bill. When an unregistered person makes a delivery to a registered person, the receiver is responsible for ensuring that all compliance requirements are completed as if they were the provider.

- Transporter: Transporters who transport products by road, air, rail, or other means must also need to generate an EWB if the supplier has not done so.

- Also, when unregistered transporters enlist on the e-way bill portal, they will be given a Transporter ID, after which E Way Bill can be generated.

| Who | When | Part | Form |

| Every GST-registered individual | Before movement of goods | Fill Part A | Form GST EWB-01 |

| A registered person is either a consignor or a consignee (the mode of transportation may be owned or rented) OR a receiver of commodities. | Before movement of goods | Fill Part B | Form GST EWB-01 |

| The consignor or consignee is a registered person, and the commodities are turned over to the commodities transporter. | Before movement of goods | Fill Part B | The registered person shall furnish the information relating to the transporter in Part B of FORM GST EWB-01 |

| A goods transporter | Before movement of goods | Generate e-way bill on basis of information shared by the registered person in Part A of FORM GST EWB-01 | |

| A GST-unregistered person and a GST-registered receiver | Compliance to be done by Recipient as if he is the Supplier. | The supplier or the transporter may not provide the details of conveyance in Part B of FORM GST EWB-01 if the goods are transported for a distance of fifty kilometers or less within the same State/Union territory from the consignor’s place of business to the transporter’s place of business for further transportation.The information in Part A of FORM GST EWB-01 must be filled in by the consignor or beneficiary if the supply is conducted by air, ship, or railways. |

Who Need To be Responsible for Creating an E Way Bill?

The one that needs to be responsible for creating an e-way bill depends on the conditions surrounding a transaction. Some of the scenarios and who is responsible for generating the E Way Bill is given in the table below:

| S. No. | Scenario | Who must generate e-way bill |

| 1. | When the consignor/supplier transports the items in his own vehicle | The supplier |

| 2. | When items are transported by the consignor/provider in a rented vehicle, by ship, by air, or by railroads | The supplier |

| 3. | When the consignee/recipient transports the items in his own car | The recipient |

| 4. | When products are delivered by the consignment/recipient in a rented vehicle, by ship, by air, or by railways | The recipient |

| 5. | When a registered supplier hands over goods to a transporter | The transporter |

| 6. | When an unregistered provider carries items to a registered recipient in his own vehicle or by hiring a vehicle. | The recipient |

| 7. | When an unauthorized supplier delivers products to a transporter | The transporter |

Also Check: CSC Login

Exemptions from the E Way Bill

The following are a list of cases when an EWB Bill isn’t required:

- If the goods being carried have a customs seal and have been transported under the supervision of customs.

- A non-motorized vehicle is used to deliver items.

- If the cargo containers being transported aren’t loaded.

- If you’re transporting transit merchandise to or from Bhutan or Nepal.

- An E-Way bill is not required if the supplier of the commodities is the State Government, the Federal Government, or a local government, and the items are transported by rail.

- If the items have a customs seal and are transferred from one customs station to another or from an Inland Container Depot to a customs port.

- When commodities are transported for customs clearance from airports, ports, land customs stations, or air cargo to a Container Freight Station or an Inland Container Station.

- If the GST laws in the Union Territory or Say state that the items being transported do not require an E-Way bill.

- If the consignor takes products from a business location to a location where they must be weighed, and inversely. The maximum distance allowed is 20 kilometers, and the delivery challan must be carried.

E Way Bill Registration

The EWB is available to different categories of taxpayers. They involve Registered suppliers, Registered and Unregistered Transporters, as well as Unregistered providers. The following is a step-by-step guide to registering as a taxpayer or a registered transporter:

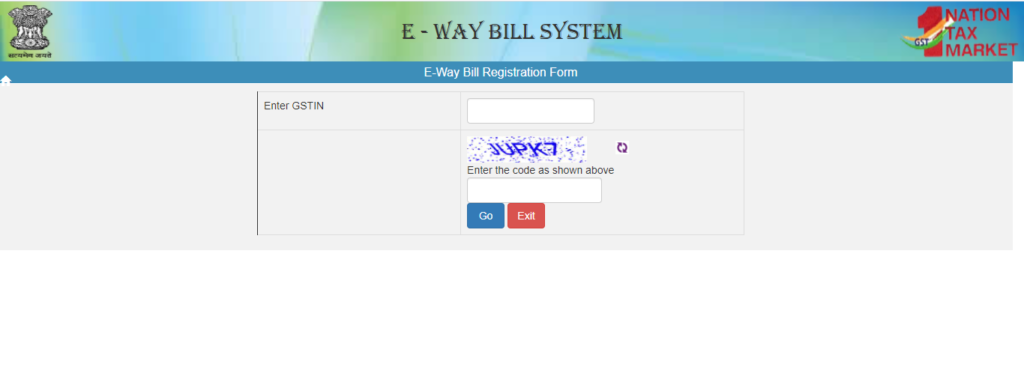

- First of all, go to the official website of EWB Portal i.e., ewaybill.nic.in.

- On the homepage of the website, click on the ‘Registration’ option followed by the ‘e-Way Bill Registration.

- ‘EWB Registration Form’ will open on the screen.

- Now Enter your ‘GSTIN Number’ and the ‘Captcha Code’.

- Click on the ‘Go’ button.

- Once you click on the ‘Go’ button, you will be redirected to a new page.

- Your details will be displayed on the screen like ‘GSTIN Number’, ‘Name’, ‘Trade Name’, and ‘Address’.

- Cross-check all the details, to avoid any mistakes.

- Once you cross-check all the details, click on the ‘Send OTP’ button.

- The ‘OTP’ will be sent to your registered mobile number.

- Enter the correct OTP in the specified space and click on the ‘Verify OTP Button’.

- After your OTP is verified, a new page will open on the screen where you can create a ‘New User ID’ and ‘Password’.

- Create the ‘User ID’ and ‘Password’ as per the given format to complete the Registration Process.

How to Create a User ID and Create a Password

When creating your user ID and password, keep the following in mind:

- The user ID should be between 8 and 15 characters long, with alphabets, digits, and special characters included.

- The password must be at least eight characters long.

- The login and password should not be given out to anybody and should be kept safe.

Step for EWB Portal Login

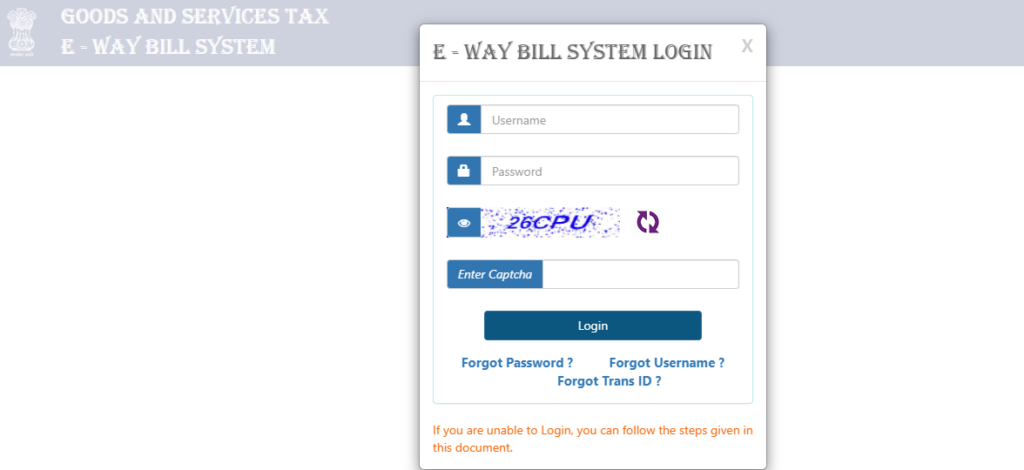

Taxpayers can log in using a ‘user id’ and ‘password’ after registering at the E Way Portal. To log in user need to follow the following step by step procedure:

- First of all, go to the official website of EWB Portal i.e., ewaybill.nic.in.

- On the homepage of the website, click on the ‘Login’ option.

- ‘EWB System Login’ page will open on the screen.

- Enter the ‘User Name’, ‘Password’, and the ‘Captcha Code’.

- Finally, click on the ‘Login’ button and you will be logged in to your registered account.

Steps for Transporters Enrolment Online Application

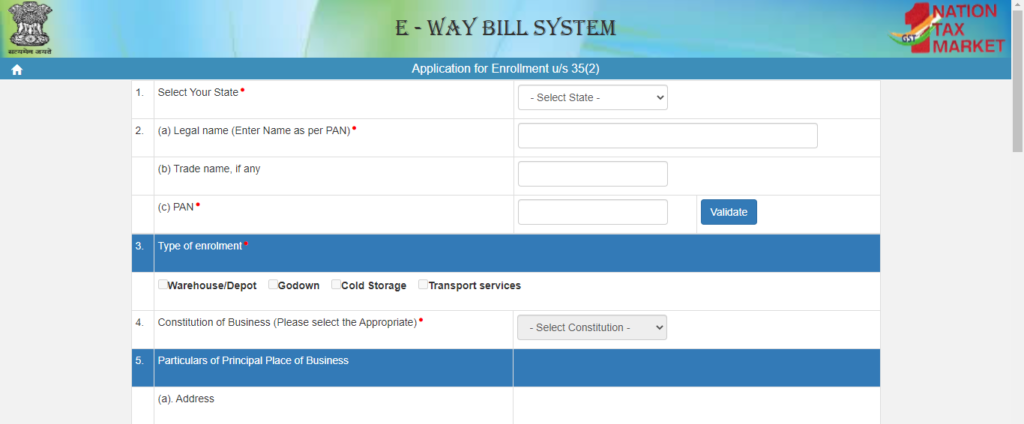

The steps for the Transporters Enrolment Online Application form are given below:

- First of all, go to the official website of EWB Portal i.e., ewaybill.nic.in.

- On the homepage of the website, click on the ‘Registration’ option followed by the ‘Enrolment for Transporters’.

- ‘Application for Enrolment u/s 35 (2)’ will open on the screen.

- Fill in the form with all the required details like Select your State, enter your Name, Trade Name, PAN Number, Select the ‘Type of enrolment’

- Then enter the ‘Particulars of Principal Place of Business, ‘Contact information, etc.

- An OTP will be sent to your mobile number, Verify the ‘OTP’.

- Now enter the Login details i.e., User Name and Password.

- After that confirm the declaration and enter the ‘Captcha Code’

- Finally, save and submit the form.

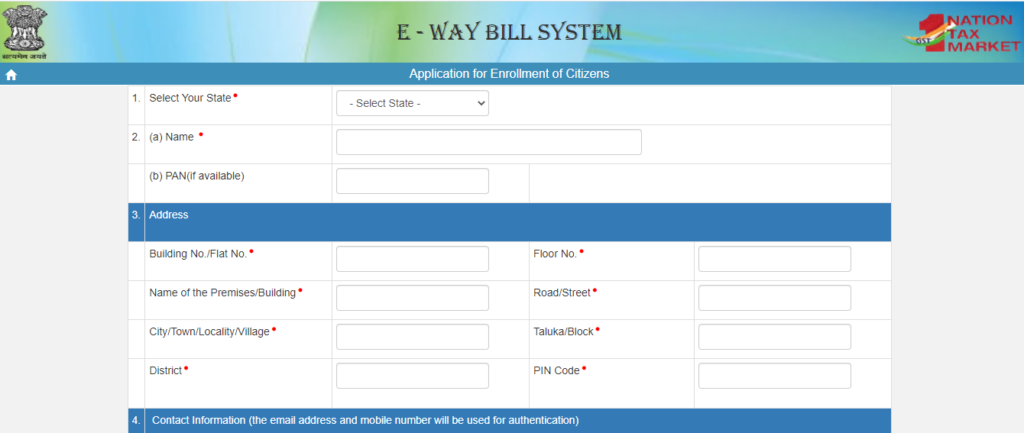

Steps for E-Way Bill for Citizens Online Application

The steps for E-Way Bill for Citizens Online Application form are given below:

- First of all, go to the official website of EWB Portal i.e., ewaybill.nic.in.

- On the homepage of the website, click on the ‘Registration’ option followed by the ‘E-Way Bill for Citizens’.

- ‘E-Way Bill for Citizens’ page will open on the screen.

Generate E-Way Bill Online

To generate the E-Way Bill Online, the user needs to follow the following step by step procedure:

- First of all, go to the official website of EWB Bill Portal i.e., ewaybill.nic.in.

- On the homepage of the website, click on the ‘Login’ option.

- ‘EWB System Login’ page will open on the screen.

- Enter the ‘User Name’, ‘Password’, and the ‘Captcha Code’.

- Finally, click on the ‘Login’ button.

- Now, once you are logged in to your account, click on the ‘E-way bill’ followed by the ‘Generate New’ option.

- A new page will open on the screen.

- Fill in the following details that appear on the screen:

- Transaction Type:

- If you’re a consignment supplier, choose “Outward.”

- If you are a recipient of consignment. te GST Bills in Excel, choose “Inward.”

- Sub-type: Choose the appropriate suitable sub-type

- Document Type: if other options are not listed, then you can select either Invoice/challan / Bill / Bill of entry/credit note.

- Document Number: Enter the document number or the invoice number.

- Date: Select the Invoice date or challan or Document.

- ‘From or to’ Depending on particular nature, in case you are a supplier or a recipient, enter the ‘To or from’ section details.

- Item Details: Add the required details of the consignment (HSN code-wise) in the mentioned section like:

- Product name

- Description

- Quantity,

- Unit,

- HSN Code

- Value / Taxable value

- Tax rate of Cess, if any charged (in%)

- Tax rates of CGST and SGST or IGST (in%)

- Transporter details: The mode of transport i.e., Road/ship/rail/air, and the approximate distance covered (in KM).

- Also enter the Transporter name, transporter ID, transporter Doc. No. & Date. Or the Vehicle number in which consignment is being transported in the below-given format:

- AB12AB1234

- or AB12A1234

- AB121234

- or ABC1234

- or AB123A1234

- Finally, click on the ‘Submit button.

- The system will then validate all the inserted data and will show an error if any.

- If there will be no error, the request will be processed and the EWB in Form EWB-01 form with a particular unique 12-digit number will be generated.

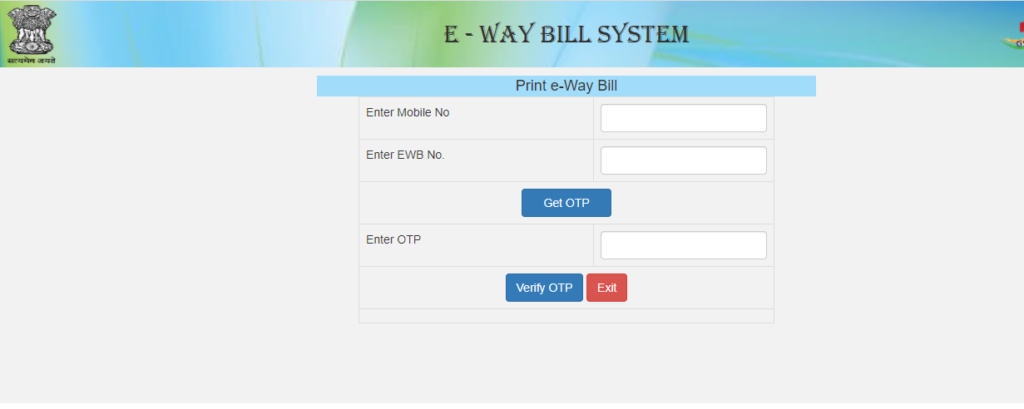

How to Print the Generated E-Way Bill Online

To print the generated E-Way Bill Online, the user needs to follow the following step by step procedure:

- First of all, go to the official website of EWB Portal i.e., ewaybill.nic.in.

- On the homepage of the website, click on the ‘Login’ option.

- ‘E Way Bill System Login’ page will open on the screen.

- Enter the ‘User Name’, ‘Password’, and the ‘Captcha Code’.

- Finally, click on the ‘Login’ button.

- Now, once you are logged in to your account, click on the ‘E-way bill’ followed by the ‘Print EWB’ option.

- ‘Print EWB’ page will open on the screen

- Enter the ‘EWB Number’ and click on the ‘Go’ option.

- Now, verify the OTP.

- After that, click on the Print option.

E Way Bill Validity

The validity of an e-way bill is determined by the distance traveled by the commodities and the date and time of its issuance. The validity of an E Way Bill can also be extended. However, the creator of such an E Way Bill must renew the bill’s validity four hours before it expires or four hours after it has expired. The E Way Bill Validity is given in the table below:

| S. No. | Type of conveyance | Distance | Validity of EWB |

| 1. | Apart from over-dimensional cargo | Less Than 100 Km | 1 Day |

| For every additional 100 Kms or part thereof | additional 1 Day | ||

| 2. | For Over dimensional cargo | Less Than 20 Km | 1 Day |

| For every additional 20 Kms or part thereof | additional 1 Day |

Penalty for not Generating EWB

In the situation where an EWB has not been generated, a penalty of Rs. 10,000 may be imposed. The vehicle transporting the commodities, as well as the products being moved, may be detained or seized in addition to the punishment.