The Rural Postal Life Insurance policy is especially available to the candidates belonging to rural areas who are not able to get the benefit of any life insurance policy due to the large amount of premium that is to be paid by the policyholders. Given below are some important specifications regarding the Rural Postal Life Insurance (RPLI). We will also share with you the important specifications and the step-by-step procedure through which you will be able to check the Status Check, Bonus Rate, Calculator.

Rural Postal Life Insurance (RPLI)

The Rural Postal Life Insurance was first introduced in the year 1995 to offer life protection to the larger population of rural India with a minimum premium rate so that everyone can take the benefit of the life insurance policy without having to worry about the large premium amounts which are nowadays normal in the various policies present in India. The policy will be provided to the economically weaker section of the women. You can also nominate people so that you can take up the benefit of the insurance after your dismissal.

Read more :- EPFO Login

Details Of RPLI Scheme 2023

| Name | Rural Postal Life Insurance (RPLI) |

| Launched by | Central Government |

| Objective | Providing Life Insurance benefits |

| Beneficiaries | Candidates belonging to rural areas |

| Official Website | http://www.postallifeinsurance.gov.in/ |

Features Of Rural Postal Life Insurance

Given below are some of the important features of the Postal Life Insurance policy:-

- The policyholder can also nominate any other beneficiary and also can make changes in the nomination of this policy.

- A loan facility is also available against this policy by submitting this policy as collateral the policy must have 3 three years of maturity if you want to take the loan through this policy.

- You can revive your policy in the following conditions only-

- The policy has lapsed after 6 successive non-payments of premium with the policy being in effect for less than 3 years.

- The policy has lapsed after 12 successive non-payments of premium where policy has been in effect for more than 3 years.

- A duplicate policy document will be issued to the policyholder if he/she has lost the original document. This also applies to the case where the original policy document is mutilated, burned or torn and the insured wants a duplicate of the same.

- This policy can be converted from a Whole Life Assurance policy to an Endowment Assurance Policy. An Endowment Assurance Policy can be converted to another Endowment Assurance plan as per the regulations and guidelines laid down by the insurer.

Rural Postal Life Insurance Benefits

The following benefits will be provided to the policyholders for postal Life Insurance policy:-

- Income tax exemption is available to the beneficiary of this policy.

- The beneficiary can pay the premium according to their financial condition.

- The premium amount is very low.

- A lot of other facilities are provided under the Rural Postal Life Insurance Scheme including assignment, loan conversion, surrender and paid-up value options.

- The policy can be transferred to any circle within the country with no additional charges.

- Passbook facility is also available to track the payment of the premium and the loan transactions premium can be paid annually, half-yearly or on a monthly basis on the financial conditions of the policyholder.

- You can also make an advance premium payment for a policy of 6 months and avail discount worth 1% of the value.

- If you make an advance premium payment for 12 months then you can avail a discount worth 2%.

- A nomination facility is also available and the claim procedure is very quick and easy.

Eligible Candidates

The employees from the following corporations are eligible to get the benefit of the PLI policy.

- Defence Services

- State Government

- Central Government

- Para Military forces

- Local Bodies

- Reserve Bank of India

- Government-aided Educational Institutions

- Public Sector Undertakings

- Nationalized Banks

- Financial Institutions

- Autonomous Bodies

- Those appointed in the Central/ State Government on a contract basis, where the contract can be extended.

- Employees of all scheduled Commercial Banks

- Extra Departmental Agents in Department of Posts

- Those employed in educational institutes that are accredited by recognized bodies such as All India Council of Technical Education, National Assessment and Accreditation Council, Medical Council of India etc.

- Those employed in Credit Co-operative Societies and other Co-operative Societies registered with the Government under the Co-operative Societies Act. These can be partly or fully funded by the State Government, Central Government, RBI, Nationalized Banks, SBI, NABARD, etc.

Also Read: PF Balance Check

Types Of Rural Postal Life Insurance Policy

There are 7 types of insurance policies available for people to take benefit from and you can check out the details regarding each type of insurance policy given below:-

Whole Life Assurance (Gram Suraksha) Plan

- Assured amount + accrue bonus is paid to nominee, assignee or legal heir, after the insured expires.

- Age Eligibility: Minimum:19 years Maximum: 55 years

- Policy Conversion: Policy can be converted to an Endowment Assurance policy after completion of a year and before the insured turns 57 years of age.

- Minimum Sum assured: Rs. 20,000

- Maximum Sum Assured: Rs. 50 lakh

- Loan Facility: Available after 4 years of completion

- Policy Surrender: Policy can be surrendered after 3 years of completion. Policyholders will not be eligible for the bonus if assigned or loaned before 5 years of completion, else a proportionate bonus on the reduced amount assured can be accrued if the policy is assigned for a loan or surrendered.

- Medical Examination: Mandatory

- Premiums Payable: The premiums are calculated based on factors such as the age of maturity and age of entry and hence, variables for the applicant.

Endowment Assurance (Gram Santosh) Plan

- Assured amount + accrued bonus is paid to the proponent when he or she attains the pre-decided age of maturity. The sum amount insured and the bonus is payable to the assigned, nominee or legal heir in case of unprecedented death.

- Age Eligibility: Minimum: 19 years Maximum: 50 years

- Policy Conversion: Policy can be converted to any other Endowment Assurance policy under the rules and regulations of PLI.

- Minimum Sum assured: Rs. 20,000

- Maximum Sum Assured: Rs. 50 lakh

- Loan Facility: Available after 4 years of completion

- Policy Surrender: Policy can be surrendered after 3 years of completion. The policy will not be eligible for the bonus if assigned or loaned before 5 years of completion else proportionate bonus on the reduced amount assured can be accrued if the policy is assigned for a loan or surrendered.

- Medical Examination mandatory

- Premiums Payable: The premiums are calculated based on factors such as the age of maturity and age of entry and hence, variables for the applicant.

Convertible Whole Life Assurance (Gram Suvidha) Plan

- Assured amount + accrued bonus is paid to the proponent when he or she attains the pre-decided age of maturity. The sum amount insured and the bonus is payable to the assigned, nominee or legal heir in case of unprecedented death.

- Age Eligibility: Minimum:19 years Maximum: 55 years

- Policy Conversion: Policy can be converted to Endowment Assurance after 5 years but must not exceed 55 years. If the option for conversion is not used, the policy will automatically turn into a Whole Life Insurance by default.

- Minimum Sum assured: Rs. 20,000

- Maximum Sum Assured: Rs. 50 lakhs

- Loan Facility: Available after 3 years of completion

- Policy Surrender: Policy can be surrendered after 3 years of completion. The policy will not be eligible for the bonus if assigned or loaned before 5 years of completion else proportionate bonus on the reduced amount assured can be accrued if the policy is assigned for a loan or surrendered.

- Medical Examination mandatory

- Premiums Payable: The premium amount is calculated on factors that include the age of maturity and age of entry and hence, variable for the applicant.

Anticipated Endowment Assurance (Gram Sumangal) Plan

- Money back policy

- 15 Years Term Policy: 20% of benefits are paid post 6 years 20% of the assured sum, 9 years 20% of the assured sum, 12 years 20% of the assured sum and 15 years 40% of the assured sum + assured bonus.

- 20 Years Term Policy: Benefits are paid post 8 years 20% of the assured sum, 12 years 20% of the assured sum, 16 years 20% of the assured sum and 20 years 40% of the assured sum + assured bonus

- Maximum Sum Assured: Rs. 50 lakh

- Such payments, in the event of the unexpected death of the insured, will not be taken into consideration and the full sum assured + accrued bonus is payable to the assignee or legal heir.

- Medical Examination mandatory

- Premiums Payable: The calculation premium is based on factors that include the age of maturity and age of entry and hence, variable for the applicant.

Joint Life Endowment Assurance (Yugal Suraksha)

- Both spouses are covered to the extent of sum assured + accrued bonus with only one premium.

- Age Eligibility: Minimum: 19 years Maximum: 55 years

- Policy Conversion: Policy can be converted to any other Endowment Assurance policy under the rules and regulations of PLI.

- Minimum Sum assured: Rs. 20,000

- Maximum Sum Assured: Rs. 50 lakh

- Loan Facility: Available after 3 years of completion

- Policy Surrender: Policy can be surrendered after 3 years of completion. The policy will not be eligible for the bonus if assigned or loaned before 5 years of completion else proportionate bonus on the reduced amount assured can be accrued if the policy is assigned for a loan or surrendered.

- Medical Examination mandatory

- Premiums Payable: The premium amount is calculated on factors that include the age of maturity and age of entry and hence, variable for the applicant.

Read More: Spice Money Login B2B

Children Policy (Bal Jeevan Bima) Plan

- Main Policyholder Age Eligibility: Maximum: 45 years

- Children Age Eligibility: Minimum: 5 years Maximum: 20 years

- Maximum Sum Assured: Rs. 3 lakh or equivalent to the sum assured of the main policy holder whichever is less

- No premium is payable, in case of death of the main policyholder and full sum assured + accrued bonus paid after the completion of the policy term.

- The main policyholder is responsible for payments for the Children Policy.

- No mandatory medical examination is required for children.

- Policy bonus calculated at the rate applicable to Endowment Policy. The POOF Rules applicable at the time shall be applicable to Children Policy.

RPLI Scheme Bonus Rates

Given below is the table indicating the bonus rates available for the various types of insurance policy:-

| Type of Insurance Policy | Rate of Bonus |

| Endowment Assurance (EA) | Rs. 50 per Rs. 1000 of the sum assured |

| Whole Life Assurance (WLA) | Rs. 65 per Rs. 1000 of the sum assured |

| Convertible Whole Life Policies | The whole life bonus rate is applicable. However, on conversion, the applicable rate will be equal to the endowment bonus rate. |

| Anticipated Endowment Assurance | Rs. 47 per Rs. 1000 of the sum assured |

Timeline For The Services

A table below indicates the turnaround time which will be eligible to get the various services done:-

| Service | Turnaround Time |

| Issue of acceptance letter | 15 days |

| Inter-Circle transfer of policies | 10 days |

| Issue of policy bonds | 15 days |

| Settlement of claims on maturity | 30 days |

| Settlement of death claim involving investigation | 90 days |

| Settlement of claims on death with the nomination | 30 days |

| Settlement of claims on death without nomination | 30 days |

| Payment of paid-up value | 30 days |

| Changes of address | 10 days |

| Loan for policies | 10 days |

| Change of nomination | 10 days |

| Issue of the duplicate policy document | 10 days |

| Assignment | 10 days |

| Conversion of policy | 15 days |

Rules And Regulations

You must follow the following rules and regulations to be eligible for the postal Life Insurance Scheme:-

- The policy number will be available on the policy document. This will be needed for your future reference, to identify your policy and to make transactions such as payment of premium, servicing the policy, etc.

- The Policy Bond is very important and the original must be maintained safely. This would be needed at the time of claim settlement. If you have lost your policy bond or if it is damaged, the insurance provider will provide you with a duplicate copy of the same upon request.

- The premium must be paid regularly, for the policy cover to be in effect. If the policy lapses due to non-payment, the cover will not be available. Thus, the policyholder will not be able to place a valid claim. The premium must be paid in advance, on the 1st day of each calendar month. A late payment penalty will be levied if there is a delay in payment. A grace period is available, which extends to the last working day of the concerned month.

- Deduction from pay – Premium can be paid via deduction from pay. This facility can be initiated only with the consent of the employer. The premium amount will be regularly deducted from the policyholder’s salary. This will be reflected in the salary slip.

- Transfer of Policy – The Postal Life Insurance policy can be transferred to another Circle within India if the policyholder has received a job transfer.

- Payment modes – The premium for the Postal Life Insurance policy can be paid via Cheque or Cash. Payment facilities include online payment, over the counter payment at post offices, Electronic Clearance System (ECS), etc.

- Contact Details – The policyholder has to make sure that he/she provides accurate information with regards to address and phone number. This is critical, especially because in the event of a claim, the Claim Cheque will be sent to the address specified. Hence, it is important that any change is updated immediately.

- Lapse of Policy – In case of 6 successive non-payment of premium and if the policy has been in effect for less than 3 years, then the policy lapses. In case of 12 successive non-payment of premium where policy has been in effect for more than 3 years, the policy will lapse.

- Revival of discontinued policy – If the policy has been discontinued once it has not been reinstated during the revival period, the policyholder can place a request to the Chief Postmaster General for the revival of the policy. This is subject to payment of all pending premiums with interest. The policyholder must also submit a report from a Medical Examiner certifying that the life assured is in good health and his/her background remains unchanged.

- Loan against policy – If the policy has been in effect for 3 years or more, the policyholder can avail of a loan against the policy. A loan facility is also available if the policy has accrued a surrender value of at least Rs. 1000.

- Policyholders can contact the officials at PLI through a letter or telephone if they want to get a grievance addressed or an issue resolved.

- Policyholders can also send across an email detailing the complaint to the email ID pli.dte@gmail.com

Policy Statistics

You can check out the postal life insurance policy Statistics by taking into consideration the table given below:-

| Year | Total number of policies procured during a fiscal year | Sum assured of these procured policies (in Rs. Crore) | Total number of active policies at the end of fiscal year | Overall sum assured amount (in Rs. Crore) | Total income of premiums (in Rs. Crore) | Corpus of fund |

| 2011-2012 | 482423 | 13288.15 | 5006060 | 76591.33 | 3681.03 | 23,010.55 |

| 2012-2013 | 454053 | 14695.59 | 5219326 | 88896.46 | 4557.29 | 26,131.34 |

| 2013-2014 | 433182 | 16129.39 | 5406093 | 102276.08 | 5352.01 | 32,716.26 |

| 2014-2015 | 324022 | 14276.91 | 5242257 | 109106.93 | 5963.46 | 39,536.33 |

| 2015-2016 | 198606 | 9644.97 | 4930838 | 109982.09 | 6657.03 | 46,302.72 |

| 2016-2017 | 213323 | 11096.67 | 4680013 | 113084.81 | 7233.89 | 55,058.61 |

Documents Required

The applicant must submit the following documents before applying for the Rural Postal Life Insurance policy:-

- Age proof- Birth certificate/SSLC mark sheet/Voter ID/Passport etc.

- Identity proof – PAN card/ driving license/voter’s ID/ Passport/ Adhaar card, etc

- Address proof – Driving license/passport/latest electricity bill/ telephone bill etc

- Declaration of the medical examiner

- Declaration in case the proposer is illiterate

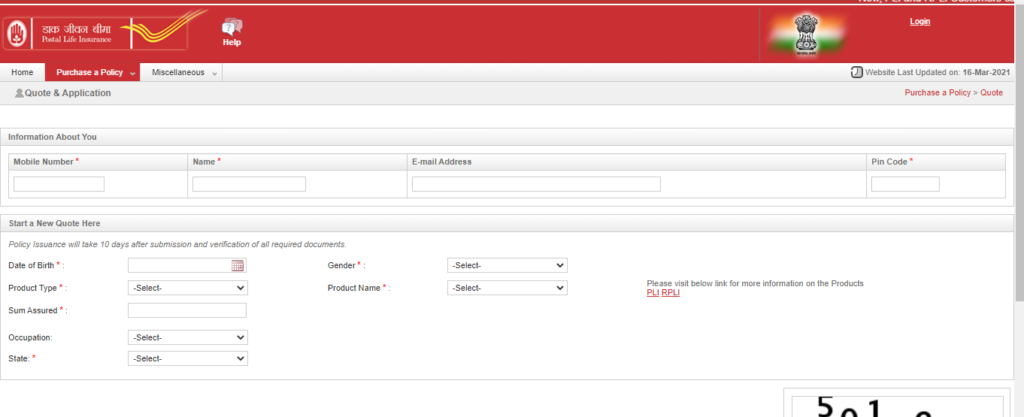

Application Procedure Rural Postal Life Insurance

To apply for the policy you will have to follow the simple procedure given below:-

- You will first have to visit the official website of the postal life insurance policy by clicking on the link given here

- You have to click on the Products tabs displayed on your screen.

- Click on the option called Rural Postal Life Insurance

- You have to click on the option called Buy Policy

- The application form will open on your screen where you will have to enter all of the information regarding yourself.

- Enter all of the information and make your payment online.

- You can also make your payment offline and fill up the application form at your nearest Indian Post Head Office.

- Upload all of the documents and successfully submit the application form.

- You have to keep the application ID safe and secure for future purposes.